- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

Orient Electric Limited's (NSE:ORIENTELEC) P/E Is On The Mark

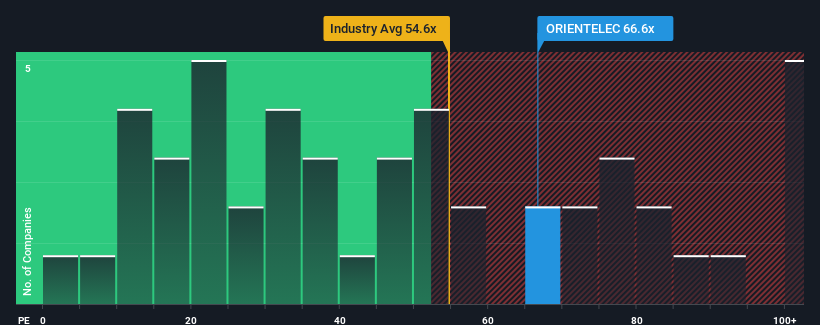

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 33x, you may consider Orient Electric Limited (NSE:ORIENTELEC) as a stock to avoid entirely with its 66.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Orient Electric hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Orient Electric

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Orient Electric's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.9%. This means it has also seen a slide in earnings over the longer-term as EPS is down 54% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 44% each year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 20% each year, which is noticeably less attractive.

With this information, we can see why Orient Electric is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Orient Electric's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Orient Electric you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.The company offers ceiling, portable, airflow, wall, pedestal, lifestyle, table, exhaust, and multi-utility fans, as well as related components and accessories; home appliances, such as air coolers, room and water heaters, steam and dry irons, mixer grinders, juicer mixer grinders, hand blenders, wet grinders, electric kettles and rice cookers, induction cooktops, sandwich maker, and stand mixers.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives