- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Exploring 3 Undiscovered Gems in India's Stock Market

Reviewed by Simply Wall St

Over the last seven days, India's stock market has seen a 3.2% decline, yet it remains up by an impressive 40% over the past year with earnings projected to grow by 17% annually in the coming years. In such dynamic conditions, identifying stocks that possess strong fundamentals and growth potential can offer significant opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.96% | 40.47% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both in India and abroad, with a market capitalization of ₹151.67 billion.

Operations: JP Power derives its revenue primarily from the power segment, contributing ₹61.68 billion, and coal sales amounting to ₹6.59 billion. The company experiences a segment adjustment of ₹6.42 billion in its financials.

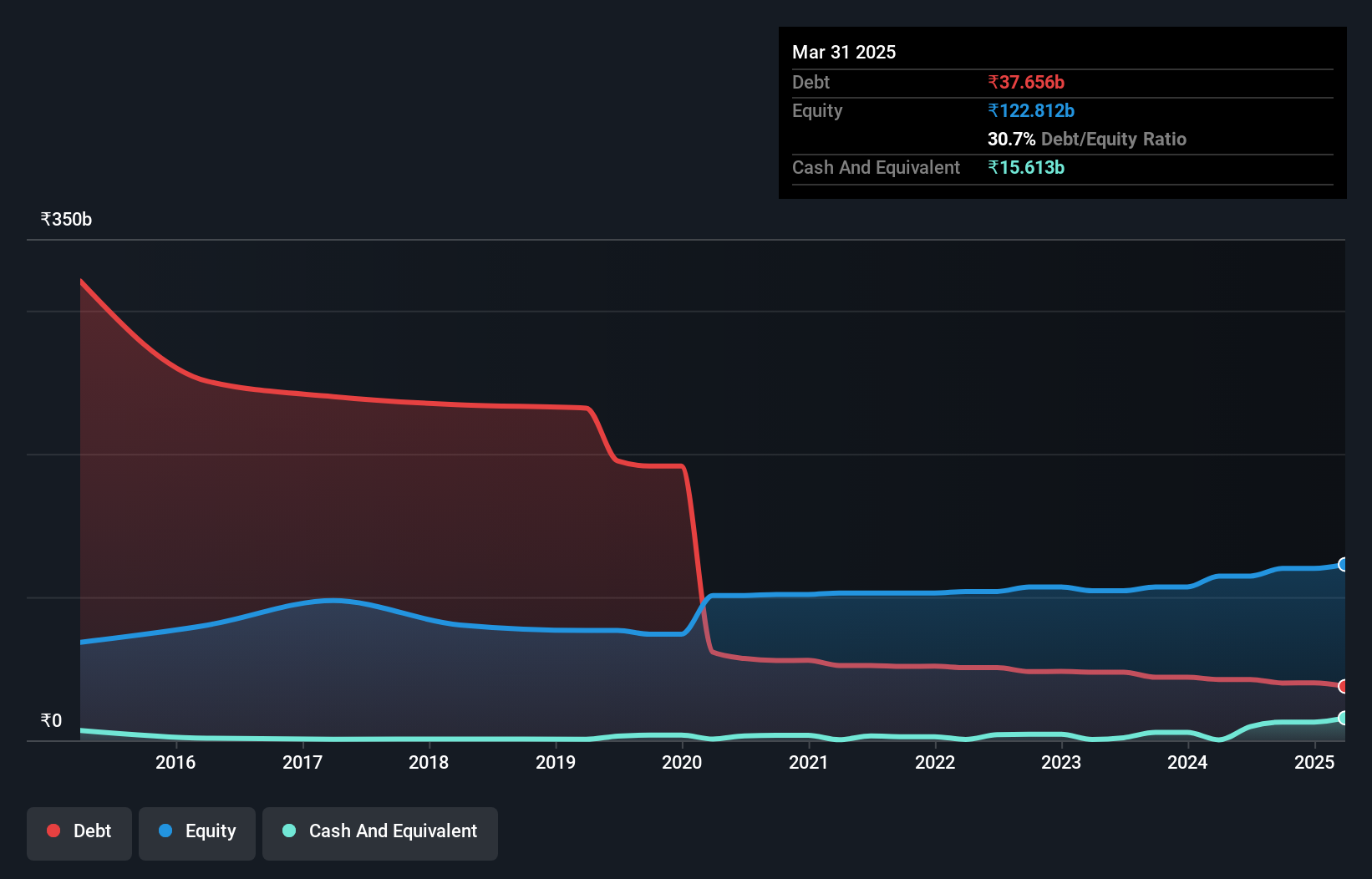

JPPOWER, a player in India's energy sector, has seen remarkable earnings growth of 22,969% over the past year, outpacing the industry's 12%. Trading at 63.6% below its estimated fair value suggests potential undervaluation. The company's debt to equity ratio improved significantly from 254.1% to 37% over five years, indicating better financial health. However, a one-off loss of ₹6.9 billion impacted recent results, though interest payments remain well covered with EBIT at 5.2x coverage.

