- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

With 38% ownership in Orient Electric Limited (NSE:ORIENTELEC), institutional investors have a lot riding on the business

Key Insights

- Significantly high institutional ownership implies Orient Electric's stock price is sensitive to their trading actions

- A total of 6 investors have a majority stake in the company with 51% ownership

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

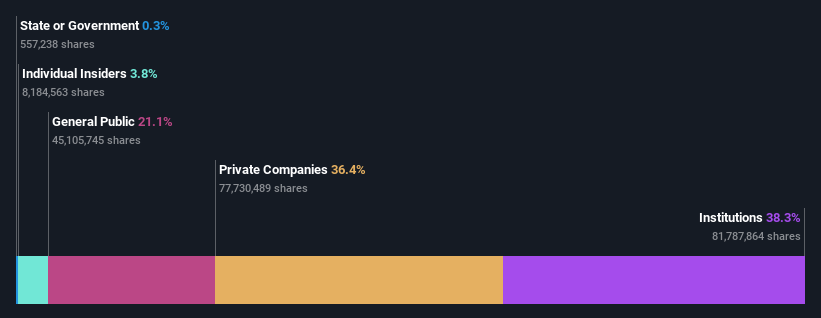

To get a sense of who is truly in control of Orient Electric Limited (NSE:ORIENTELEC), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are institutions with 38% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And things are looking up for institutional investors after the company gained ₹4.4b in market cap last week. The one-year return on investment is currently 16% and last week's gain would have been more than welcomed.

Let's delve deeper into each type of owner of Orient Electric, beginning with the chart below.

See our latest analysis for Orient Electric

What Does The Institutional Ownership Tell Us About Orient Electric?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

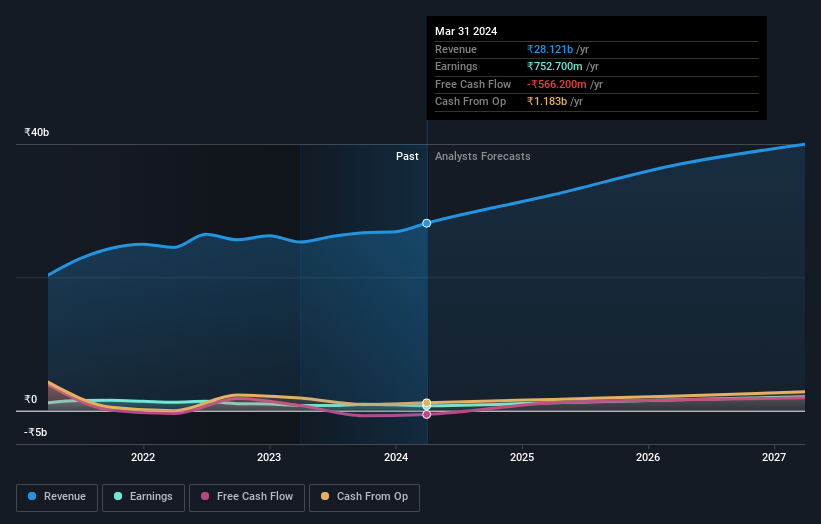

We can see that Orient Electric does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Orient Electric's earnings history below. Of course, the future is what really matters.

Hedge funds don't have many shares in Orient Electric. Our data shows that Central India Industries Limited is the largest shareholder with 25% of shares outstanding. With 8.0% and 6.0% of the shares outstanding respectively, ICICI Prudential Asset Management Company Limited and Shekhavati Investments And Traders Ltd. are the second and third largest shareholders.

We also observed that the top 6 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Orient Electric

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

We can report that insiders do own shares in Orient Electric Limited. It has a market capitalization of just ₹56b, and insiders have ₹2.1b worth of shares, in their own names. It is good to see some investment by insiders, but it might be worth checking if those insiders have been buying.

General Public Ownership

With a 21% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Orient Electric. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 36%, of the Orient Electric stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Orient Electric better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Orient Electric you should be aware of, and 1 of them is potentially serious.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.The company offers ceiling, portable, airflow, wall, pedestal, lifestyle, table, exhaust, and multi-utility fans, as well as related components and accessories; home appliances, such as air coolers, room and water heaters, steam and dry irons, mixer grinders, juicer mixer grinders, hand blenders, wet grinders, electric kettles and rice cookers, induction cooktops, sandwich maker, and stand mixers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026