Top Growth Companies With High Insider Ownership On Indian Exchange August 2024

Reviewed by Simply Wall St

The market is up 1.8% over the last week and has climbed 46% in the past year, with earnings expected to grow by 17% per annum over the next few years. In this favorable environment, identifying growth companies with high insider ownership can be particularly advantageous as it often signals confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 35% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 21.8% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| KEI Industries (BSE:517569) | 19.1% | 20.4% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Underneath we present a selection of stocks filtered out by our screen.

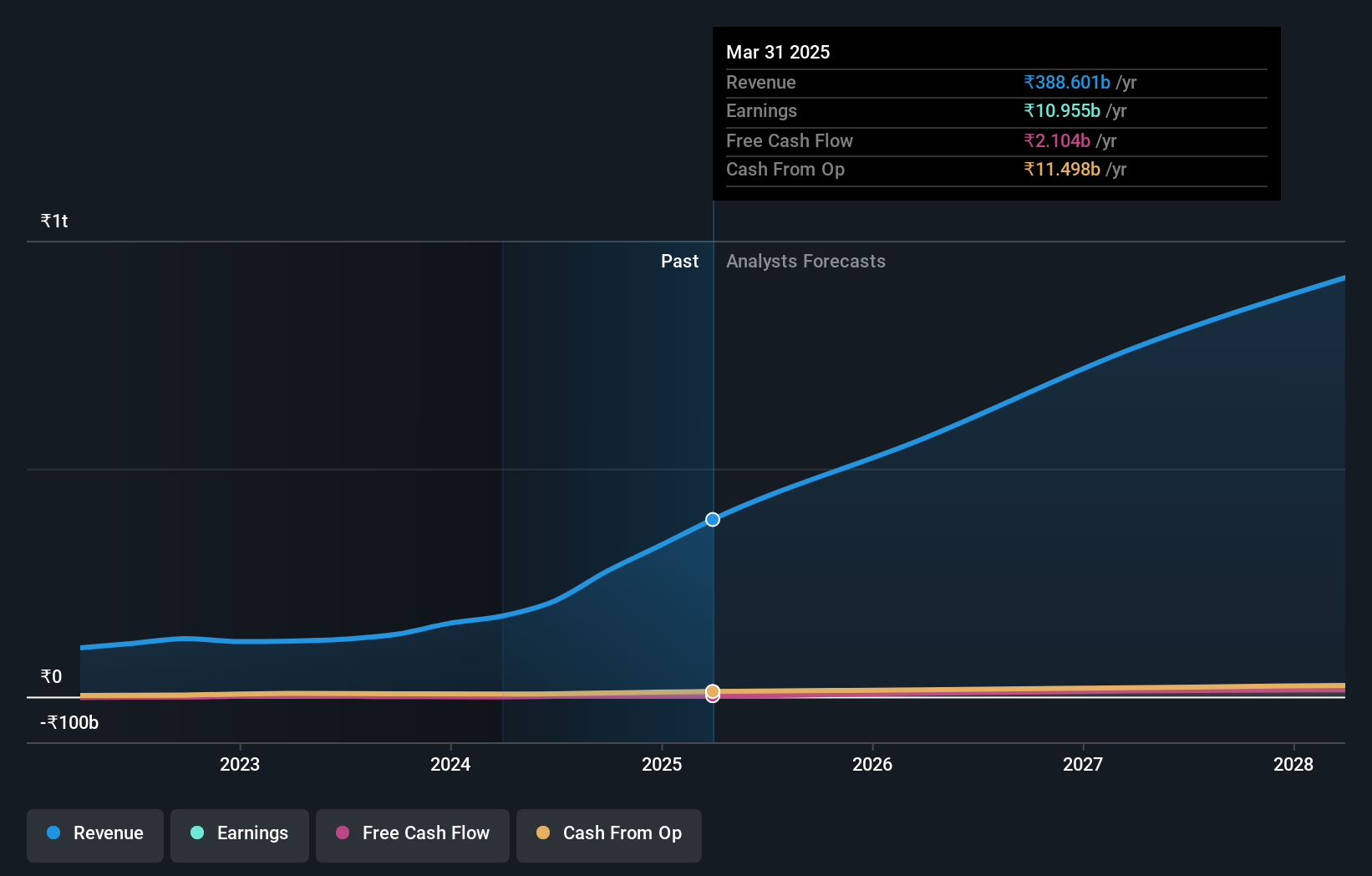

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services in India and has a market cap of ₹794.06 billion.

Operations: Dixon Technologies (India) Limited's revenue segments include Home Appliances (₹12.51 billion), Lighting Products (₹7.92 billion), Mobile & EMS Division (₹143.16 billion), and Consumer Electronics & Appliances (₹41.21 billion).

Insider Ownership: 24.6%

Revenue Growth Forecast: 23.6% p.a.

Dixon Technologies (India) exhibits strong growth potential with forecasted revenue growth of 23.6% per year, outpacing the Indian market's 10%. Its earnings are expected to grow significantly at 36.6% annually over the next three years, surpassing market expectations. Recent Q1 results showed substantial revenue and net income increases compared to last year. The company also appointed Mr. Sunil Ranjhan as Chief Human Resource Officer, enhancing its leadership team with his extensive HR experience across APAC regions.

- Get an in-depth perspective on Dixon Technologies (India)'s performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Dixon Technologies (India) implies its share price may be too high.

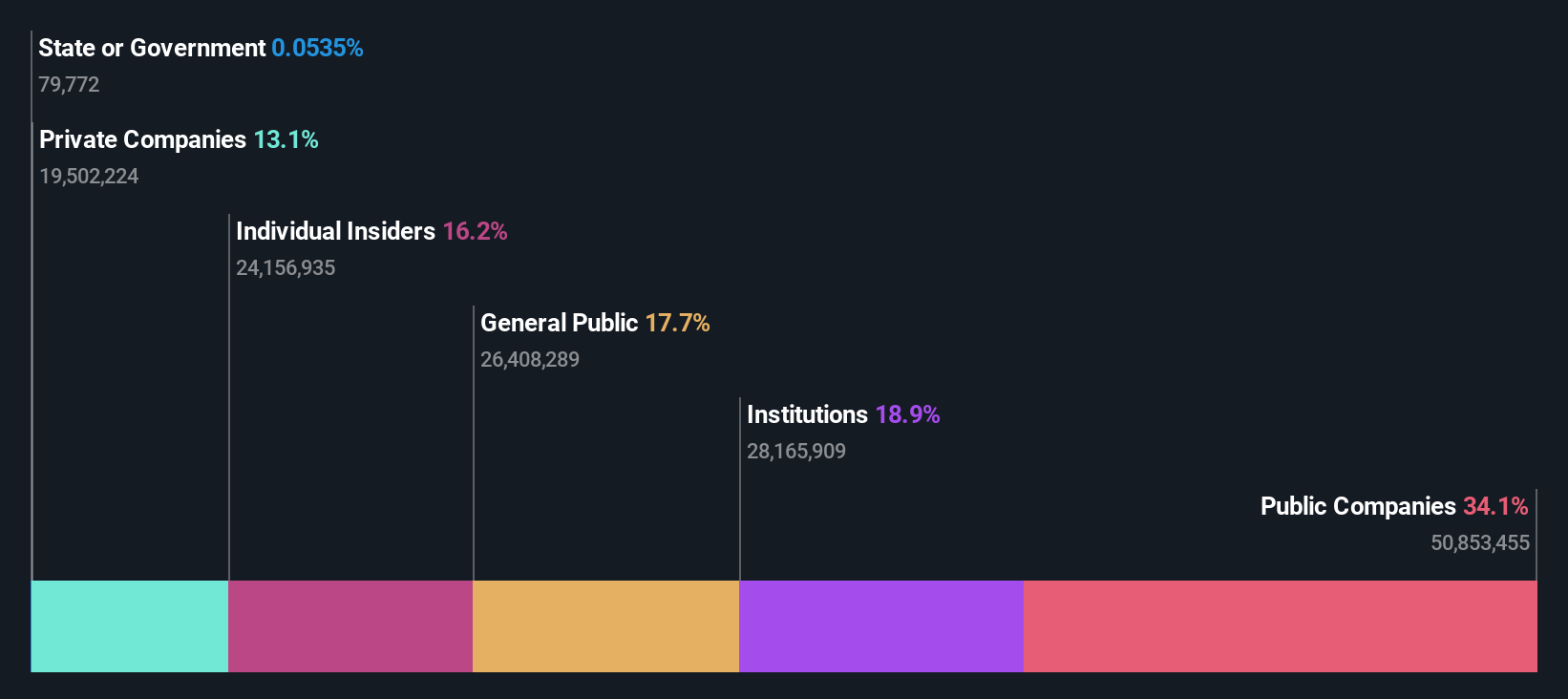

Quess (NSEI:QUESS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market cap of ₹108.75 billion.

Operations: The company's revenue segments include Workforce Management (₹138.44 billion), Operating Asset Management (₹28.43 billion), Global Technology Solutions excluding Product Led Business (₹23.87 billion), and Product Led Business (₹4.29 billion).

Insider Ownership: 15.8%

Revenue Growth Forecast: 13.5% p.a.

Quess Corp Limited shows promising growth with earnings forecasted to grow at 23% annually, outpacing the Indian market's 17%. Recent Q1 results revealed significant revenue and net income increases, with sales reaching ₹50.03 billion and net income doubling to ₹1.04 billion. The appointment of Gurmeet Chahal as CEO of Quess Global Technology Solutions highlights a strategic focus on AI and digital transformation, potentially enhancing future growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Quess.

- Our valuation report unveils the possibility Quess' shares may be trading at a discount.

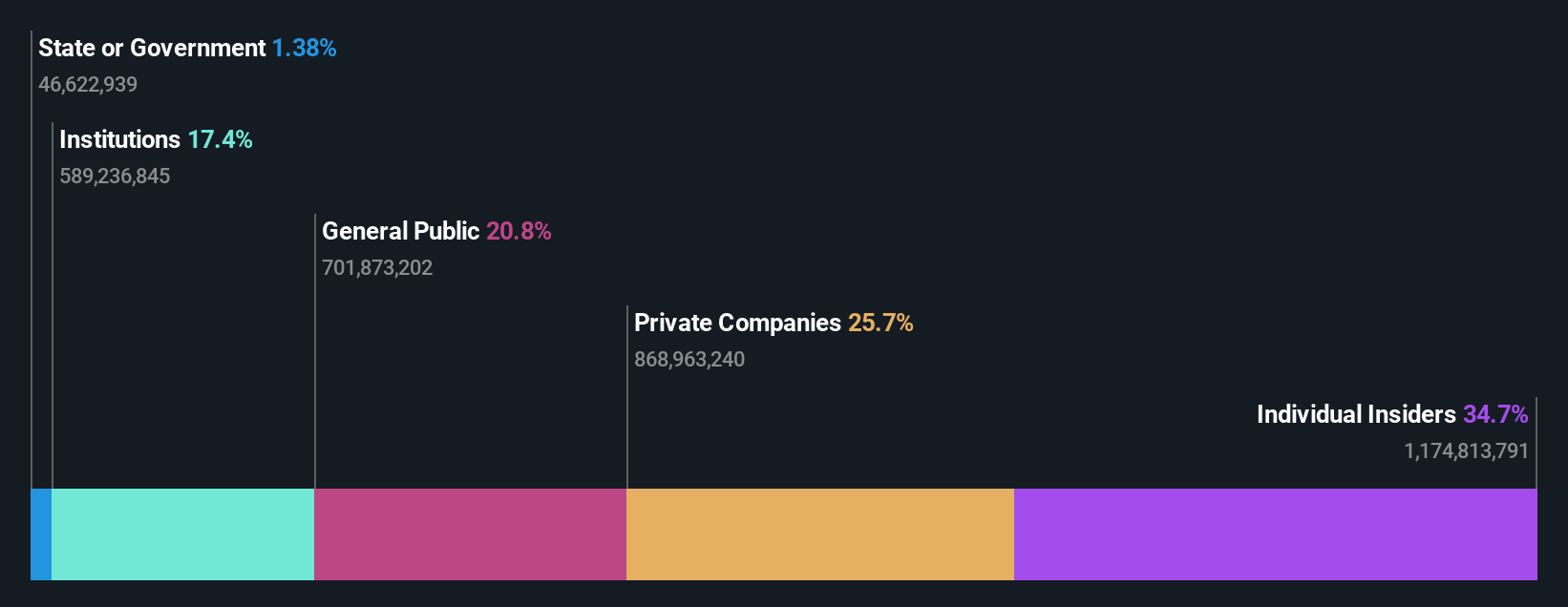

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, with a market cap of ₹2.06 trillion, operates as the franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages.

Operations: Revenue from the manufacturing and sale of beverages amounted to ₹180.52 billion.

Insider Ownership: 36.3%

Revenue Growth Forecast: 15.4% p.a.

Varun Beverages demonstrates strong growth potential with earnings forecasted to grow at 22.27% annually, surpassing the Indian market's 17%. Recent Q2 results showed substantial revenue and net income increases, with sales reaching ₹73.34 billion and net income rising to ₹12.53 billion. Despite high debt levels, the company maintains a robust Return on Equity forecast of 30.6%. The recent dividend affirmation and changes in capital structure further reflect confidence in sustained growth.

- Click to explore a detailed breakdown of our findings in Varun Beverages' earnings growth report.

- The analysis detailed in our Varun Beverages valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Click here to access our complete index of 93 Fast Growing Indian Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VBL

Varun Beverages

Manufactures, bottles, sells, and distributes beverages and value-added products under the PepsiCo brands.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026