- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

Orient Electric Limited's (NSE:ORIENTELEC) Share Price Matching Investor Opinion

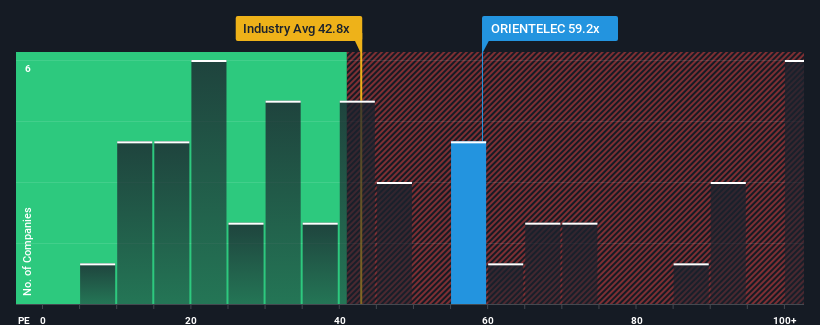

With a price-to-earnings (or "P/E") ratio of 59.2x Orient Electric Limited (NSE:ORIENTELEC) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Orient Electric hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Orient Electric

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Orient Electric's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.1%. As a result, earnings from three years ago have also fallen 37% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 39% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 21% per annum growth forecast for the broader market.

In light of this, it's understandable that Orient Electric's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Orient Electric's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Orient Electric's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Orient Electric (1 makes us a bit uncomfortable!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.The company offers ceiling, portable, airflow, wall, pedestal, lifestyle, table, exhaust, and multi-utility fans, as well as related components and accessories; home appliances, such as air coolers, room and water heaters, steam and dry irons, mixer grinders, juicer mixer grinders, hand blenders, wet grinders, electric kettles and rice cookers, induction cooktops, sandwich maker, and stand mixers.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives