Do Nandani Creation's (NSE:JAIPURKURT) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Nandani Creation (NSE:JAIPURKURT). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Nandani Creation

How Quickly Is Nandani Creation Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Nandani Creation has grown EPS by 32% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

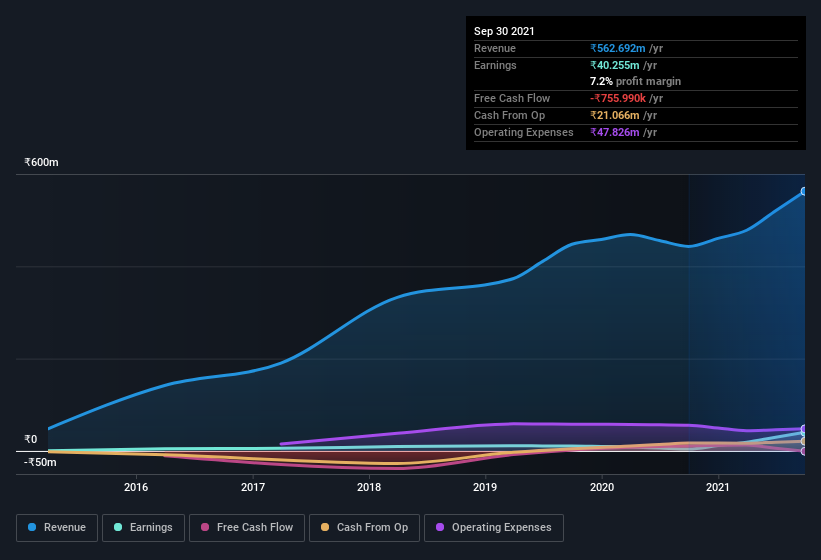

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Nandani Creation shareholders can take confidence from the fact that EBIT margins are up from 4.5% to 11%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Nandani Creation is no giant, with a market capitalization of ₹883m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Nandani Creation Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Nandani Creation insiders own a significant number of shares certainly appeals to me. In fact, they own 91% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only ₹883m Nandani Creation is really small for a listed company. So despite a large proportional holding, insiders only have ₹802m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Nandani Creation Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Nandani Creation's strong EPS growth. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. However, before you get too excited we've discovered 3 warning signs for Nandani Creation that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nandani Creation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JAIPURKURT

Nandani Creation

Manufactures and retails contemporary women's wear in India and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026