Is Now The Time To Put Texmaco Rail & Engineering (NSE:TEXRAIL) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Texmaco Rail & Engineering (NSE:TEXRAIL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Texmaco Rail & Engineering with the means to add long-term value to shareholders.

View our latest analysis for Texmaco Rail & Engineering

How Fast Is Texmaco Rail & Engineering Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Texmaco Rail & Engineering to have grown EPS from ₹0.064 to ₹2.13 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

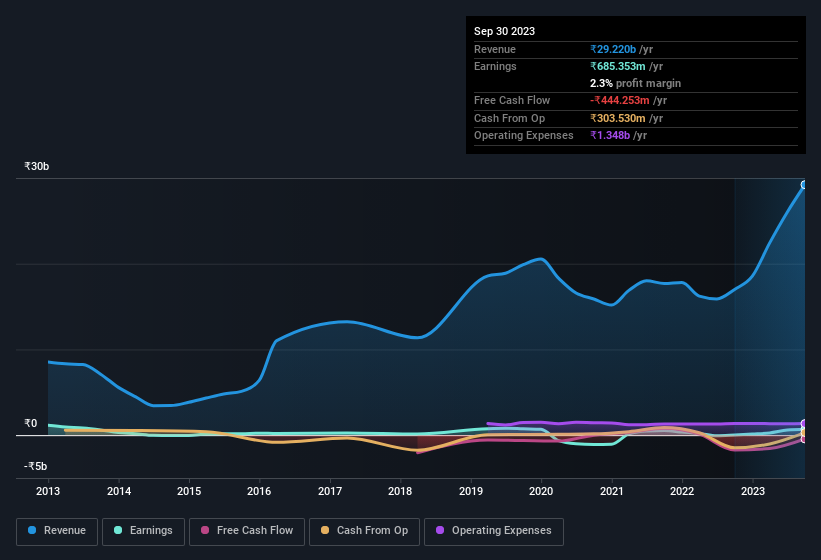

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Texmaco Rail & Engineering shareholders is that EBIT margins have grown from 3.7% to 5.7% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Texmaco Rail & Engineering's balance sheet strength, before getting too excited.

Are Texmaco Rail & Engineering Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Texmaco Rail & Engineering insiders have stood united by refusing to sell shares over the last year. But the real excitement comes from the ₹11m that Non-Executive & Non-Independent Director Akshay Poddar spent buying shares (at an average price of about ₹44.31). Purchases like this clue us in to the to the faith management has in the business' future.

Along with the insider buying, another encouraging sign for Texmaco Rail & Engineering is that insiders, as a group, have a considerable shareholding. To be specific, they have ₹3.8b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 9.6% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Texmaco Rail & Engineering's CEO, Udyavar Kamath, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Texmaco Rail & Engineering, with market caps between ₹17b and ₹67b, is around ₹24m.

Texmaco Rail & Engineering's CEO took home a total compensation package worth ₹21m in the year leading up to March 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Texmaco Rail & Engineering Deserve A Spot On Your Watchlist?

Texmaco Rail & Engineering's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Texmaco Rail & Engineering deserves timely attention. You should always think about risks though. Case in point, we've spotted 2 warning signs for Texmaco Rail & Engineering you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Texmaco Rail & Engineering, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texmaco Rail & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEXRAIL

Texmaco Rail & Engineering

Manufactures, sells, and provides services for rail and rail related products in India and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives