- India

- /

- Commercial Services

- /

- NSEI:DJML

DJ Mediaprint & Logistics Limited (NSE:DJML) Shares Slammed 28% But Getting In Cheap Might Be Difficult Regardless

DJ Mediaprint & Logistics Limited (NSE:DJML) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 134% in the last twelve months.

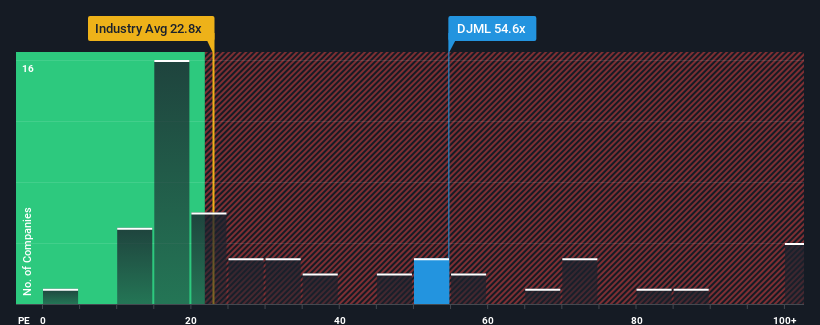

Although its price has dipped substantially, DJ Mediaprint & Logistics may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 54.6x, since almost half of all companies in India have P/E ratios under 27x and even P/E's lower than 15x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

DJ Mediaprint & Logistics certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for DJ Mediaprint & Logistics

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like DJ Mediaprint & Logistics' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 169% last year. The strong recent performance means it was also able to grow EPS by 187% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why DJ Mediaprint & Logistics is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Even after such a strong price drop, DJ Mediaprint & Logistics' P/E still exceeds the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that DJ Mediaprint & Logistics maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for DJ Mediaprint & Logistics (1 is potentially serious!) that you need to take into consideration.

If you're unsure about the strength of DJ Mediaprint & Logistics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DJML

DJ Mediaprint & Logistics

Provides integrated printing, logistics, and courier solutions in the Asia Pacific, North America, Europe, and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives