- India

- /

- Electrical

- /

- NSEI:UEL

Undiscovered Gems in India To Explore This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 3.2% decline, yet it boasts an impressive 40% rise over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying promising stocks involves looking for companies with strong growth potential and resilience that can capitalize on these robust market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Avantel | 5.92% | 33.97% | 37.33% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Anup Engineering (NSEI:ANUP)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Anup Engineering Limited, along with its subsidiaries, specializes in manufacturing and fabricating process equipment for various industries including oil and gas, petrochemicals, LNG, fertilizers, chemicals, pharmaceuticals, power, water, paper and pulp, and aerospace in India with a market cap of ₹56.17 billion.

Operations: Anup Engineering generates revenue primarily from its engineering products, amounting to ₹5.71 billion.

Anup Engineering, a promising player in the machinery industry, has seen its earnings grow by 68% over the past year, outpacing the industry's 25.8%. This growth is supported by high-quality earnings and positive free cash flow. The company's debt-to-equity ratio has increased from 2.6% to 3.9% over five years, but it holds more cash than total debt. Recent strategic moves include securing critical orders worth over ₹1 billion and entering a manufacturing agreement with Graham India and USA, signaling robust future prospects.

- Navigate through the intricacies of Anup Engineering with our comprehensive health report here.

Evaluate Anup Engineering's historical performance by accessing our past performance report.

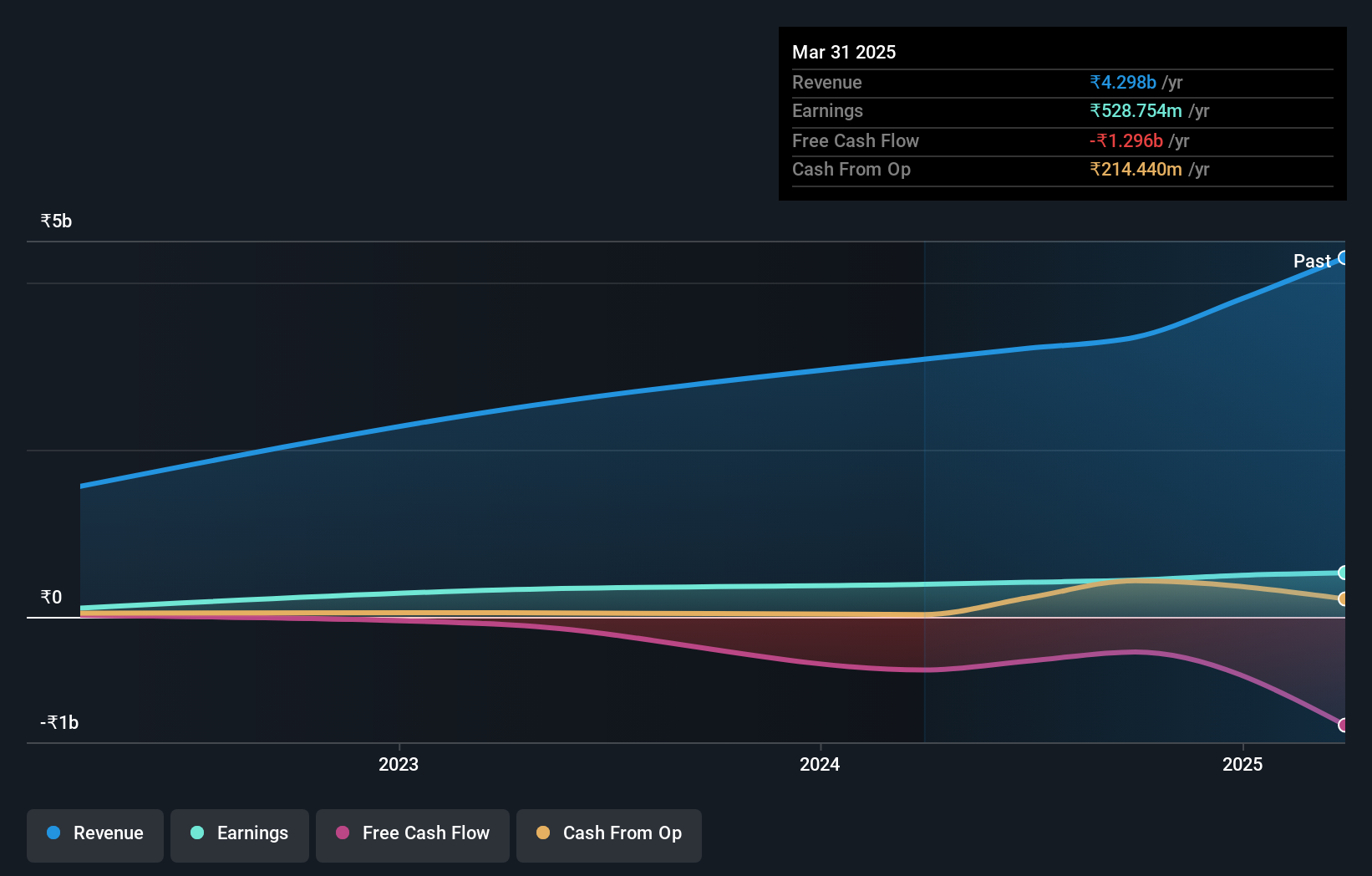

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in the manufacturing and sale of aluminium and copper fin and tube-type heat exchangers for the HVAC and refrigeration industry, with a market cap of ₹26.30 billion.

Operations: KRN generates revenue primarily from the manufacture and sale of HVAC parts and accessories, amounting to ₹3.08 billion.

Venturing into the world of KRN Heat Exchanger and Refrigeration reveals a company with promising prospects. Recently completing an IPO worth INR 3.42 billion, it aims to expand its manufacturing capabilities. With net income rising to INR 390.69 million from INR 323.14 million last year, earnings per share also climbed to INR 8.69 from INR 7.34 previously. Despite illiquid shares, its satisfactory net debt-to-equity ratio of 37% and strong interest coverage (28x EBIT) highlight financial stability amidst growth ambitions in the ventilation solutions sector.

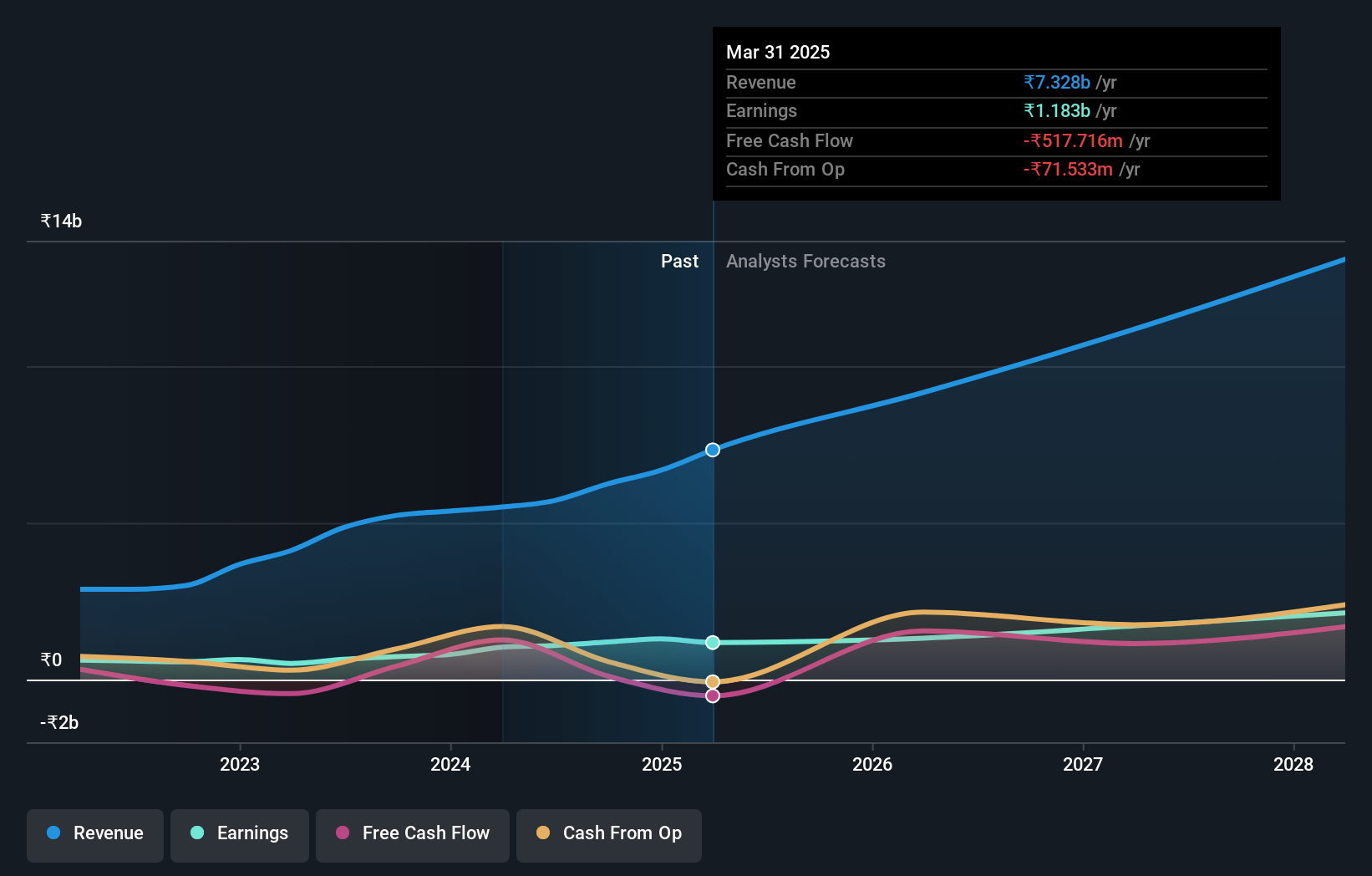

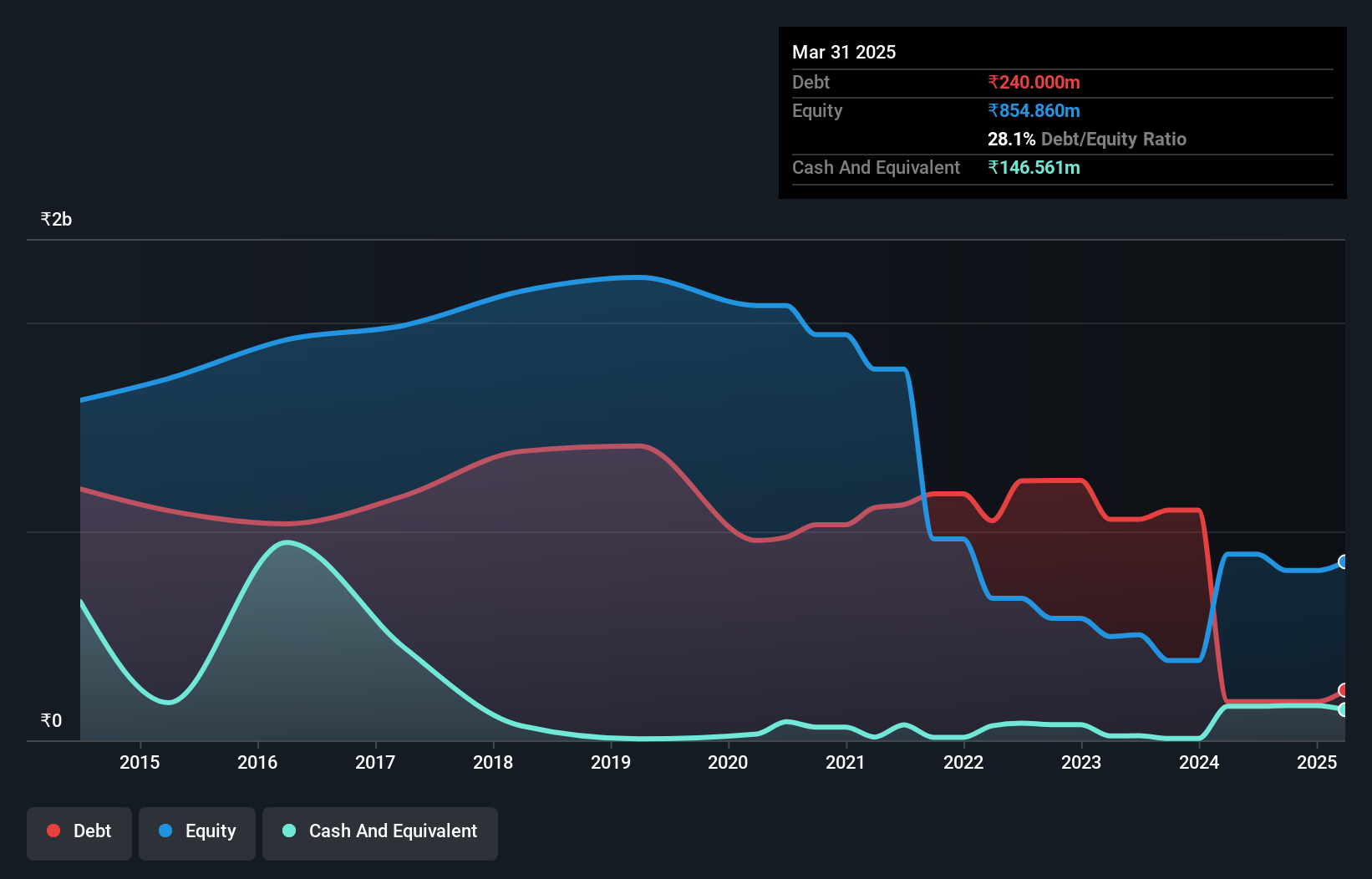

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited is involved in the generation of solar power in India, with a market capitalization of ₹84.41 billion.

Operations: Ujaas Energy generates revenue primarily from its solar power plant operations, contributing ₹307.70 million. The company's net profit margin shows a notable trend at 7.5%.

Ujaas Energy, a smaller player in the renewable sector, recently turned profitable with a net income of ₹38.15M for Q1 2024 against a previous loss of ₹58.57M. Despite facing a hefty one-off loss of ₹91M over the past year, the company managed to reduce its debt to equity ratio from 59.4% to 20.8% over five years, showcasing financial discipline. However, shareholders experienced significant dilution recently amidst strategic shifts like bonus share allotments and changes in bylaws.

- Unlock comprehensive insights into our analysis of Ujaas Energy stock in this health report.

Review our historical performance report to gain insights into Ujaas Energy's's past performance.

Turning Ideas Into Actions

- Gain an insight into the universe of 468 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UEL

Excellent balance sheet with low risk.

Market Insights

Community Narratives