- India

- /

- Consumer Durables

- /

- NSEI:AMBER

Amber Enterprises India (NSE:AMBER) jumps 11% this week, though earnings growth is still tracking behind five-year shareholder returns

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. For example, the Amber Enterprises India Limited (NSE:AMBER) share price is up a whopping 468% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. In more good news, the share price has risen 16% in thirty days.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Amber Enterprises India

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

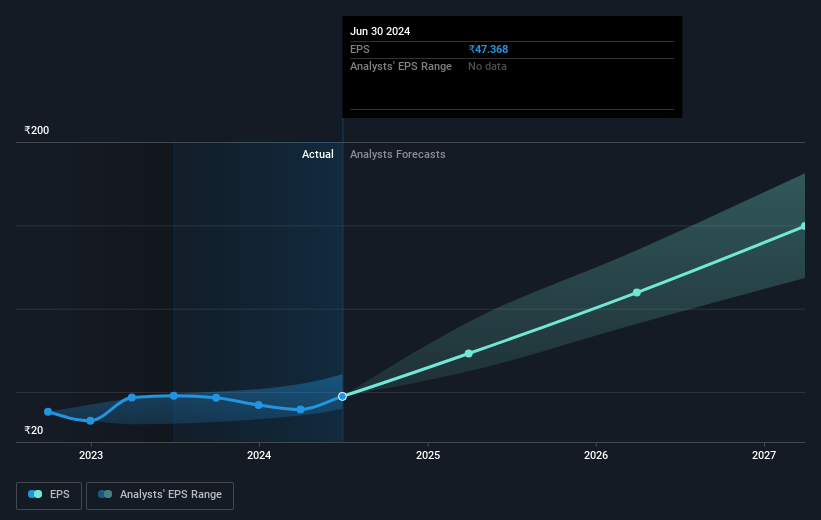

During five years of share price growth, Amber Enterprises India achieved compound earnings per share (EPS) growth of 2.7% per year. This EPS growth is slower than the share price growth of 42% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This optimism is visible in its fairly high P/E ratio of 109.23.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Amber Enterprises India's key metrics by checking this interactive graph of Amber Enterprises India's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Amber Enterprises India shareholders have received a total shareholder return of 75% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 42% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AMBER

Amber Enterprises India

Provides room air conditioner solutions in India.

Solid track record with reasonable growth potential.