Undervalued Stock Estimates On The Indian Exchange For September 2024

Reviewed by Simply Wall St

In the last week, the Indian market is up 1.7% and has surged by 41% over the last 12 months, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying undervalued stocks can provide significant opportunities for investors looking to capitalize on potential growth at a reasonable price.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹810.55 | ₹1509.79 | 46.3% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2328.75 | ₹4407.07 | 47.2% |

| Apollo Pipes (BSE:531761) | ₹632.75 | ₹1144.25 | 44.7% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1339.50 | ₹2174.22 | 38.4% |

| Patel Engineering (BSE:531120) | ₹61.67 | ₹94.55 | 34.8% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹511.25 | ₹762.32 | 32.9% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹60.23 | ₹93.25 | 35.4% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹293.15 | ₹445.15 | 34.1% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹296.15 | ₹585.75 | 49.4% |

| Tarsons Products (NSEI:TARSONS) | ₹440.45 | ₹708.31 | 37.8% |

Let's uncover some gems from our specialized screener.

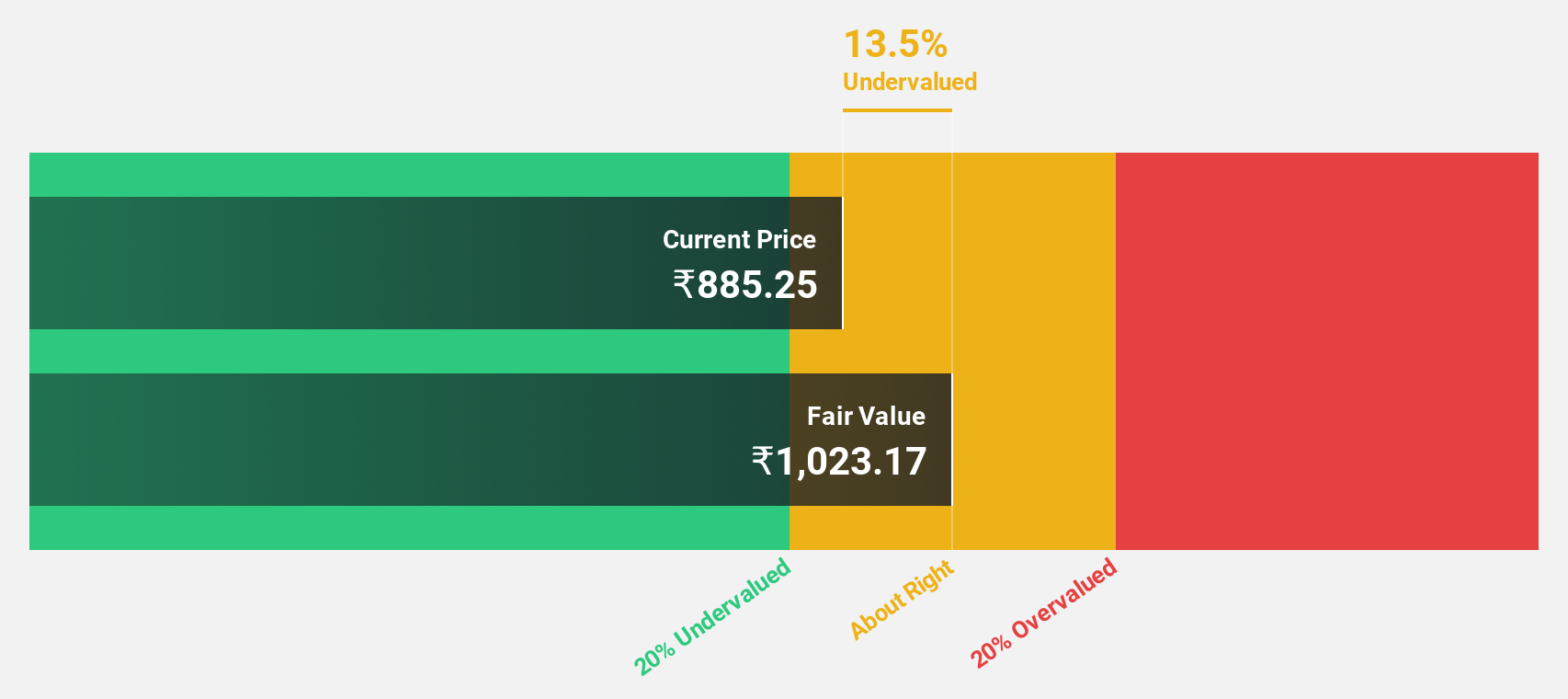

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited operates in the steel, mining, and infrastructure sectors in India and internationally, with a market cap of ₹1.06 trillion.

Operations: The company's revenue primarily comes from manufacturing steel products, totaling ₹510.56 billion.

