- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

Orient Electric (NSE:ORIENTELEC) Has Affirmed Its Dividend Of ₹0.75

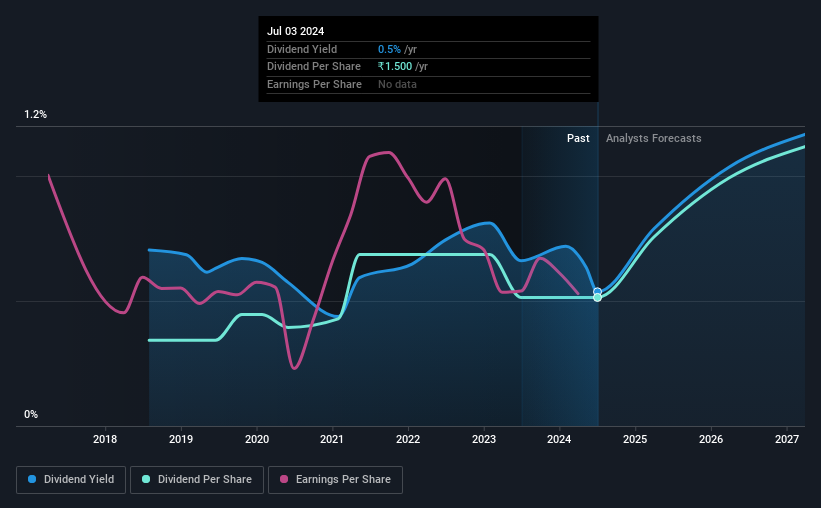

Orient Electric Limited's (NSE:ORIENTELEC) investors are due to receive a payment of ₹0.75 per share on 31st of August. This means the dividend yield will be fairly typical at 0.5%.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Orient Electric's stock price has increased by 32% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Orient Electric

Orient Electric's Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, Orient Electric's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Over the next year, EPS is forecast to expand by 176.4%. If the dividend continues along recent trends, we estimate the payout ratio will be 17%, which is in the range that makes us comfortable with the sustainability of the dividend.

Orient Electric's Dividend Has Lacked Consistency

It's comforting to see that Orient Electric has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2018, the dividend has gone from ₹1.00 total annually to ₹1.50. This works out to be a compound annual growth rate (CAGR) of approximately 7.0% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Orient Electric May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Unfortunately, Orient Electric's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. Orient Electric is struggling to find viable investments, so it is returning more to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Orient Electric is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Orient Electric (1 can't be ignored!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.The company offers ceiling, portable, airflow, wall, pedestal, lifestyle, table, exhaust, and multi-utility fans, as well as related components and accessories; home appliances, such as air coolers, room and water heaters, steam and dry irons, mixer grinders, juicer mixer grinders, hand blenders, wet grinders, electric kettles and rice cookers, induction cooktops, sandwich maker, and stand mixers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026