- India

- /

- Consumer Durables

- /

- NSEI:DIXON

If You Had Bought Dixon Technologies (India) (NSE:DIXON) Shares Three Years Ago You'd Have Earned 493% Returns

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One bright shining star stock has been Dixon Technologies (India) Limited (NSE:DIXON), which is 493% higher than three years ago. On top of that, the share price is up 88% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for Dixon Technologies (India)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

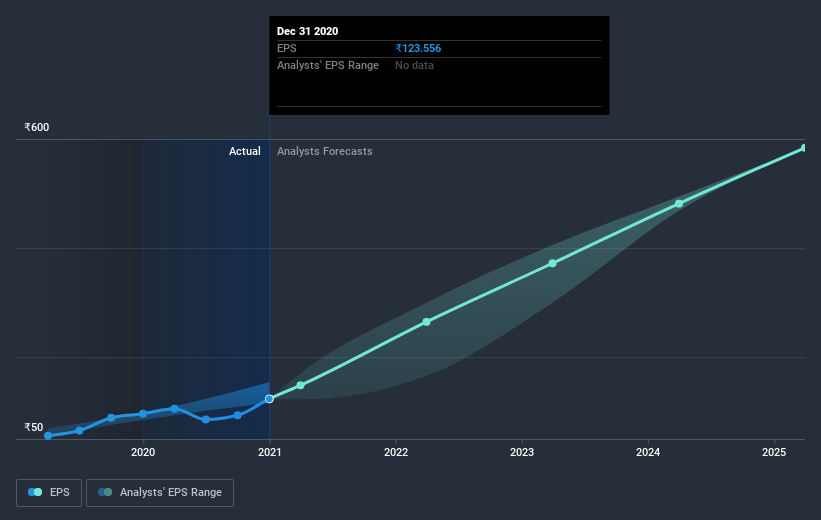

Dixon Technologies (India) was able to grow its EPS at 34% per year over three years, sending the share price higher. This EPS growth is lower than the 81% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It's not unusual to see the market 're-rate' a stock, after a few years of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 158.69.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Dixon Technologies (India) has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Dixon Technologies (India)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Dixon Technologies (India)'s total shareholder return last year was 348%. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 81%. Given the track record of solid returns over varying time frames, it might be worth putting Dixon Technologies (India) on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Dixon Technologies (India) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Dixon Technologies (India), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Dixon Technologies (India), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DIXON

Dixon Technologies (India)

Engages in the provision of electronic manufacturing services in India and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives