Investors Aren't Entirely Convinced About DCM Nouvelle Limited's (NSE:DCMNVL) Earnings

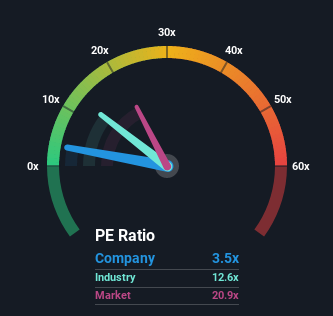

With a price-to-earnings (or "P/E") ratio of 3.5x DCM Nouvelle Limited (NSE:DCMNVL) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 21x and even P/E's higher than 45x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, DCM Nouvelle has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for DCM Nouvelle

Does Growth Match The Low P/E?

DCM Nouvelle's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 302% last year. The latest three year period has also seen an excellent 213% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that DCM Nouvelle's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that DCM Nouvelle currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with DCM Nouvelle (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DCMNVL

DCM Nouvelle

Engages in the manufacturing and sale of cotton yarn in India, Bangladesh, China, Eqypt, and internationally.

Mediocre balance sheet low.