Liberty Shoes Ltd. (NSE:LIBERTSHOE) Looks Just Right With A 31% Price Jump

Liberty Shoes Ltd. (NSE:LIBERTSHOE) shares have continued their recent momentum with a 31% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 71%.

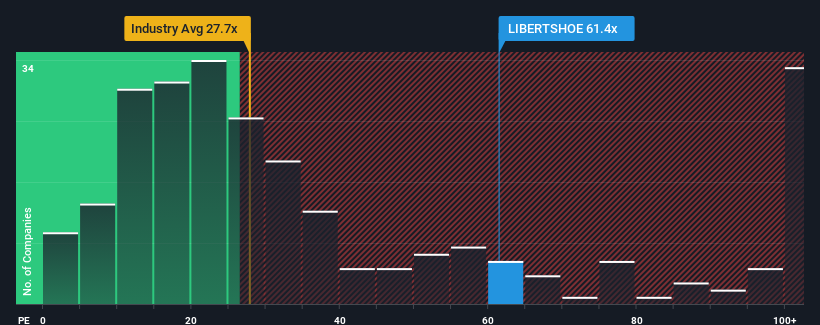

Since its price has surged higher, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 32x, you may consider Liberty Shoes as a stock to avoid entirely with its 61.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Liberty Shoes' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Liberty Shoes

How Is Liberty Shoes' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Liberty Shoes' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Even so, admirably EPS has lifted 4,341% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Liberty Shoes is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Liberty Shoes' P/E

Liberty Shoes' P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Liberty Shoes revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Liberty Shoes that you should be aware of.

If you're unsure about the strength of Liberty Shoes' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LIBERTSHOE

Liberty Shoes

Manufactures and trades in footwear, accessories, and lifestyle products in India and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives