Indo Count Industries Limited's (NSE:ICIL) Share Price Boosted 28% But Its Business Prospects Need A Lift Too

Indo Count Industries Limited (NSE:ICIL) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

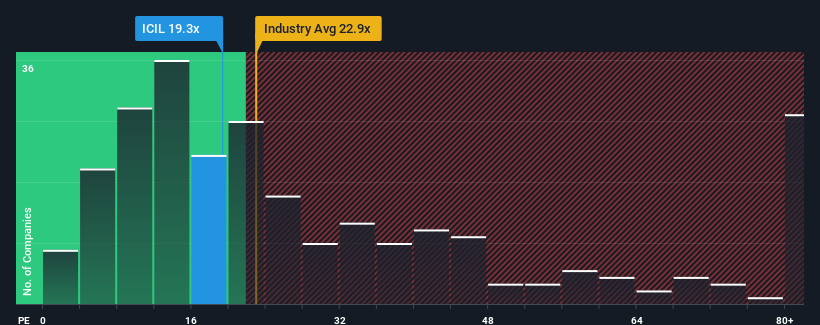

In spite of the firm bounce in price, Indo Count Industries may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.3x, since almost half of all companies in India have P/E ratios greater than 26x and even P/E's higher than 49x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

We've discovered 3 warning signs about Indo Count Industries. View them for free.Indo Count Industries hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Indo Count Industries

How Is Indo Count Industries' Growth Trending?

In order to justify its P/E ratio, Indo Count Industries would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 4.1% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 1.7% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 21% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 24% growth forecast for the broader market.

With this information, we can see why Indo Count Industries is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Indo Count Industries' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Indo Count Industries maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Indo Count Industries (2 can't be ignored!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ICIL

Indo Count Industries

Manufactures and sells home textile products in India and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026