Axita Cotton Limited's (NSE:AXITA) Shares Leap 25% Yet They're Still Not Telling The Full Story

Axita Cotton Limited (NSE:AXITA) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 33%.

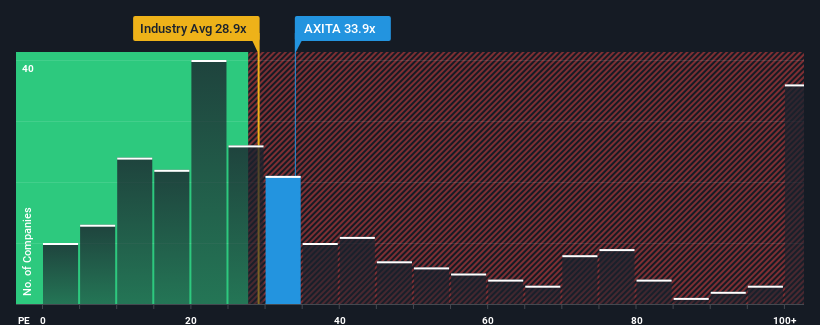

In spite of the firm bounce in price, it's still not a stretch to say that Axita Cotton's price-to-earnings (or "P/E") ratio of 33.9x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 35x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The earnings growth achieved at Axita Cotton over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Axita Cotton

Does Growth Match The P/E?

Axita Cotton's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. The latest three year period has also seen an excellent 447% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Axita Cotton's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Axita Cotton's P/E?

Axita Cotton's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Axita Cotton currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Axita Cotton (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Axita Cotton, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AXITA

Axita Cotton

Engages in manufacturing, processing, finishing, and trading of cotton bales, yarns, and seeds in India.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives