- India

- /

- Professional Services

- /

- NSEI:DYNAMIC

Should You Be Adding Dynamic Services & Security (NSE:DYNAMIC) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Dynamic Services & Security (NSE:DYNAMIC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Dynamic Services & Security

How Fast Is Dynamic Services & Security Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Dynamic Services & Security managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Dynamic Services & Security is growing revenues, and EBIT margins improved by 5.3 percentage points to 11%, over the last year. That's great to see, on both counts.

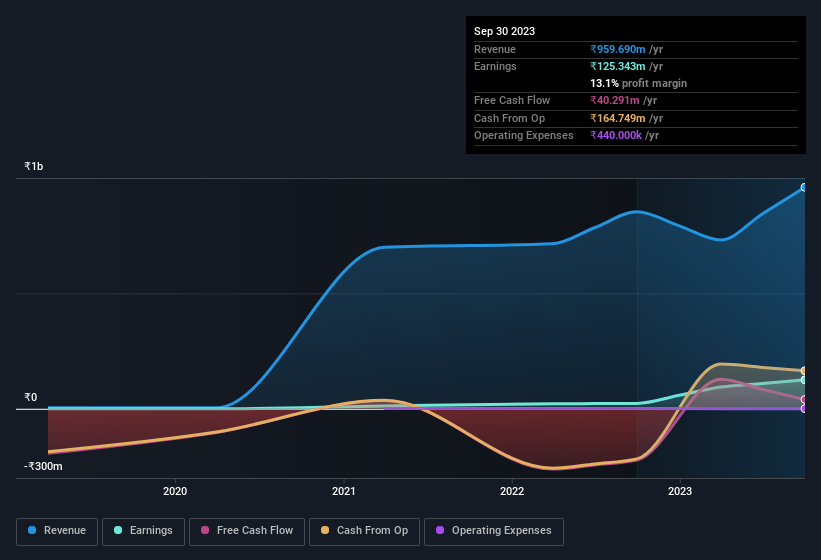

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Dynamic Services & Security isn't a huge company, given its market capitalisation of ₹1.6b. That makes it extra important to check on its balance sheet strength.

Are Dynamic Services & Security Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Dynamic Services & Security will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 50% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Of course, Dynamic Services & Security is a very small company, with a market cap of only ₹1.6b. So despite a large proportional holding, insiders only have ₹808m worth of stock. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Should You Add Dynamic Services & Security To Your Watchlist?

One positive for Dynamic Services & Security is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. Even so, be aware that Dynamic Services & Security is showing 1 warning sign in our investment analysis , you should know about...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DYNAMIC

Dynamic Services & Security

Provides security guarding and manpower solutions in India.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.