November 2024's Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed earnings reports and economic uncertainties, investors are keenly observing the shifts in major indices, with value stocks outperforming growth shares amid cautious corporate forecasts. In this environment, identifying stocks that may be trading below their intrinsic value becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.85 | US$37.48 | 49.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.47 | 50% |

| Arteche Lantegi Elkartea (BME:ART) | €6.10 | €12.20 | 50% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 50% |

| Bangkok Genomics Innovation (SET:BKGI) | THB2.68 | THB5.35 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.39 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.91 | US$546.14 | 49.8% |

Let's explore several standout options from the results in the screener.

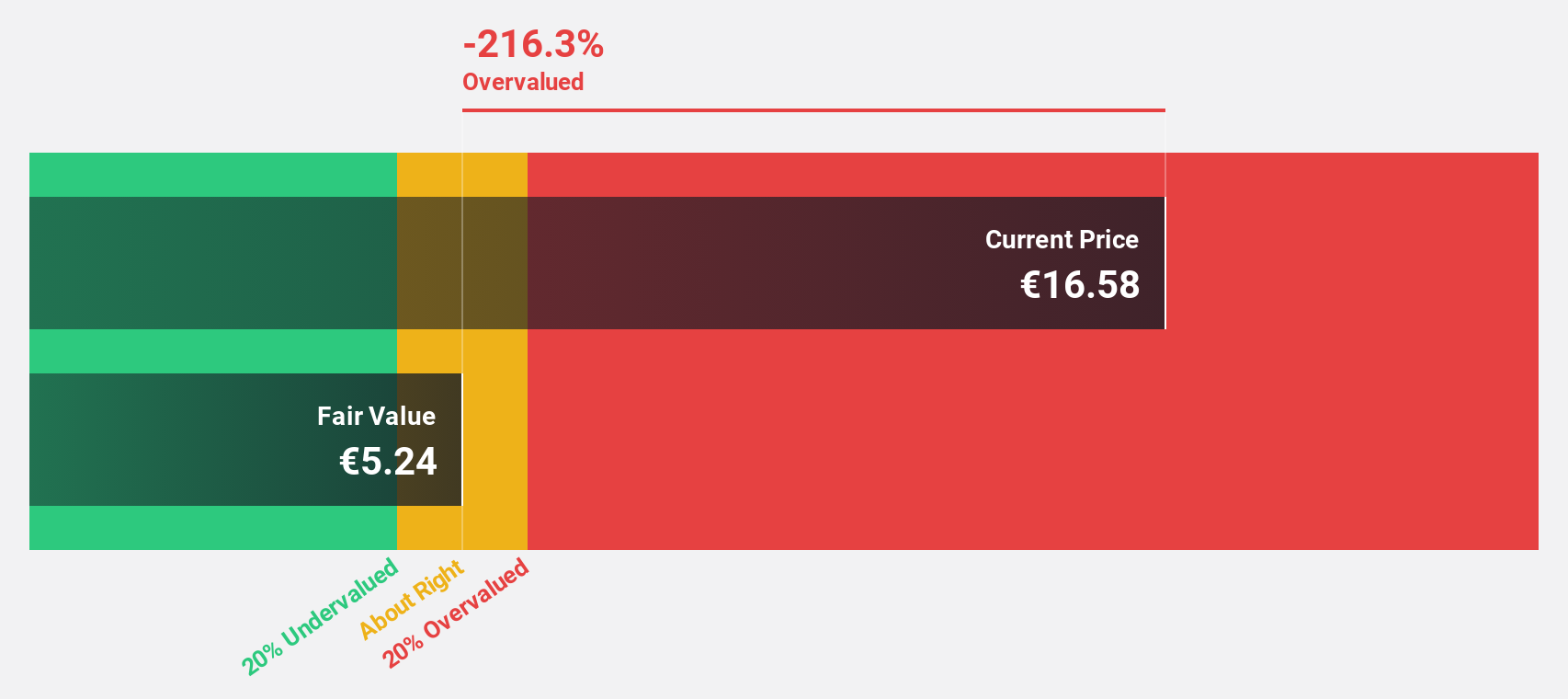

Fincantieri (BIT:FCT)

Overview: Fincantieri S.p.A. is a global player in the shipbuilding industry with a market cap of €1.69 billion.

Operations: The company's revenue is primarily derived from Shipbuilding (€5.92 billion), Offshore and Specialized Vessels (€1.17 billion), and Equipment, Systems and Infrastructure (€1.21 billion).

Estimated Discount To Fair Value: 28.1%

Fincantieri is trading at €5.25, notably below its estimated fair value of €7.3, making it highly undervalued based on discounted cash flow analysis by more than 20%. Despite past shareholder dilution and a forecasted low return on equity of 16.5% in three years, the company is expected to become profitable with earnings growth projected at 77.75% annually, surpassing average market growth and outperforming the Italian market's revenue growth rate.

- Our growth report here indicates Fincantieri may be poised for an improving outlook.

- Take a closer look at Fincantieri's balance sheet health here in our report.

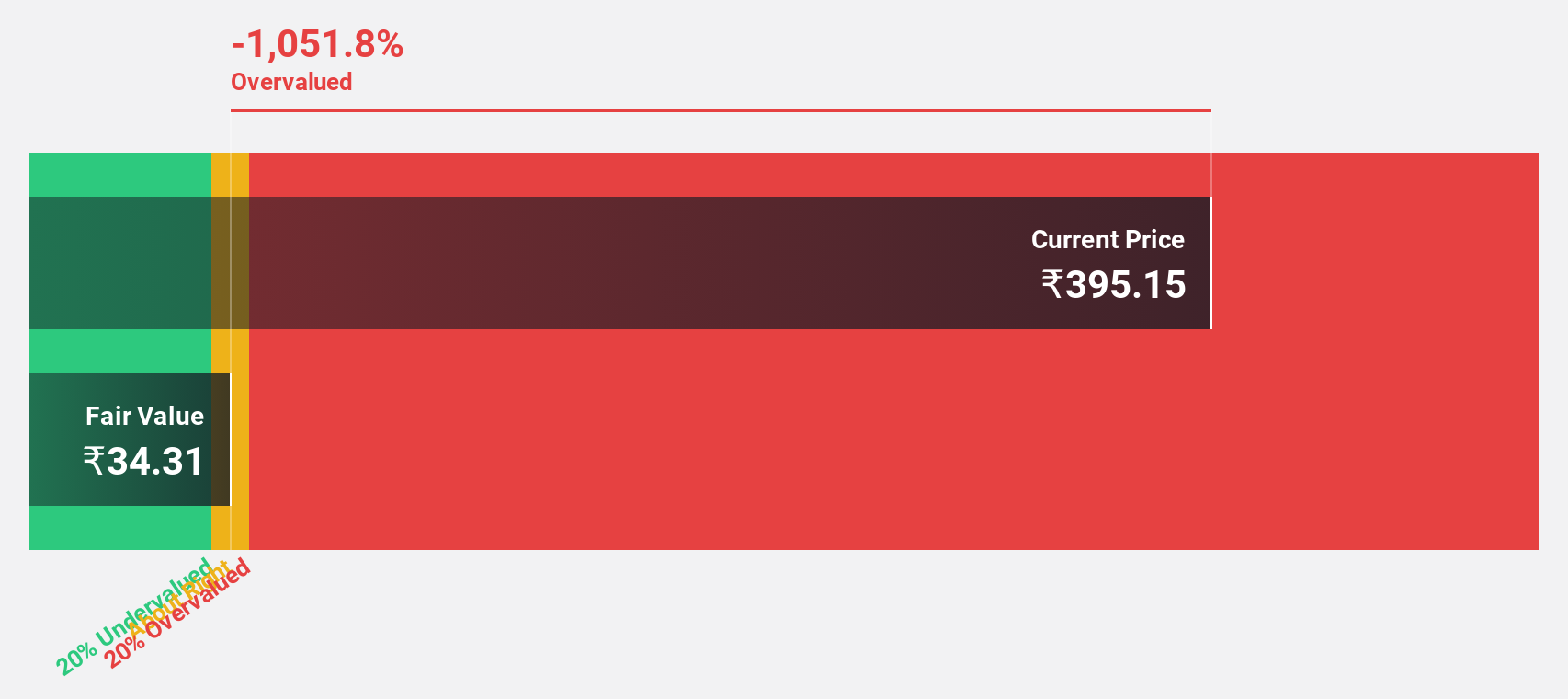

PDS (NSEI:PDSL)

Overview: PDS Limited, along with its subsidiaries, engages in the design, development, sourcing, manufacturing, marketing, and distribution of various readymade garments and other consumer products globally, with a market cap of ₹79.43 billion.

Operations: The company generates revenue primarily from Sourcing, which accounts for ₹113.53 billion, and Manufacturing, contributing ₹7.49 billion.

Estimated Discount To Fair Value: 41.8%

PDS Limited is trading at ₹563.6, significantly below its estimated fair value of ₹968.45, indicating it is undervalued based on discounted cash flow analysis by over 20%. Despite a decrease in profit margins from 2.2% to 1.3%, the company forecasts strong earnings growth of 42.8% per year, outpacing the Indian market's average growth rate of 18.1%. However, its dividend yield remains low and not well covered by free cash flows.

- The analysis detailed in our PDS growth report hints at robust future financial performance.

- Click here to discover the nuances of PDS with our detailed financial health report.

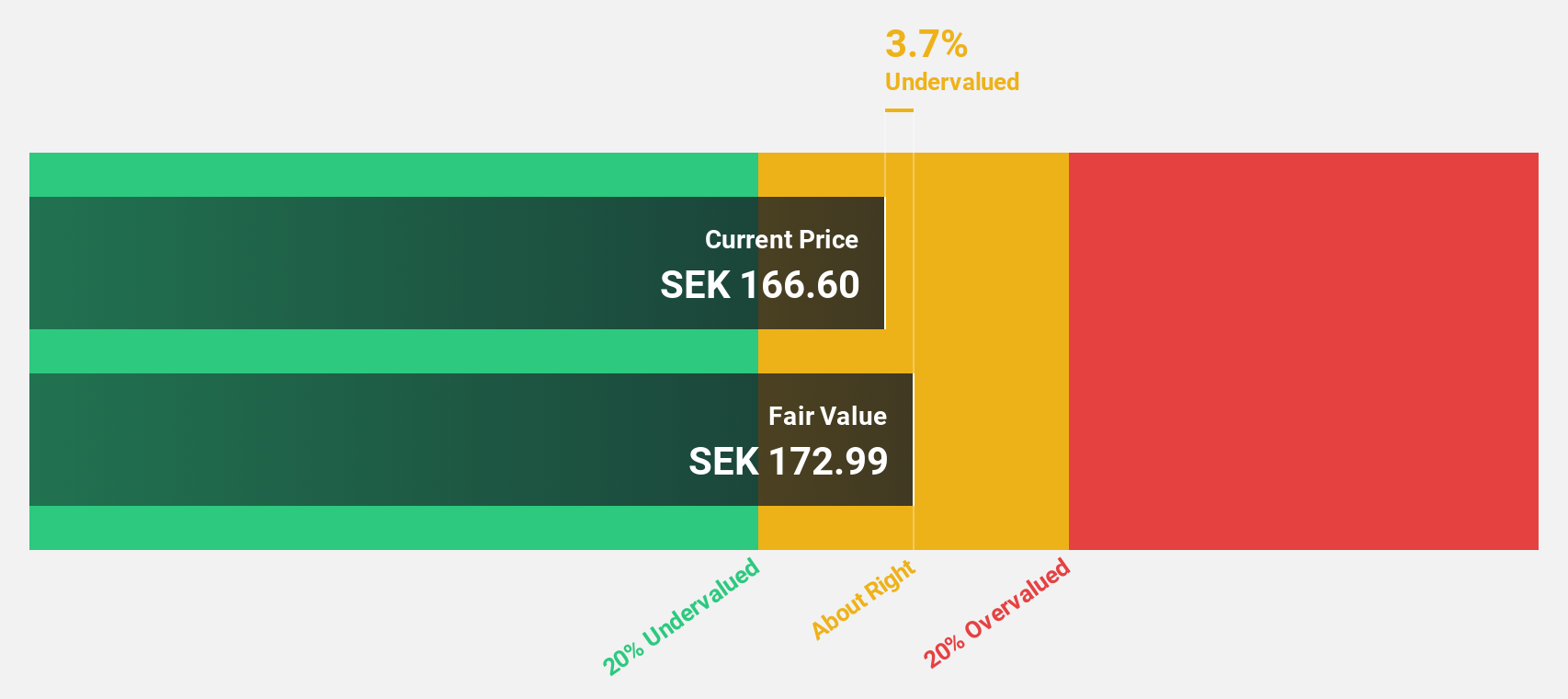

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) is a global provider of architecture and engineering consultancy services, with a market cap of SEK63.52 billion.

Operations: The company's revenue segments include Sweco Sweden with SEK8.88 billion, Sweco Belgium at SEK3.99 billion, Sweco Norway totaling SEK3.48 billion, Sweco Finland at SEK3.62 billion, Sweco Denmark with SEK3.38 billion, Sweco Netherlands at SEK3.28 billion, and Sweco UK contributing SEK1.48 billion; additionally, the German & Central European segment generates SEK2.78 billion in revenue.

Estimated Discount To Fair Value: 32.6%

Sweco AB is trading at SEK 176.5, considerably below its fair value estimate of SEK 261.96, suggesting undervaluation based on cash flows. The company's earnings grew to SEK 376 million in Q3 2024 from SEK 268 million a year earlier, with sales reaching SEK 6.78 billion. Earnings are forecast to grow faster than the Swedish market at an annual rate of 16.8%. However, Sweco's dividend track record remains unstable despite strong financial performance indicators.

- Insights from our recent growth report point to a promising forecast for Sweco's business outlook.

- Dive into the specifics of Sweco here with our thorough financial health report.

Next Steps

- Embark on your investment journey to our 955 Undervalued Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PDSL

PDS

Together its subsidiaries, designs, develops, sources, manufactures, markets, and distributes various readymade garments and other consumer products worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026