Do Jindal Worldwide's (NSE:JINDWORLD) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Jindal Worldwide (NSE:JINDWORLD). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out the opportunities and risks within the IN Luxury industry.

How Fast Is Jindal Worldwide Growing Its Earnings Per Share?

Over the last three years, Jindal Worldwide has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Jindal Worldwide's EPS skyrocketed from ₹4.34 to ₹6.97, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 61%.

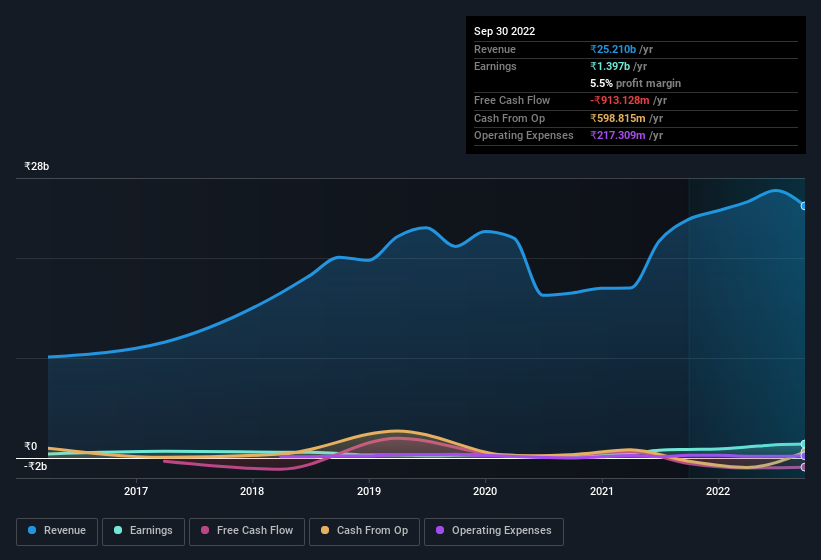

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Jindal Worldwide shareholders is that EBIT margins have grown from 7.2% to 9.2% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Jindal Worldwide Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Jindal Worldwide will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 84% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. at the current share price. That means they have plenty of their own capital riding on the performance of the business!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Jindal Worldwide, with market caps between ₹33b and ₹130b, is around ₹33m.

The Jindal Worldwide CEO received total compensation of just ₹11m in the year to March 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Jindal Worldwide To Your Watchlist?

You can't deny that Jindal Worldwide has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Jindal Worldwide has underlying strengths that make it worth a look at. Even so, be aware that Jindal Worldwide is showing 3 warning signs in our investment analysis , you should know about...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JINDWORLD

Jindal Worldwide

Engages in the manufacture and sale of textile products in India and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026