I Ran A Stock Scan For Earnings Growth And Goldiam International (NSE:GOLDIAM) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Goldiam International (NSE:GOLDIAM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Goldiam International

Goldiam International's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Goldiam International's stratospheric annual EPS growth of 51%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

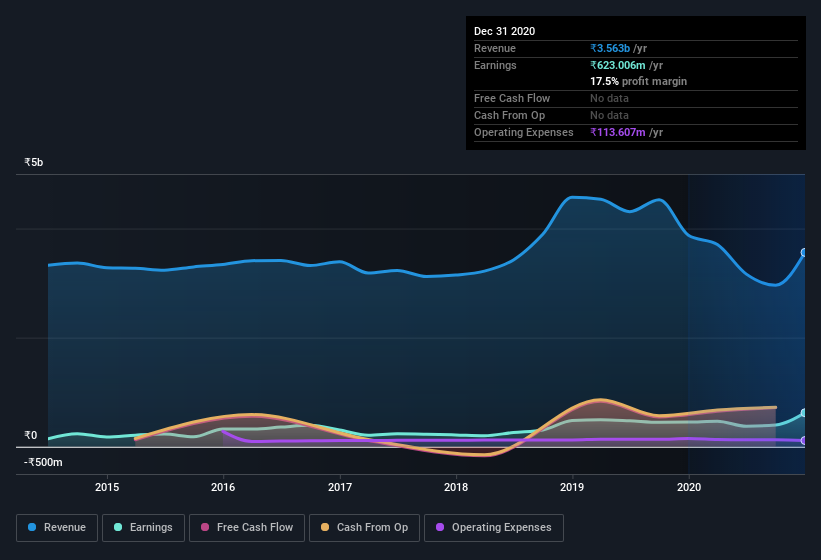

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Goldiam International's EBIT margins are flat but, of some concern, its revenue is actually down. Suffice it to say that is not a great sign of growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Goldiam International is no giant, with a market capitalization of ₹8.9b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Goldiam International Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Goldiam International shares, in the last year. With that in mind, it's heartening that Anmol Bhansali, the Whole-Time Director of the company, paid ₹579k for shares at around ₹129 each.

On top of the insider buying, we can also see that Goldiam International insiders own a large chunk of the company. In fact, they own 72% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹6.4b invested in the business, using the current share price. That's nothing to sneeze at!

Is Goldiam International Worth Keeping An Eye On?

Goldiam International's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Goldiam International deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Goldiam International , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Goldiam International isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Goldiam International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GOLDIAM

Goldiam International

Manufactures, sells, and trades in diamond studded gold, silver, and platinum jewelry in India.

Flawless balance sheet slight.