Estimated Discount To Fair Value: 15.2%

Jindal Steel & Power (JSPL) is trading at ₹1043.1, which is 15.2% below its estimated fair value of ₹1229.36, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 24% annually over the next three years, outpacing the Indian market's expected growth rate of 17.1%. Recent strategic alliances with Jindal Renewables to integrate green hydrogen and renewable energy further enhance JSPL's long-term sustainability and cost-efficiency in steel production.

- Upon reviewing our latest growth report, Jindal Steel & Power's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Jindal Steel & Power with our detailed financial health report.

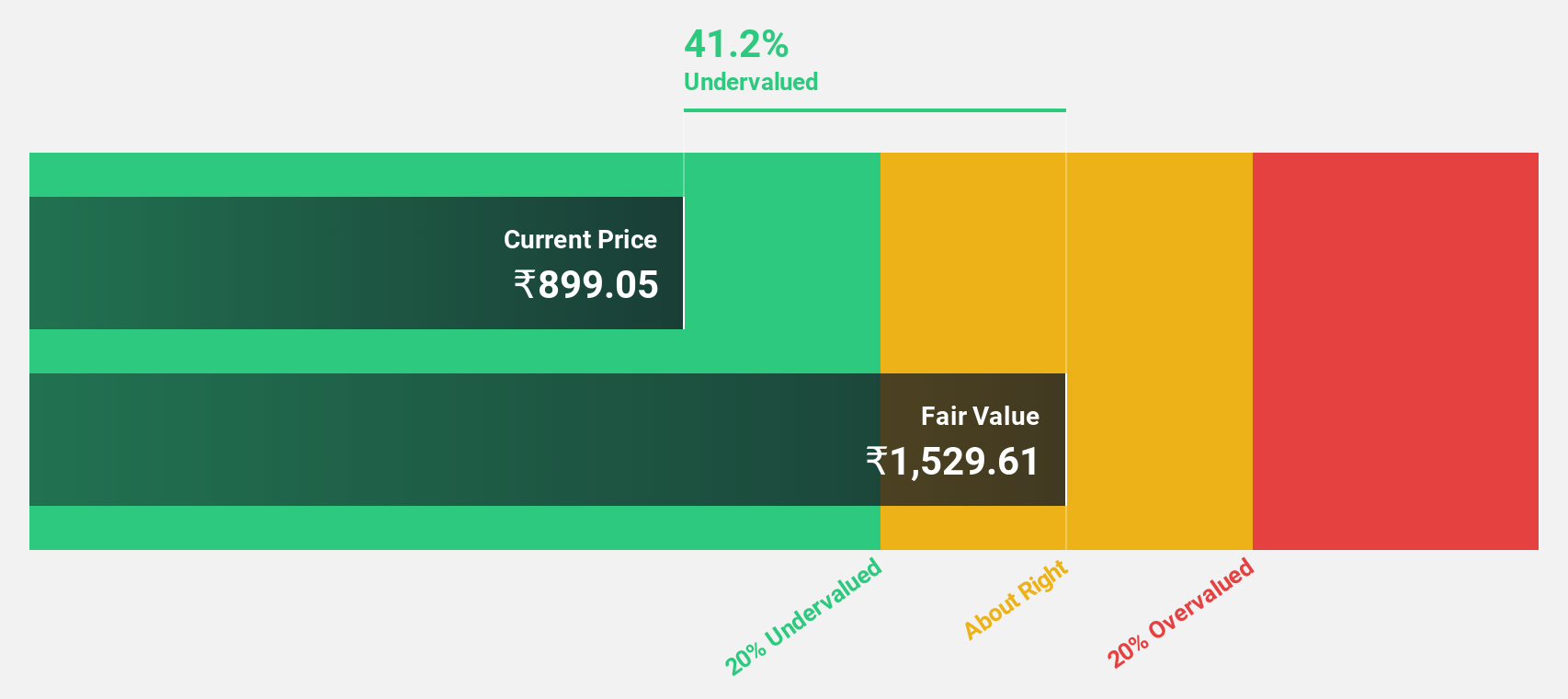

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across multiple regions including Africa, Australia, North America, Europe, Asia, India, and internationally with a market cap of ₹127.77 billion.

Operations: The company's revenue from the pharmaceutical business, excluding bio-pharmaceuticals, totals ₹42.09 billion.

Estimated Discount To Fair Value: 31.3%

Strides Pharma Science, trading at ₹1395.45, is 31.3% below its estimated fair value of ₹2032.1, indicating it is highly undervalued based on cash flows. The company’s revenue is forecast to grow at 11.5% annually, outpacing the Indian market's growth rate of 10.1%. Earnings are expected to increase by 98.07% per year and the company aims to become profitable within three years, reflecting strong potential for future profitability and value appreciation.

- In light of our recent growth report, it seems possible that Strides Pharma Science's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Strides Pharma Science's balance sheet health report.

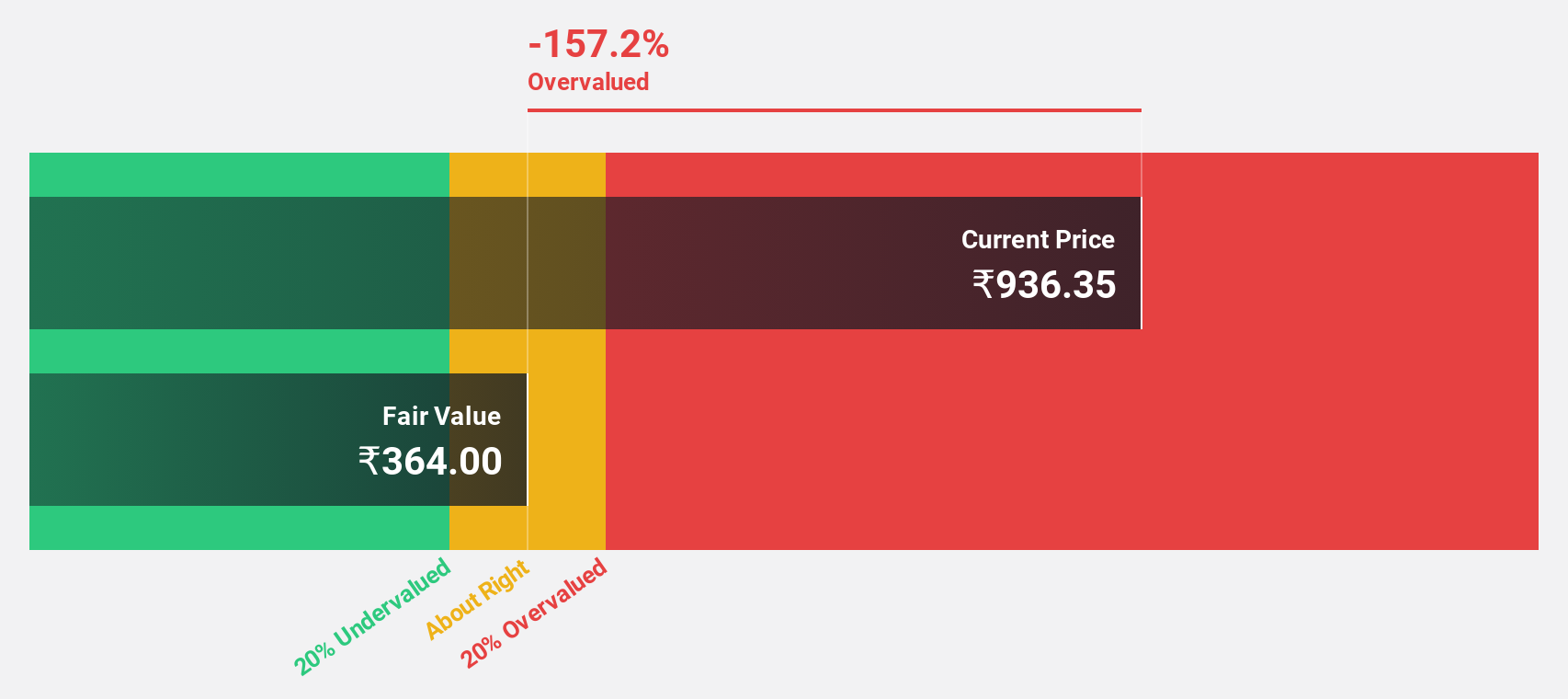

Titagarh Rail Systems (NSEI:TITAGARH)

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems in India and internationally, with a market cap of ₹180.87 billion.

Operations: The company's revenue segments include Passenger Rail Systems generating ₹3.32 billion and Freight Rail Systems (including Shipbuilding, Bridges, and Defence) contributing ₹35.14 billion.

Estimated Discount To Fair Value: 38.4%

Titagarh Rail Systems (₹1339.5) is trading at 38.4% below its estimated fair value of ₹2174.22, making it highly undervalued based on cash flows. The company’s earnings are forecast to grow 30.1% annually over the next three years, outpacing the Indian market's growth rate of 17.1%. Despite recent shareholder dilution, Titagarh's revenue is expected to increase by 25.7% per year, significantly faster than the market average of 10.1%.

- The analysis detailed in our Titagarh Rail Systems growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Titagarh Rail Systems stock in this financial health report.

Seize The Opportunity

- Discover the full array of 27 Undervalued Indian Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:STAR

Strides Pharma Science

Develops, manufactures, and sells pharmaceutical products in Africa, Australia, North America, Europe, Asia, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives