- India

- /

- Professional Services

- /

- NSEI:RITES

RITES Limited's (NSE:RITES) 32% Price Boost Is Out Of Tune With Earnings

RITES Limited (NSE:RITES) shares have continued their recent momentum with a 32% gain in the last month alone. The annual gain comes to 127% following the latest surge, making investors sit up and take notice.

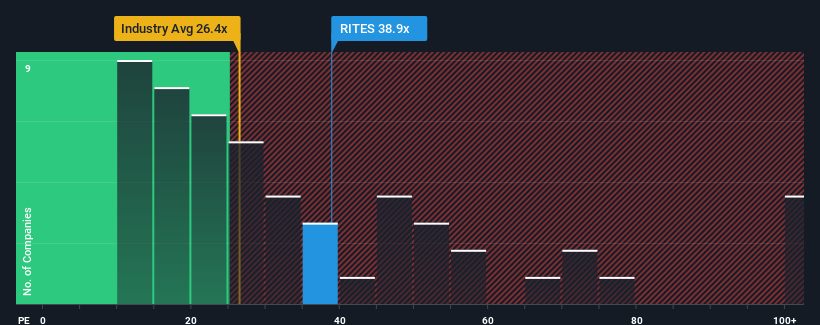

After such a large jump in price, RITES may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 38.9x, since almost half of all companies in India have P/E ratios under 31x and even P/E's lower than 17x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

RITES hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for RITES

How Is RITES' Growth Trending?

RITES' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 11% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 24% during the coming year according to the two analysts following the company. With the market predicted to deliver 25% growth , the company is positioned for a comparable earnings result.

In light of this, it's curious that RITES' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From RITES' P/E?

RITES' P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of RITES' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for RITES (1 is a bit unpleasant!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RITES

RITES

Operates as an engineering consultancy company in the field of railways, highways, airports, ports, ropeways, urban transport, and inland waterways.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives