The US Federal Reserve's unexpected 50 bps rate cut and its shift in policy are boosting the emerging markets. Despite India lagging behind its Asian counterparts, domestic benchmarks have breached new highs, driven primarily by large-cap stocks. In this environment, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an attractive option for investors seeking to navigate current market conditions. Here are three Indian dividend stocks yielding up to 7.7%.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.27% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 4.37% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.04% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 7.78% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 5.72% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.58% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.11% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.32% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.76% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.04% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Indian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited primarily engages in refining crude oil and marketing petroleum products in India and internationally, with a market cap of ₹1.59 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue from two main segments: Downstream Petroleum, which contributed ₹5.07 billion, and Exploration & Production of Hydrocarbons, which added ₹1.92 billion.

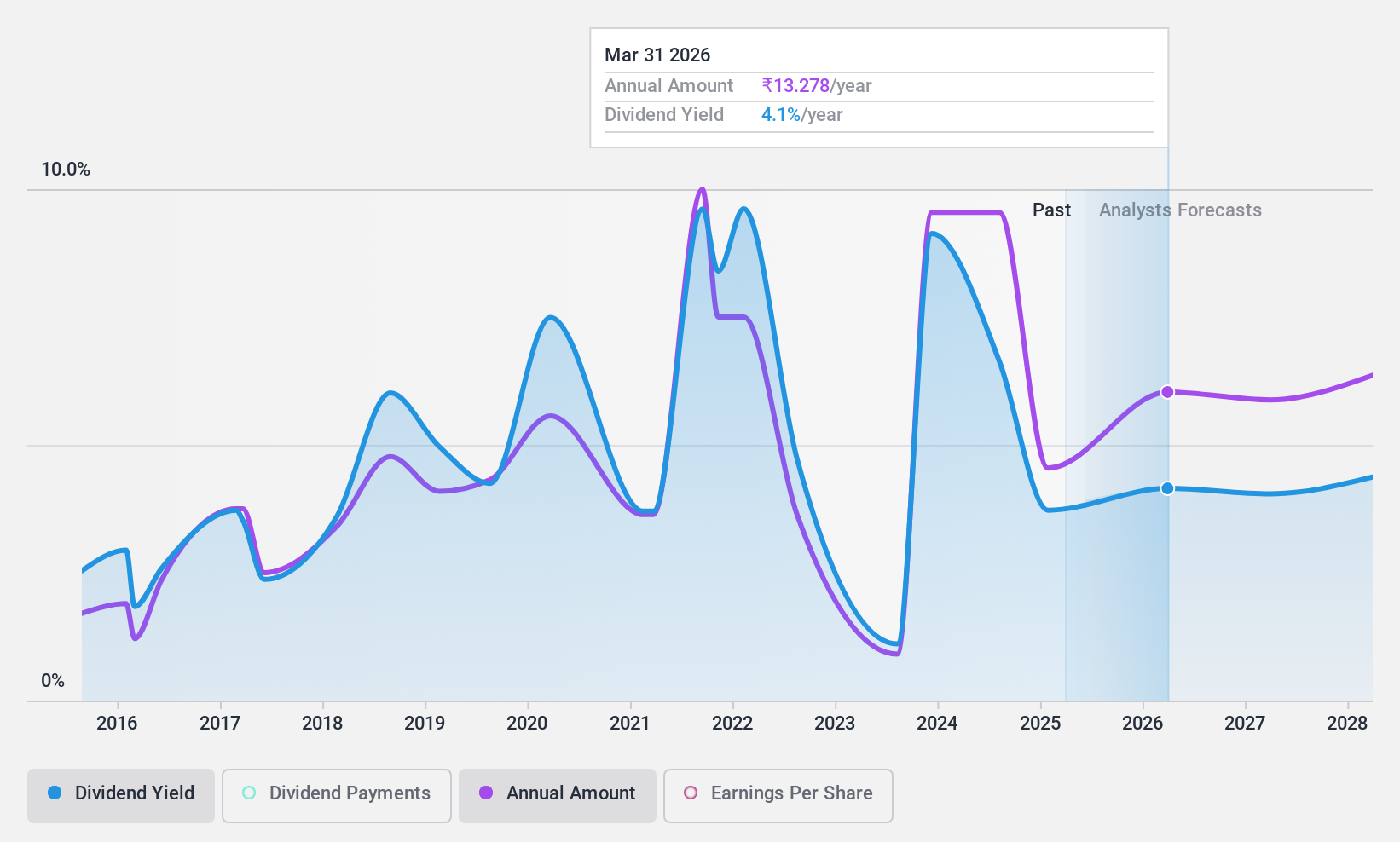

Dividend Yield: 5.7%

Bharat Petroleum's dividend yield of 5.72% places it in the top 25% of Indian dividend payers, supported by a low payout ratio (33.3%) and cash payout ratio (34.6%), indicating strong coverage by earnings and cash flows. Despite this, its dividends have been volatile over the past decade, raising concerns about reliability. Recent strategic moves into renewable energy and green hydrogen through joint ventures may bolster future earnings stability amidst expected short-term profit declines.

- Click to explore a detailed breakdown of our findings in Bharat Petroleum's dividend report.

- Our valuation report here indicates Bharat Petroleum may be undervalued.

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited, with a market cap of ₹2.48 trillion, refines, pipeline transports, and markets petroleum products in India and internationally through its subsidiaries.

Operations: Indian Oil Corporation Limited generates revenue from Petrochemicals (₹262.95 billion) and Petroleum Products (₹8.25 trillion).

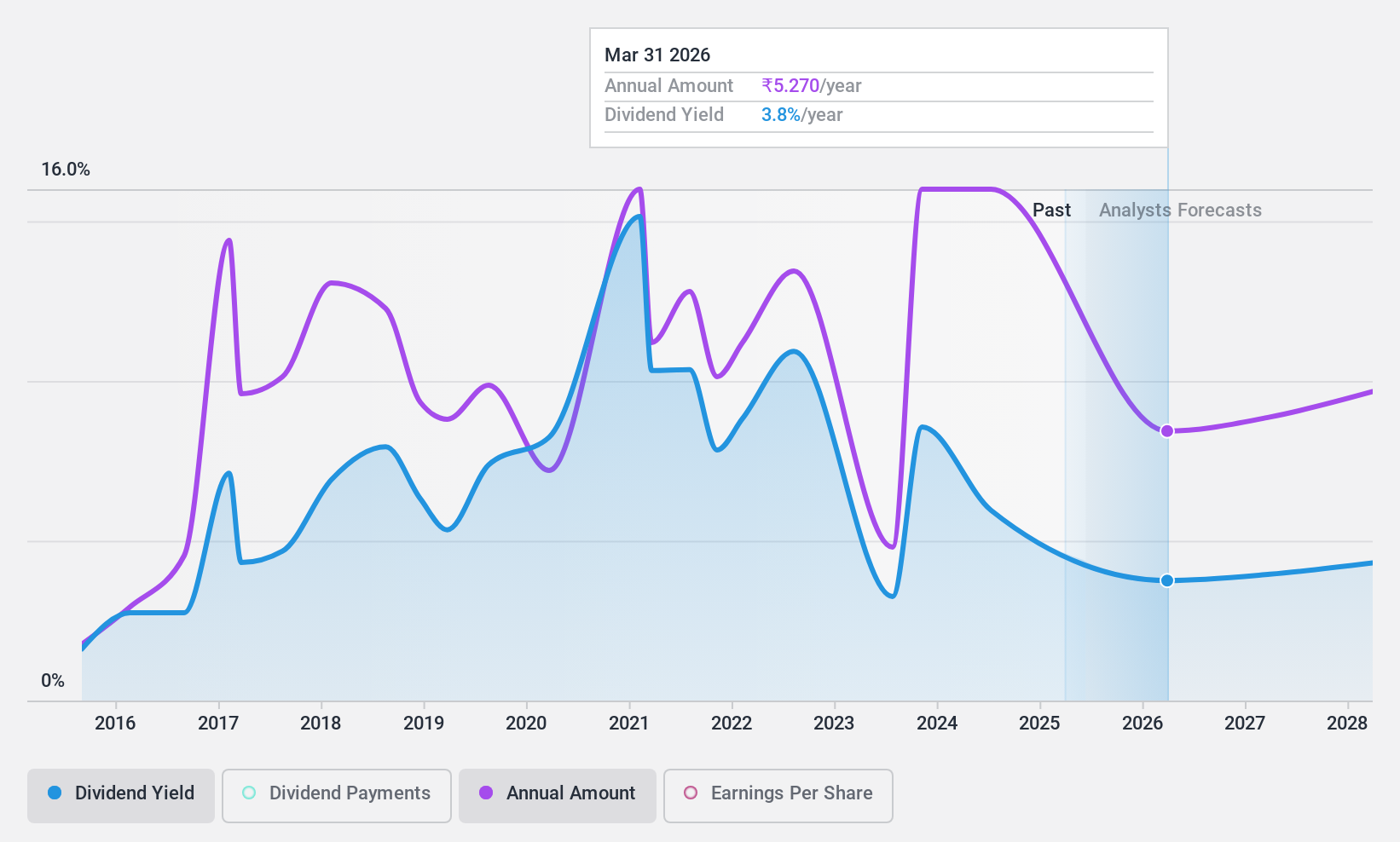

Dividend Yield: 7.8%

Indian Oil's dividend yield of 7.78% ranks it among the top 25% of Indian dividend payers. The company's dividends are covered by earnings (payout ratio: 39.6%) and cash flows (cash payout ratio: 56.8%). However, its high debt levels and volatile dividend history over the past decade raise concerns about sustainability. Recent leadership changes and a final dividend declaration of ₹7 per share for FY2023-24 highlight ongoing corporate adjustments amidst fluctuating earnings performance.

- Delve into the full analysis dividend report here for a deeper understanding of Indian Oil.

- Insights from our recent valuation report point to the potential undervaluation of Indian Oil shares in the market.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, with a market cap of ₹21.14 billion, manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles across India, the United States, the Asia Pacific, Europe, Japan, and internationally.

Operations: Uniparts India Limited generates revenue primarily from the sale of linkage parts and components for off-highway vehicles, amounting to ₹11.04 billion.

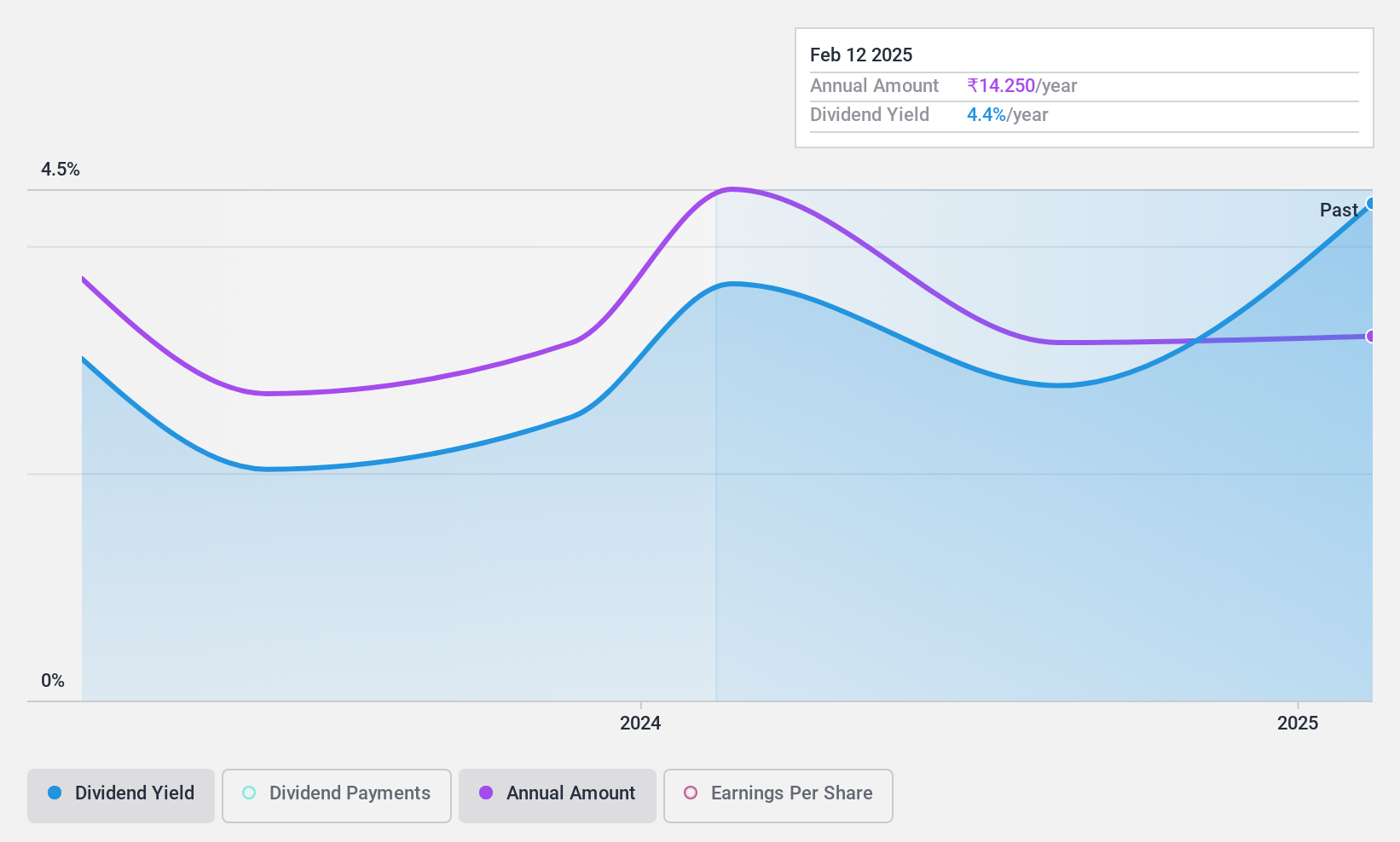

Dividend Yield: 4.4%

Uniparts India recently approved two interim dividends totaling ₹14 per share, reflecting a commitment to returning value to shareholders. Despite a payout ratio of 73.8% and cash payout ratio of 56.7%, which indicate dividends are covered by earnings and cash flows, the company's dividend history is unstable with volatility in payments over the past two years. Additionally, Uniparts trades at a favorable P/E ratio of 18.8x compared to the Indian market average of 34.1x.

- Unlock comprehensive insights into our analysis of Uniparts India stock in this dividend report.

- Our expertly prepared valuation report Uniparts India implies its share price may be lower than expected.

Summing It All Up

- Reveal the 16 hidden gems among our Top Indian Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UNIPARTS

Uniparts India

Manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles in India, the United States, the Asia Pacific, Europe, Japan, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.