- India

- /

- Consumer Durables

- /

- NSEI:BAJAJELEC

Shareholders May Not Overlook Bajaj Electricals Insiders Selling ₹856m In Stock

Despite the fact that Bajaj Electricals Limited (NSE:BAJAJELEC) stock rose 10% last week, insiders who sold ₹856m worth of stock in the previous 12 months are likely to be better off. Holding on to stock would have meant their investment would be worth less now than it was at the time of sale. Thus selling at an average price of ₹668, which is higher than the current price, may have been the best decision.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

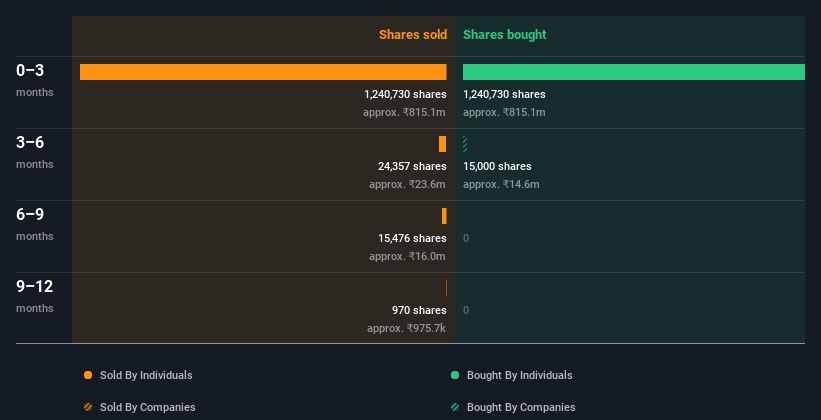

Bajaj Electricals Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by insider Manish Kejriwal for ₹815m worth of shares, at about ₹657 per share. That means that even when the share price was higher than ₹597 (the recent price), an insider wanted to purchase shares. It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. Manish Kejriwal was the only individual insider to buy shares in the last twelve months.

Over the last year we saw more insider selling of Bajaj Electricals shares, than buying. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Bajaj Electricals

I will like Bajaj Electricals better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Bajaj Electricals insiders own 18% of the company, worth about ₹12b. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Bajaj Electricals Tell Us?

Insider buying and selling have balanced each other out in the last three months, so we can't deduct anything useful from these recent trades. While we gain confidence from high insider ownership of Bajaj Electricals, we can't say the same about their transactions in the last year, in the absence of further purchases. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Bajaj Electricals. You'd be interested to know, that we found 3 warning signs for Bajaj Electricals and we suggest you have a look.

Of course Bajaj Electricals may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Bajaj Electricals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAJAJELEC

Bajaj Electricals

Engages in the provision of consumer products and lighting solutions in India.

Reasonable growth potential average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026