I Ran A Stock Scan For Earnings Growth And Filatex India (NSE:FILATEX) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Filatex India (NSE:FILATEX). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Filatex India

Filatex India's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that Filatex India has grown EPS by 40% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Filatex India's EBIT margins have actually improved by 6.8 percentage points in the last year, to reach 13%, but, on the flip side, revenue was down 20%. That falls short of ideal.

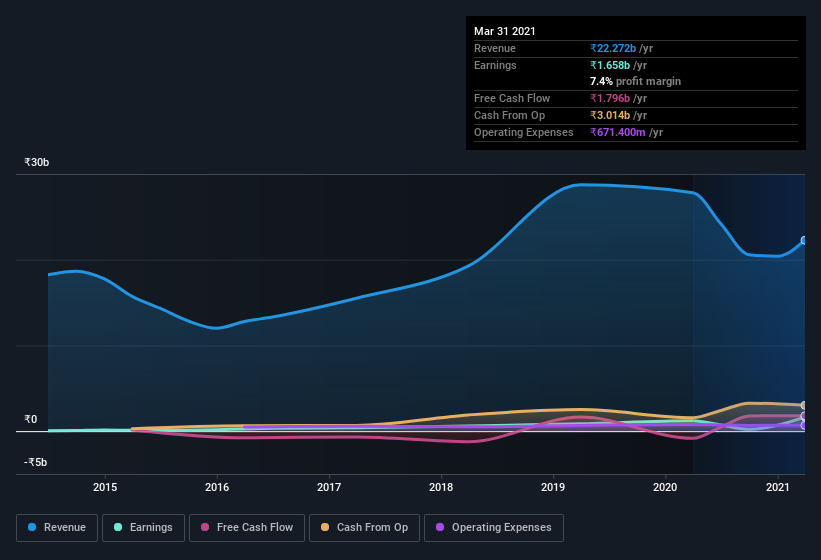

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Filatex India isn't a huge company, given its market capitalization of ₹21b. That makes it extra important to check on its balance sheet strength.

Are Filatex India Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Filatex India insiders did net -₹13m selling stock over the last year, they invested ₹57m, a much higher figure. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Chairman & MD, Madhu Bhageria, who made the biggest single acquisition, paying ₹30m for shares at about ₹31.94 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Filatex India insiders own more than a third of the company. Indeed, with a collective holding of 51%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have ₹11b invested in the business, using the current share price. That's nothing to sneeze at!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Madhu Bhageria, is paid less than the median for similar sized companies. For companies with market capitalizations between ₹7.3b and ₹29b, like Filatex India, the median CEO pay is around ₹17m.

The Filatex India CEO received ₹12m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Filatex India To Your Watchlist?

Filatex India's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Filatex India deserves timely attention. Even so, be aware that Filatex India is showing 4 warning signs in our investment analysis , you should know about...

The good news is that Filatex India is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Filatex India, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:FILATEX

Filatex India

Manufactures, sells, and trades polyester filament yarn, and synthetic yarn and textiles in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives