- India

- /

- Consumer Durables

- /

- NSEI:PILITA

Here's Why Pil Italica Lifestyle Limited's (NSE:PILITA) CEO Compensation Is The Least Of Shareholders' Concerns

Key Insights

- Pil Italica Lifestyle will host its Annual General Meeting on 27th of June

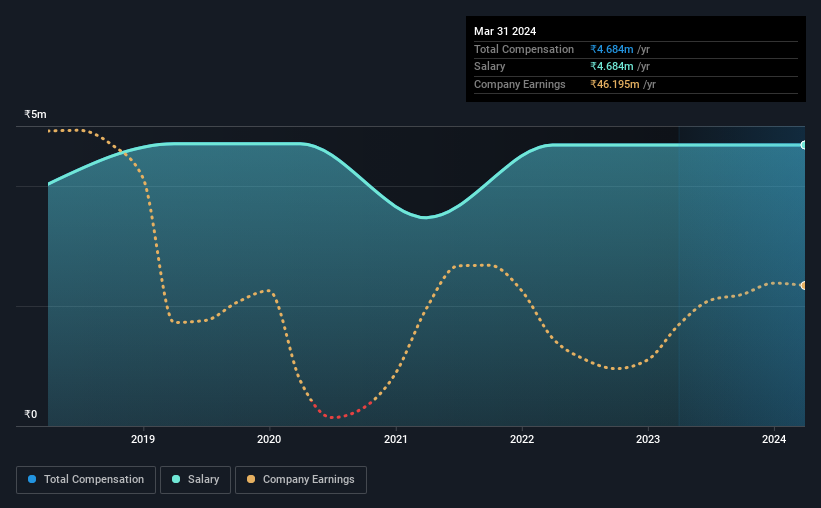

- Total pay for CEO Daud Dawood includes ₹4.68m salary

- Total compensation is similar to the industry average

- Over the past three years, Pil Italica Lifestyle's EPS grew by 7.6% and over the past three years, the total shareholder return was 25%

CEO Daud Dawood has done a decent job of delivering relatively good performance at Pil Italica Lifestyle Limited (NSE:PILITA) recently. As shareholders go into the upcoming AGM on 27th of June, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Pil Italica Lifestyle

Comparing Pil Italica Lifestyle Limited's CEO Compensation With The Industry

At the time of writing, our data shows that Pil Italica Lifestyle Limited has a market capitalization of ₹2.8b, and reported total annual CEO compensation of ₹4.7m for the year to March 2024. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹4.7m.

In comparison with other companies in the Indian Consumer Durables industry with market capitalizations under ₹17b, the reported median total CEO compensation was ₹4.2m. So it looks like Pil Italica Lifestyle compensates Daud Dawood in line with the median for the industry. Moreover, Daud Dawood also holds ₹3.8m worth of Pil Italica Lifestyle stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹4.7m | ₹4.7m | 100% |

| Other | - | - | - |

| Total Compensation | ₹4.7m | ₹4.7m | 100% |

Speaking on an industry level, nearly 100% of total compensation represents salary, while the remainder of 0.23559481% is other remuneration. Speaking on a company level, Pil Italica Lifestyle prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Pil Italica Lifestyle Limited's Growth

Pil Italica Lifestyle Limited's earnings per share (EPS) grew 7.6% per year over the last three years. In the last year, its revenue is up 14%.

This revenue growth could really point to a brighter future. And, while modest, the EPS growth is noticeable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Pil Italica Lifestyle Limited Been A Good Investment?

Pil Italica Lifestyle Limited has generated a total shareholder return of 25% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Pil Italica Lifestyle rewards its CEO solely through a salary, ignoring non-salary benefits completely. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Pil Italica Lifestyle that investors should think about before committing capital to this stock.

Important note: Pil Italica Lifestyle is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PILITA

Pil Italica Lifestyle

Manufactures and sells plastic molded furniture and other articles in India.It operates through two segments: Manufacturing and Finance.

Excellent balance sheet with questionable track record.