- Get an in-depth perspective on Jaiprakash Power Ventures' performance by reading our health report here.

Assess Jaiprakash Power Ventures' past performance with our detailed historical performance reports.

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in the manufacturing and sale of aluminium and copper fin and tube-type heat exchangers for the HVACR industry, with a market capitalization of ₹28.54 billion.

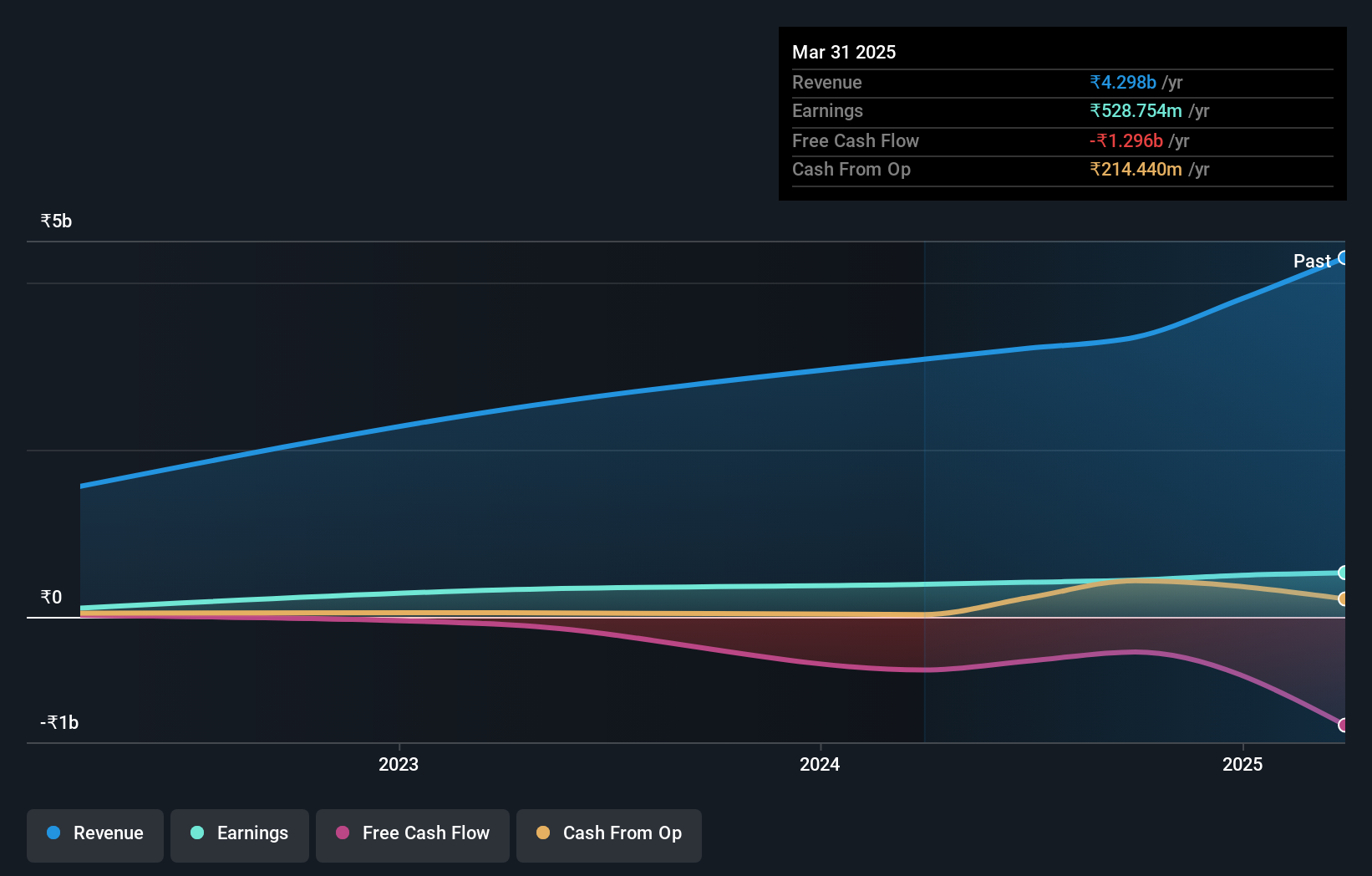

Operations: KRN's primary revenue stream is from the manufacture and sale of HVAC parts and accessories, generating ₹3.08 billion. The company's financial performance can be analyzed through its gross profit margin, which provides insights into its production efficiency and cost management.

KRN Heat Exchanger and Refrigeration, a small player in the industry, recently completed an IPO raising INR 3.42 billion to fund a new manufacturing facility. Their earnings growth of 20.9% outpaced the Metals and Mining sector, showcasing robust performance with net income reaching INR 390.69 million from INR 323.14 million last year. Despite high non-cash earnings and satisfactory debt levels at a net debt to equity ratio of 37.5%, free cash flow remains negative, highlighting potential liquidity concerns amidst expansion efforts.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited is involved in the generation of solar power in India, with a market capitalization of ₹84.41 billion.

Operations: Ujaas Energy derives its revenue primarily from the operation of solar power plants, generating ₹307.70 million, while its electric vehicle segment contributes ₹41 million.

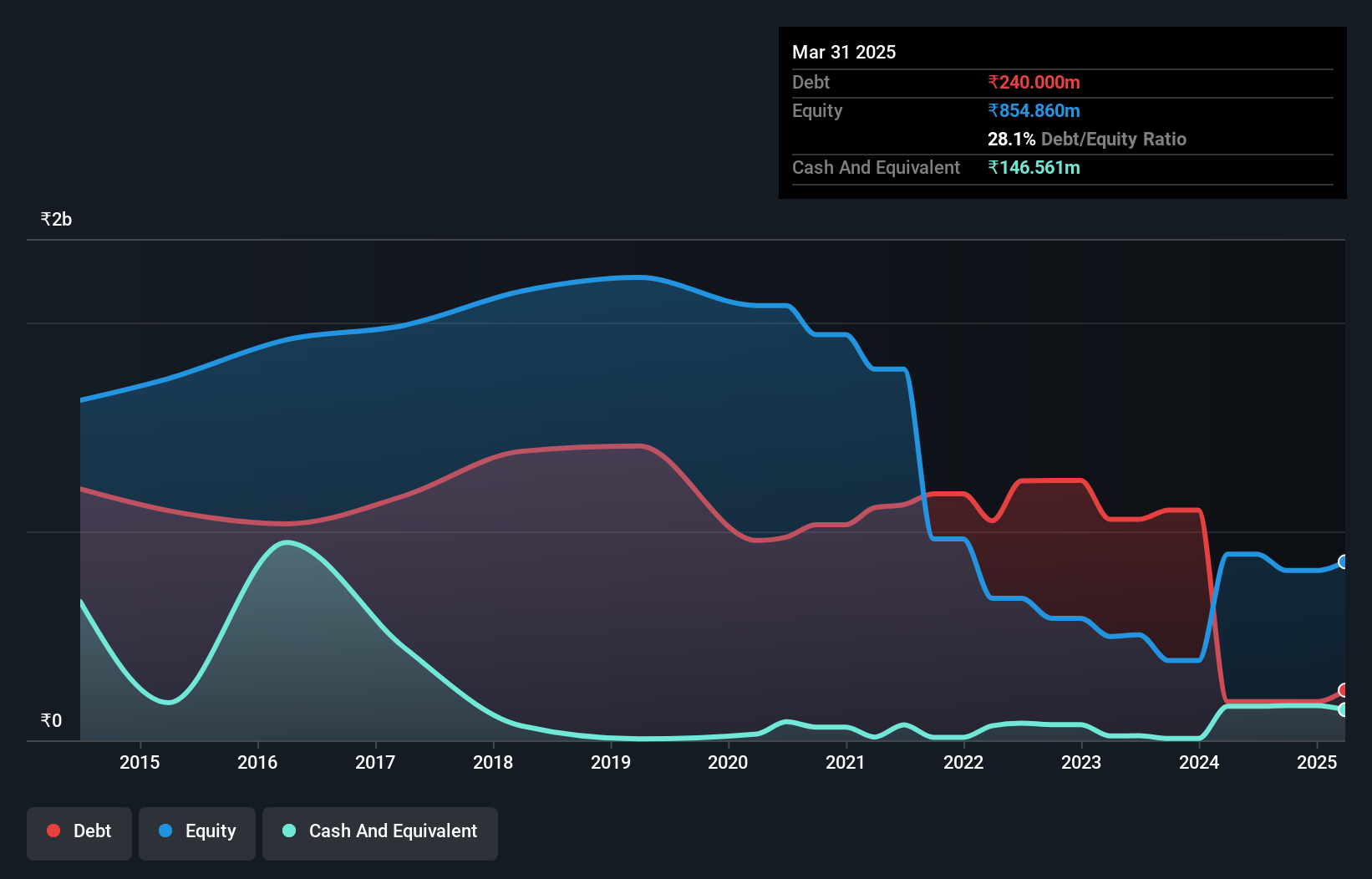

Ujaas Energy, a smaller player in the renewable sector, has shown notable progress by becoming profitable this year with a net income of ₹38.15 million for the quarter ending June 2024, compared to a net loss of ₹58.57 million last year. Despite sales dipping to ₹62.89 million from ₹71.84 million, revenue climbed to ₹107.16 million from ₹74.83 million previously reported. The company’s debt-to-equity ratio improved significantly from 59% five years ago to 21% now, indicating better financial health and stability moving forward.

- Delve into the full analysis health report here for a deeper understanding of Ujaas Energy.

Examine Ujaas Energy's past performance report to understand how it has performed in the past.

Taking Advantage

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 465 more companies for you to explore.Click here to unveil our expertly curated list of 468 Indian Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives