- India

- /

- Consumer Durables

- /

- NSEI:PRITI

Do Priti International's (NSE:PRITI) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Priti International (NSE:PRITI), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Priti International with the means to add long-term value to shareholders.

View our latest analysis for Priti International

Priti International's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Priti International's EPS has grown 37% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

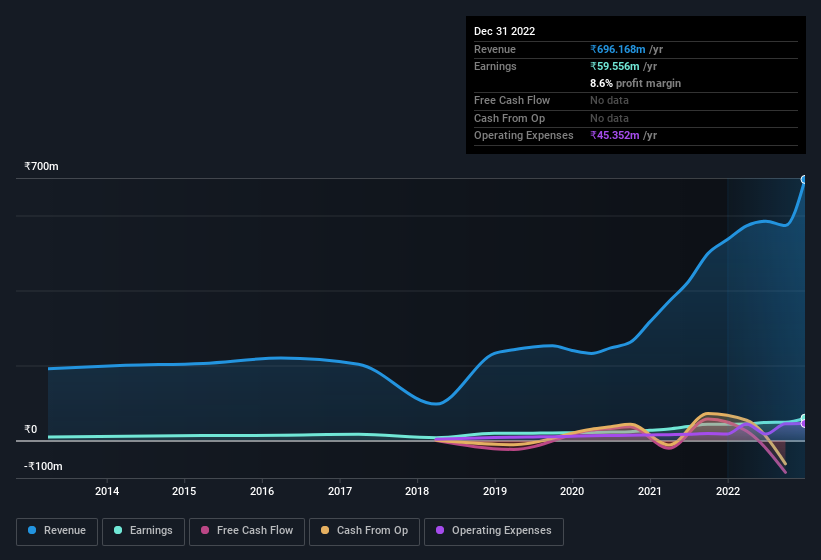

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Priti International shareholders can take confidence from the fact that EBIT margins are up from 6.5% to 11%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Priti International is no giant, with a market capitalisation of ₹2.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Priti International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Priti International shares, in the last year. So it's definitely nice that Chairman & Vigil Mechanism Officer Goverdhan Lohiya bought ₹1.2m worth of shares at an average price of around ₹172. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Priti International.

It's commendable to see that insiders have been buying shares in Priti International, but there is more evidence of shareholder friendly management. Namely, Priti International has a very reasonable level of CEO pay. For companies with market capitalisations under ₹17b, like Priti International, the median CEO pay is around ₹3.4m.

The Priti International CEO received total compensation of only ₹2.5m in the year to March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Priti International Deserve A Spot On Your Watchlist?

For growth investors, Priti International's raw rate of earnings growth is a beacon in the night. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. All in all, this stock is worth the time to delve deeper into the details. You should always think about risks though. Case in point, we've spotted 2 warning signs for Priti International you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Priti International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRITI

Priti International

Engages in the manufacture, sale, and export of wooden, metal, and textile based furniture and handicraft products in India.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.