- India

- /

- Consumer Durables

- /

- NSEI:PULZ

Here's Why We Think Pulz Electronics (NSE:PULZ) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Pulz Electronics (NSE:PULZ). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Pulz Electronics with the means to add long-term value to shareholders.

See our latest analysis for Pulz Electronics

Pulz Electronics' Improving Profits

Over the last three years, Pulz Electronics has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Pulz Electronics boosted its trailing twelve month EPS from ₹3.58 to ₹4.12, in the last year. This amounts to a 15% gain; a figure that shareholders will be pleased to see.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Pulz Electronics is growing revenues, and EBIT margins improved by 2.3 percentage points to 22%, over the last year. Both of which are great metrics to check off for potential growth.

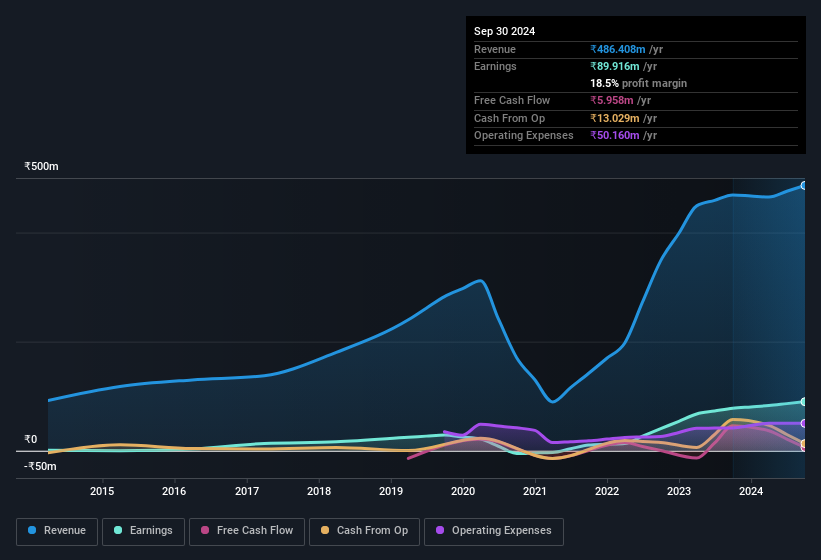

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Pulz Electronics isn't a huge company, given its market capitalisation of ₹1.2b. That makes it extra important to check on its balance sheet strength.

Are Pulz Electronics Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations under ₹17b, like Pulz Electronics, the median CEO pay is around ₹3.6m.

Pulz Electronics' CEO only received compensation totalling ₹2.4m in the year to March 2024. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Pulz Electronics Worth Keeping An Eye On?

One important encouraging feature of Pulz Electronics is that it is growing profits. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So based on its merits, the stock deserves further research, if not an addition to your watchlist. Before you take the next step you should know about the 2 warning signs for Pulz Electronics (1 doesn't sit too well with us!) that we have uncovered.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PULZ

Pulz Electronics

Engages in the development, manufacture, and sale of audio systems in India, South East Asia, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026