- India

- /

- Professional Services

- /

- NSEI:ACEINTEG

Here's Why We Think Ace Integrated Solutions (NSE:ACEINTEG) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Ace Integrated Solutions (NSE:ACEINTEG). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Ace Integrated Solutions

How Fast Is Ace Integrated Solutions Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Ace Integrated Solutions has grown EPS by 31% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Ace Integrated Solutions shareholders can take confidence from the fact that EBIT margins are up from 0.7% to 22%, and revenue is growing. That's great to see, on both counts.

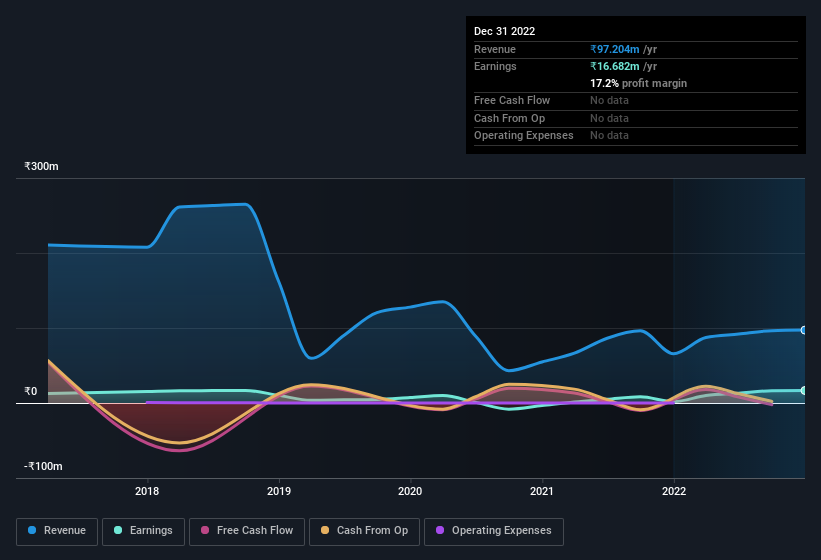

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Ace Integrated Solutions is no giant, with a market capitalisation of ₹380m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Ace Integrated Solutions Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Ace Integrated Solutions insiders own a significant number of shares certainly is appealing. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Although, with Ace Integrated Solutions being valued at ₹380m, this is a small company we're talking about. That means insiders only have ₹280m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under ₹16b, like Ace Integrated Solutions, the median CEO pay is around ₹3.5m.

The CEO of Ace Integrated Solutions was paid just ₹3.0m in total compensation for the year ending March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Ace Integrated Solutions To Your Watchlist?

You can't deny that Ace Integrated Solutions has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the key takeaway is that Ace Integrated Solutions is worth keeping an eye on. Before you take the next step you should know about the 4 warning signs for Ace Integrated Solutions (3 don't sit too well with us!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Ace Integrated Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ACEINTEG

Ace Integrated Solutions

Together with its subsidiary, Ace Prometric Solutions Limited, provides manpower recruitment and examination management services for government and semi-government organizations in India.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives