Garware Technical Fibres Limited Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

Garware Technical Fibres Limited (NSE:GARFIBRES) missed earnings with its latest quarterly results, disappointing overly-optimistic forecasts. Results look to have been somewhat negative - revenue fell 3.5% short of analyst estimates at ₹3.4b, and statutory earnings of ₹23.38 per share missed forecasts by 8.7%. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analyst latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Garware Technical Fibres

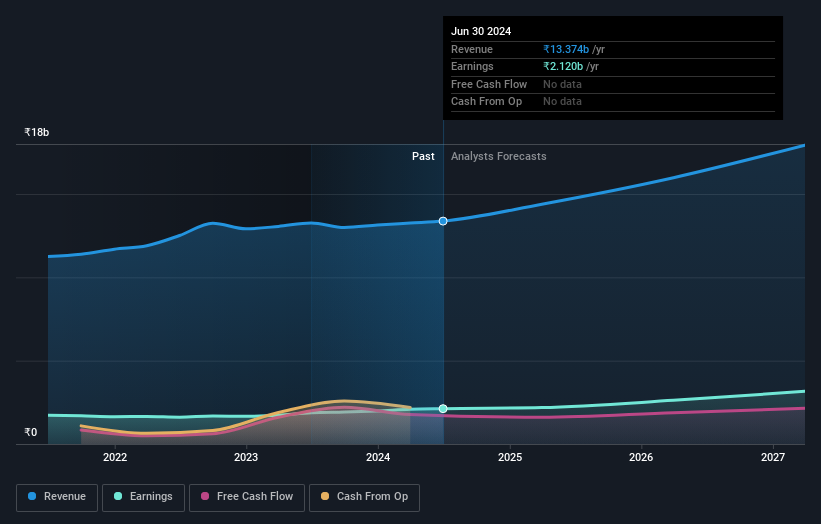

Following the latest results, Garware Technical Fibres' sole analyst are now forecasting revenues of ₹14.4b in 2025. This would be a satisfactory 7.6% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to rise 3.0% to ₹110. Yet prior to the latest earnings, the analyst had been anticipated revenues of ₹14.4b and earnings per share (EPS) of ₹113 in 2025. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analyst did make a minor downgrade to their earnings per share forecasts.

The consensus price target held steady at ₹4,050, with the analyst seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Garware Technical Fibres' rate of growth is expected to accelerate meaningfully, with the forecast 10% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 8.5% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 14% annually. So it's clear that despite the acceleration in growth, Garware Technical Fibres is expected to grow meaningfully slower than the industry average.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Garware Technical Fibres. Fortunately, the analyst also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Garware Technical Fibres' revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2027, which can be seen for free on our platform here.

We also provide an overview of the Garware Technical Fibres Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GARFIBRES

Garware Technical Fibres

Manufactures and sells various technical textile products in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.