- India

- /

- Professional Services

- /

- NSEI:RITES

RITES Limited's (NSE:RITES) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- RITES to hold its Annual General Meeting on 12th of September

- CEO Rahul Mithal's total compensation includes salary of ₹6.16m

- The total compensation is 50% less than the average for the industry

- RITES' EPS declined by 0.7% over the past three years while total shareholder return over the past three years was 182%

Shareholders may be wondering what CEO Rahul Mithal plans to do to improve the less than great performance at RITES Limited (NSE:RITES) recently. At the next AGM coming up on 12th of September, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for RITES

How Does Total Compensation For Rahul Mithal Compare With Other Companies In The Industry?

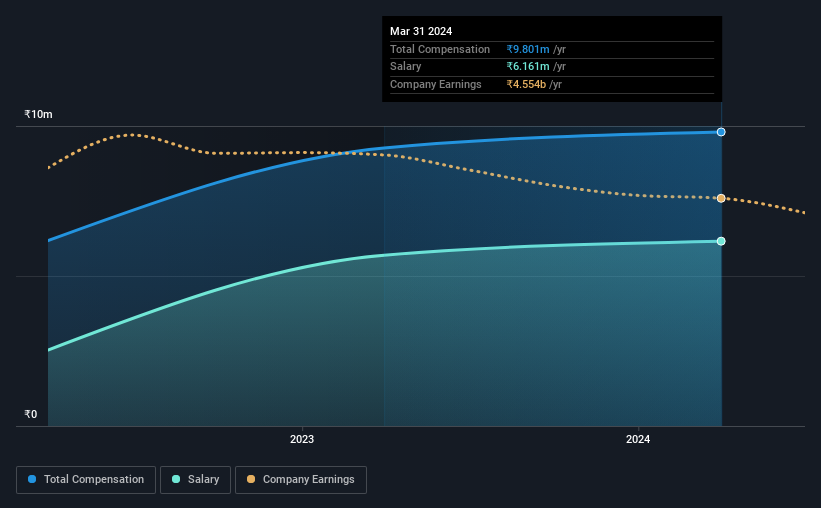

Our data indicates that RITES Limited has a market capitalization of ₹160b, and total annual CEO compensation was reported as ₹9.8m for the year to March 2024. That's just a smallish increase of 5.7% on last year. Notably, the salary which is ₹6.16m, represents most of the total compensation being paid.

For comparison, other companies in the Indian Professional Services industry with market capitalizations ranging between ₹84b and ₹269b had a median total CEO compensation of ₹20m. Accordingly, RITES pays its CEO under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹6.2m | ₹5.7m | 63% |

| Other | ₹3.6m | ₹3.6m | 37% |

| Total Compensation | ₹9.8m | ₹9.3m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. It's interesting to note that RITES allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

RITES Limited's Growth

RITES Limited saw earnings per share stay pretty flat over the last three years. Its revenue is down 6.8% over the previous year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has RITES Limited Been A Good Investment?

We think that the total shareholder return of 182%, over three years, would leave most RITES Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us wonder if these strong returns can continue. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for RITES that investors should think about before committing capital to this stock.

Switching gears from RITES, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RITES

RITES

Operates as an engineering consultancy company in the field of railways, highways, airports, ports, ropeways, urban transport, and inland waterways.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives