- India

- /

- Electrical

- /

- NSEI:ZODIAC

With EPS Growth And More, Zodiac Energy (NSE:ZODIAC) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Zodiac Energy (NSE:ZODIAC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Zodiac Energy

How Quickly Is Zodiac Energy Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Zodiac Energy has managed to grow EPS by 19% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

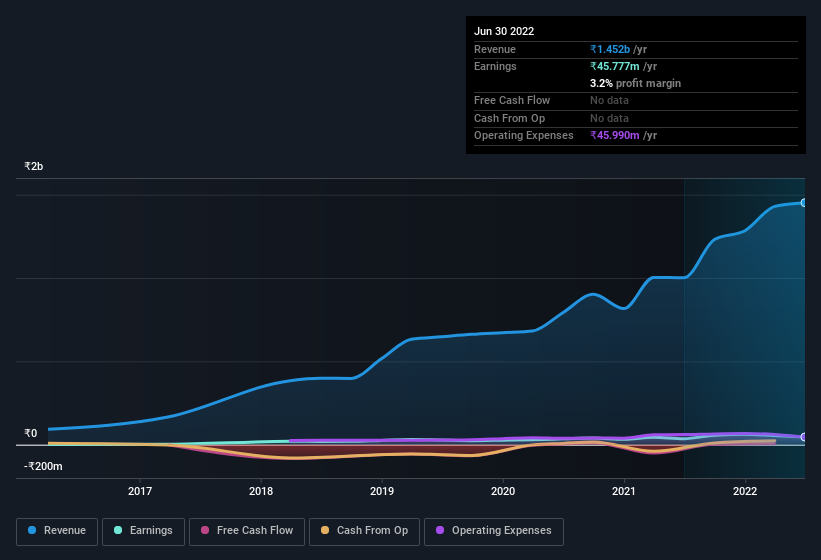

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Zodiac Energy remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 45% to ₹1.5b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Zodiac Energy isn't a huge company, given its market capitalisation of ₹2.2b. That makes it extra important to check on its balance sheet strength.

Are Zodiac Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders in Zodiac Energy both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. So, on balance, the insider transactions are mildly encouraging. Zooming in, we can see that the biggest insider purchase was by Founder Kunjbihari Shah for ₹1.0m worth of shares, at about ₹28.04 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Zodiac Energy will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 79% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at ₹1.7b at the current share price. So there's plenty there to keep them focused!

Does Zodiac Energy Deserve A Spot On Your Watchlist?

For growth investors, Zodiac Energy's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Zodiac Energy (1 makes us a bit uncomfortable) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Zodiac Energy, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zodiac Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZODIAC

Zodiac Energy

Engages in the installation of solar power generation plants and related items primarily in India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives