- India

- /

- Oil and Gas

- /

- NSEI:ONGC

Exploring Three Indian Dividend Stocks With Yields Up To 3.8%

Reviewed by Simply Wall St

In the past year, the Indian market has shown robust growth, climbing by 43%, despite a recent 1.3% dip over the last week. In this dynamic environment, dividend stocks that offer yields up to 3.8% can be particularly appealing for investors looking for steady income combined with potential market earnings growth forecasted at 16% annually.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 3.92% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 3.71% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.26% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.46% | ★★★★★☆ |

| Castrol India (BSE:500870) | 3.04% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.28% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.91% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.12% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.03% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.60% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Indian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

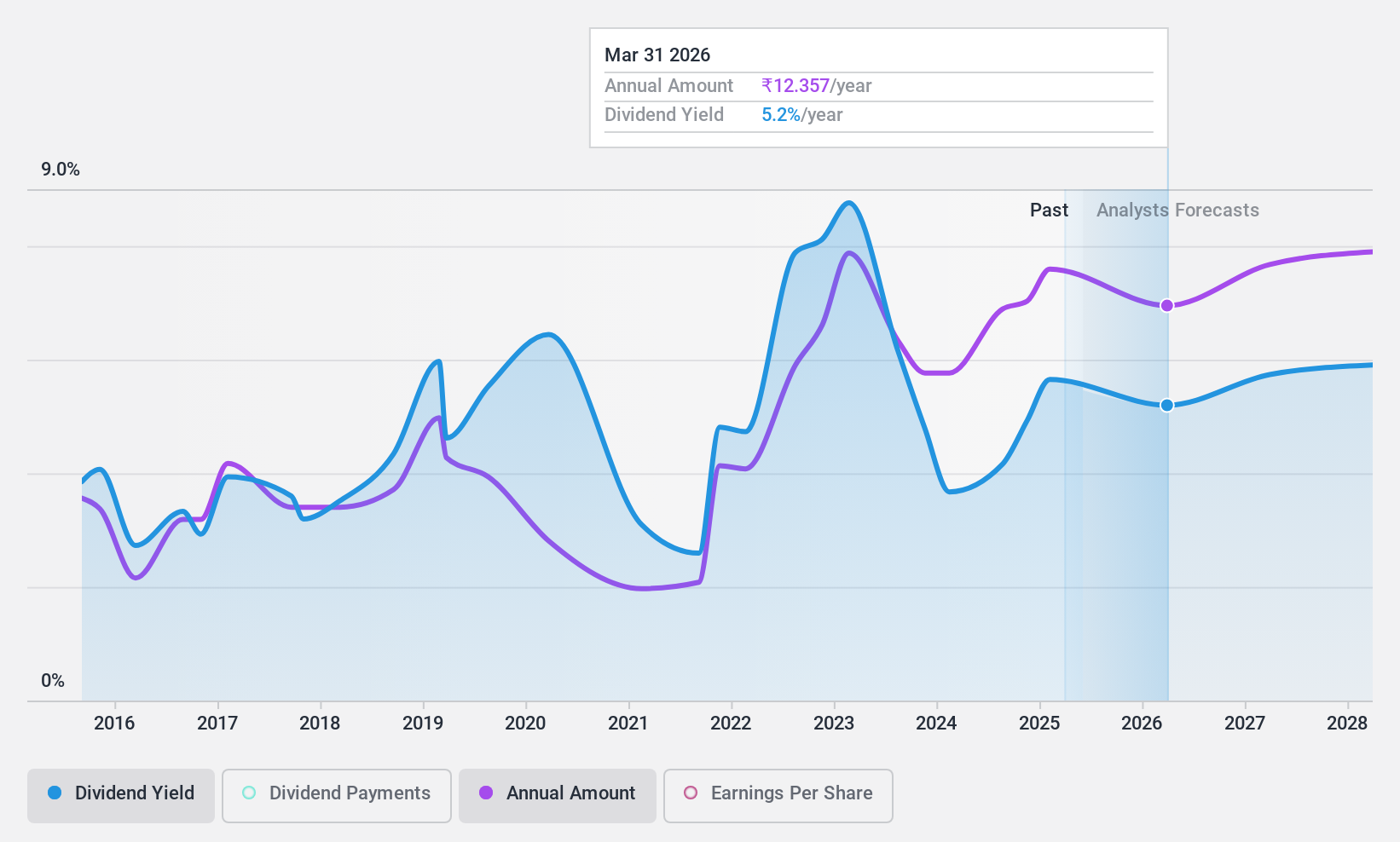

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited specializes in manufacturing, marketing, and trading lubricants for the automobile and industrial sectors within India, with a market capitalization of approximately ₹56.78 billion.

Operations: Gulf Oil Lubricants India Limited generates revenue primarily through the sale of lubricants, amounting to ₹33.01 billion.

Dividend Yield: 3.5%

Gulf Oil Lubricants India boasts a P/E ratio of 18.4x, notably lower than the Indian market average of 33.4x, suggesting relative undervaluation. Despite a volatile dividend history over the past decade, recent earnings growth of 32.6% and forecasts for an 11.9% annual increase could bolster future dividends. Dividends are well-supported by both earnings and cash flows with payout ratios at 57.4% and 62.7%, respectively, although share price volatility remains a concern.

- Click here and access our complete dividend analysis report to understand the dynamics of Gulf Oil Lubricants India.

- Our comprehensive valuation report raises the possibility that Gulf Oil Lubricants India is priced lower than what may be justified by its financials.

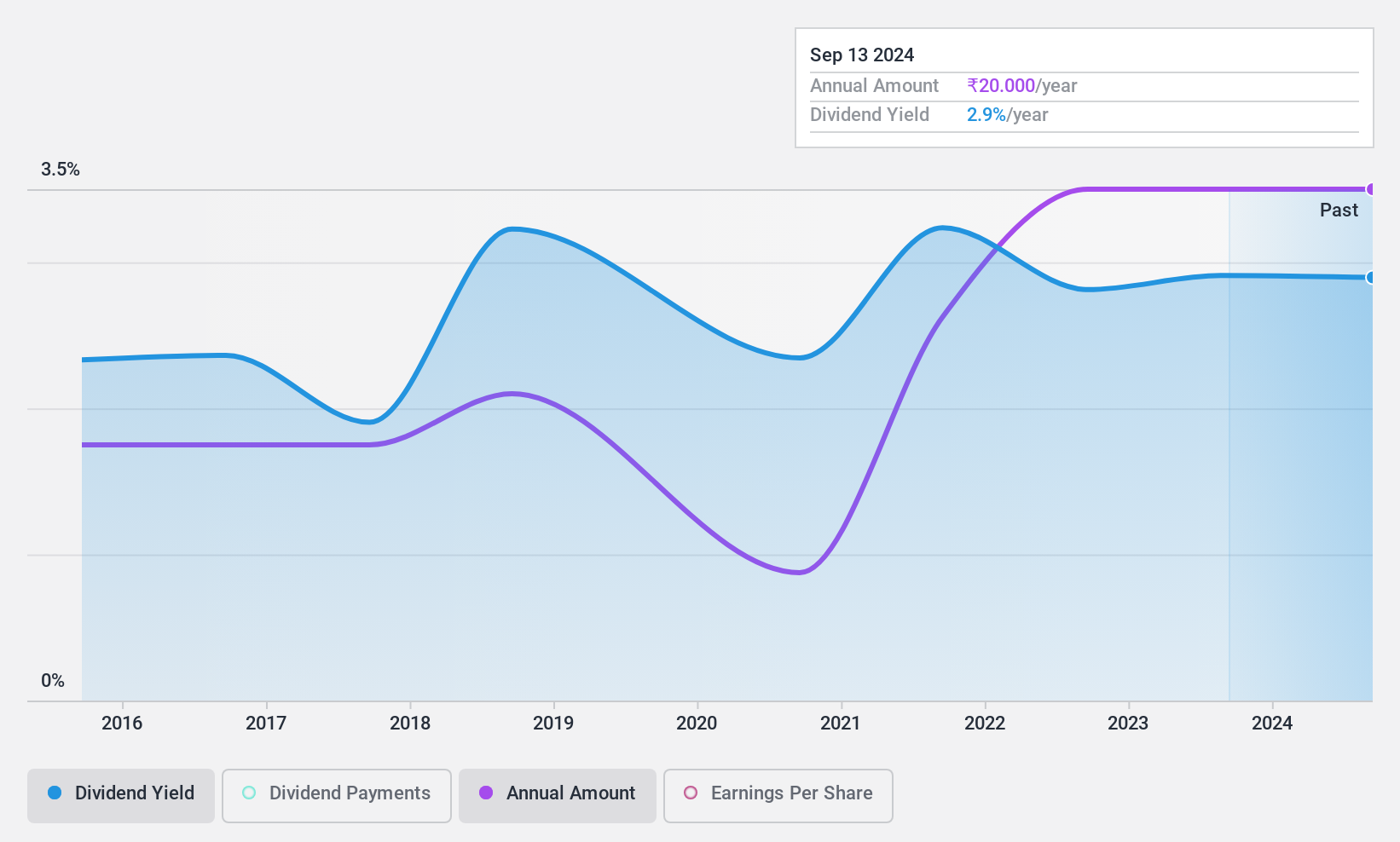

Monte Carlo Fashions (NSEI:MONTECARLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monte Carlo Fashions Limited is a company that manufactures and trades wool, cotton, and blended knitted and woven apparels both in India and internationally, with a market cap of ₹13.16 billion.

Operations: Monte Carlo Fashions Limited generates revenue primarily from the manufacturing and trading of textile garments, totaling ₹10.62 billion.

Dividend Yield: 3.1%

Monte Carlo Fashions offers a dividend yield of 3.15%, ranking in the top quartile among Indian stocks, supported by earnings with a payout ratio of 69.2% and cash flows at 88.8%. However, its dividend history is less stable, reflecting volatility over its nine-year payment period. Recent financials show a downturn with a net loss reported in Q4 2024, contrasting sharply with last year's profit, potentially challenging future dividend sustainability despite recent affirmations of INR 20 per share for FY2023-24.

- Navigate through the intricacies of Monte Carlo Fashions with our comprehensive dividend report here.

- Our expertly prepared valuation report Monte Carlo Fashions implies its share price may be too high.

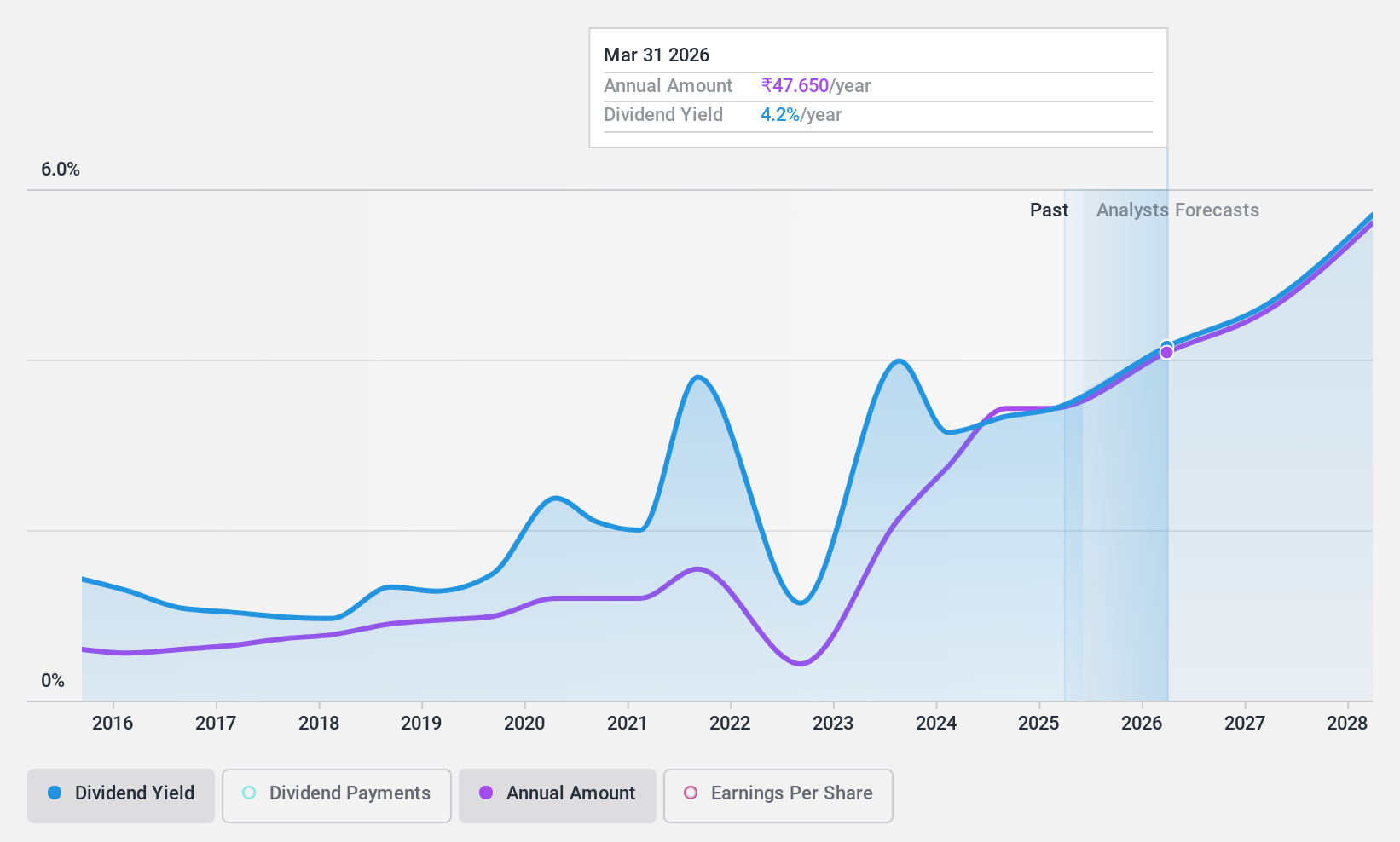

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, operating both domestically and internationally, is engaged in the exploration, development, and production of crude oil and natural gas with a market capitalization of approximately ₹4.02 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through refining and marketing (₹56.75 billion), as well as exploration and production activities, both onshore (₹4.39 billion) and offshore (₹9.43 billion) within India, alongside international operations contributing ₹0.96 billion.

Dividend Yield: 3.8%

ONGC offers a dividend yield of 3.83%, placing it among the top 25% of Indian dividend stocks. With a low payout ratio of 31.3% and cash payout ratio at 32.5%, its dividends are well-supported by both earnings and cash flow, despite a history of volatility in dividend payments over the last decade. The company trades at a P/E ratio significantly below the market average, suggesting good relative value, although its inconsistent dividend track record may concern some investors.

- Take a closer look at Oil and Natural Gas' potential here in our dividend report.

- Our expertly prepared valuation report Oil and Natural Gas implies its share price may be lower than expected.

Taking Advantage

- Click here to access our complete index of 19 Top Indian Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ONGC

Oil and Natural Gas

Engages in the exploration, development, production, and distribution of crude oil, natural gas, and value-added products in India and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion