- India

- /

- Consumer Durables

- /

- NSEI:ORIENTELEC

Concerns Surrounding Orient Electric's (NSE:ORIENTELEC) Performance

Orient Electric Limited's (NSE:ORIENTELEC ) stock didn't jump after it announced some healthy earnings. We think that investors might be worried about some concerning underlying factors.

View our latest analysis for Orient Electric

A Closer Look At Orient Electric's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

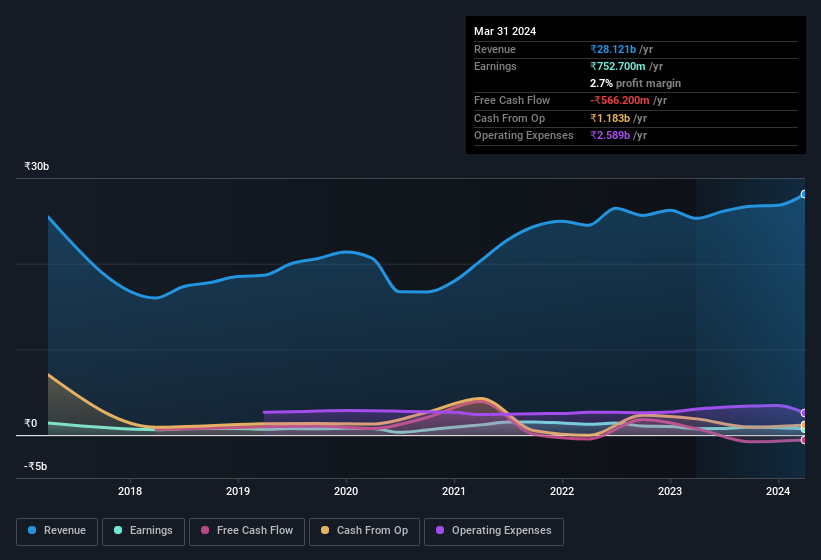

Over the twelve months to March 2024, Orient Electric recorded an accrual ratio of 0.27. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of ₹566m, in contrast to the aforementioned profit of ₹752.7m. We saw that FCF was ₹759m a year ago though, so Orient Electric has at least been able to generate positive FCF in the past. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. The good news for shareholders is that Orient Electric's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by ₹187m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. If Orient Electric doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Orient Electric's Profit Performance

Summing up, Orient Electric received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Orient Electric's profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. When we did our research, we found 2 warning signs for Orient Electric (1 is a bit concerning!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORIENTELEC

Orient Electric

Manufactures, purchases, and sells electrical consumer durables, and lighting and switchgear products in India and internationally.The company offers ceiling, portable, airflow, wall, pedestal, lifestyle, table, exhaust, and multi-utility fans, as well as related components and accessories; home appliances, such as air coolers, room and water heaters, steam and dry irons, mixer grinders, juicer mixer grinders, hand blenders, wet grinders, electric kettles and rice cookers, induction cooktops, sandwich maker, and stand mixers.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026