- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

Orient Electric Limited's (NSE:ORIENTELEC) CEO Looks Like They Deserve Their Pay Packet

The performance at Orient Electric Limited (NSE:ORIENTELEC) has been quite strong recently and CEO Rakesh Khanna has played a role in it. Coming up to the next AGM on 29 July 2021, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Orient Electric

How Does Total Compensation For Rakesh Khanna Compare With Other Companies In The Industry?

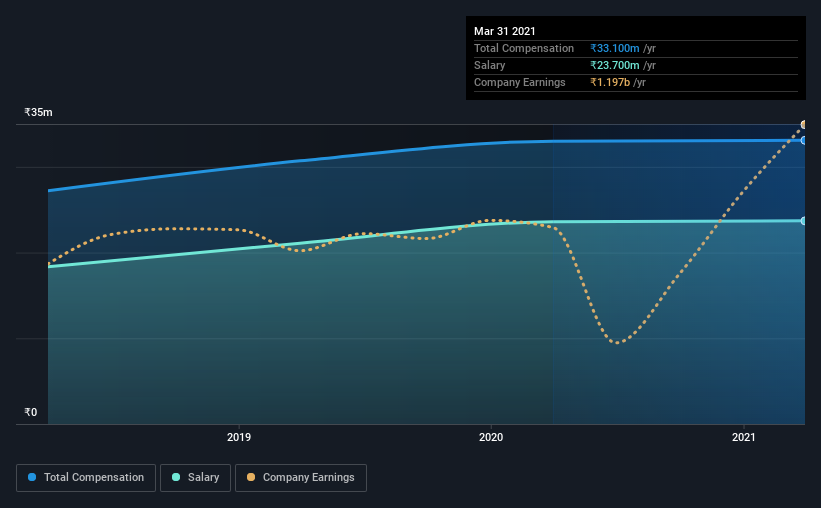

Our data indicates that Orient Electric Limited has a market capitalization of ₹74b, and total annual CEO compensation was reported as ₹33m for the year to March 2021. This means that the compensation hasn't changed much from last year. In particular, the salary of ₹23.7m, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between ₹30b and ₹119b, we discovered that the median CEO total compensation of that group was ₹26m. From this we gather that Rakesh Khanna is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹24m | ₹24m | 72% |

| Other | ₹9.4m | ₹9.4m | 28% |

| Total Compensation | ₹33m | ₹33m | 100% |

On an industry level, roughly 95% of total compensation represents salary and 5% is other remuneration. Orient Electric sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Orient Electric Limited's Growth

Over the past three years, Orient Electric Limited has seen its earnings per share (EPS) grow by 23% per year. Its revenue is down 1.4% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Orient Electric Limited Been A Good Investment?

Boasting a total shareholder return of 189% over three years, Orient Electric Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Orient Electric that you should be aware of before investing.

Switching gears from Orient Electric, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Orient Electric, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.

Flawless balance sheet with high growth potential.