- India

- /

- Electrical

- /

- NSEI:IWEL

Exploring Undervalued Stocks on the Indian Exchange in July 2024

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, climbing 2.4% over the past week and an impressive 46% increase over the last year, with earnings expected to grow by 16% annually. In such a thriving market, identifying undervalued stocks can offer investors potential opportunities for substantial gains.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹712.50 | ₹1021.78 | 30.3% |

| HEG (NSEI:HEG) | ₹2208.90 | ₹3310.64 | 33.3% |

| Updater Services (NSEI:UDS) | ₹306.45 | ₹538.26 | 43.1% |

| Vedanta (NSEI:VEDL) | ₹465.65 | ₹744.09 | 37.4% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹284.70 | ₹506.43 | 43.8% |

| Strides Pharma Science (NSEI:STAR) | ₹931.95 | ₹1664.05 | 44% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹521.10 | ₹909.08 | 42.7% |

| Delhivery (NSEI:DELHIVERY) | ₹394.45 | ₹747.18 | 47.2% |

| PVR INOX (NSEI:PVRINOX) | ₹1458.15 | ₹2542.94 | 42.7% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3312.00 | ₹5764.61 | 42.5% |

Let's explore several standout options from the results in the screener

Godrej Properties (NSEI:GODREJPROP)

Overview: Godrej Properties Limited operates in real estate construction and development across India, with a market capitalization of approximately ₹920.92 billion.

Operations: The company generates revenues primarily from real estate construction and development, amounting to approximately ₹29.95 billion, with a smaller segment in hospitality contributing around ₹0.41 billion.

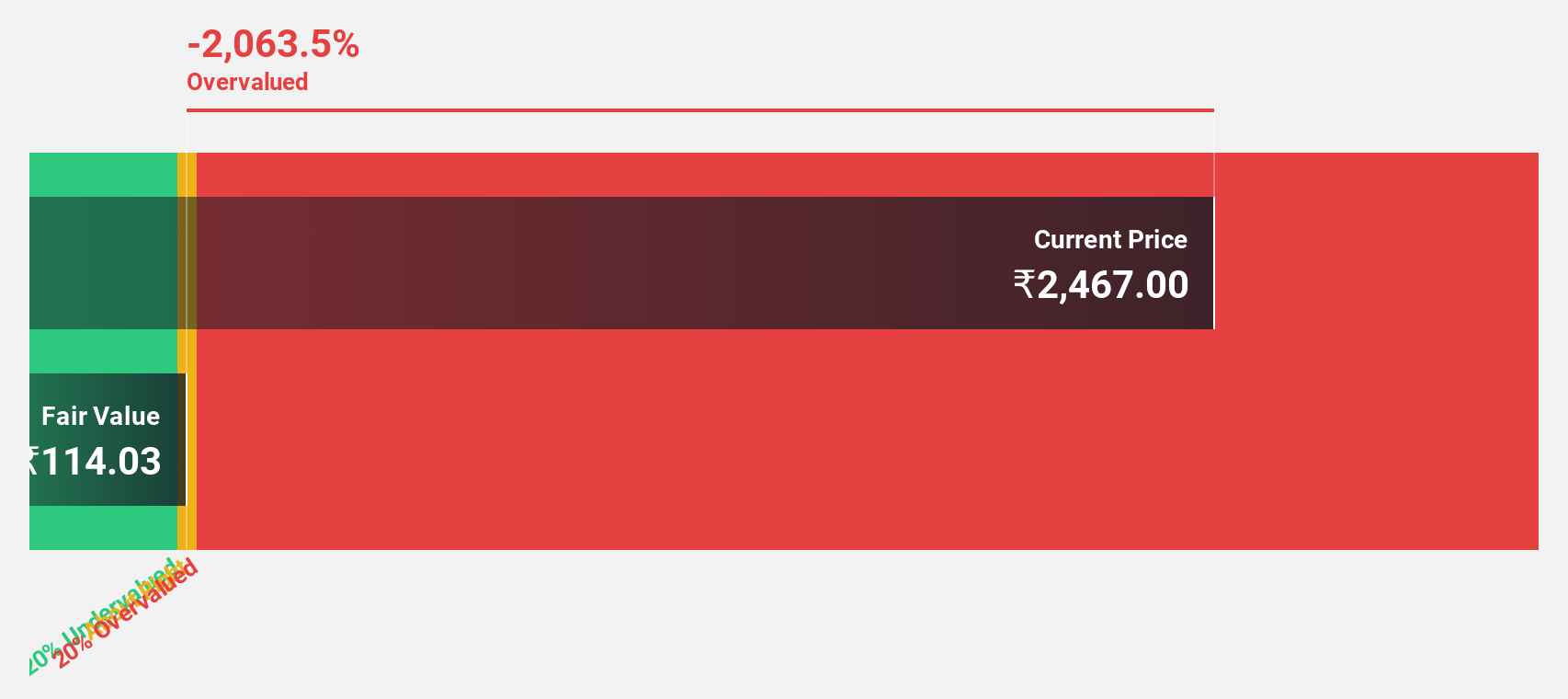

Estimated Discount To Fair Value: 42.5%

Godrej Properties, priced at ₹3312, trades significantly below its estimated fair value of ₹5764.61, reflecting a deep undervaluation based on discounted cash flow models. Despite challenges in debt coverage by operating cash flow, the company shows robust prospects with expected earnings growth of 35.9% annually over the next three years and revenue growth projections surpassing 20% annually. Recent acquisitions in Bengaluru and Pune underline aggressive expansion, enhancing future revenue potential significantly to approximately INR 30 billion combined.

- Insights from our recent growth report point to a promising forecast for Godrej Properties' business outlook.

- Take a closer look at Godrej Properties' balance sheet health here in our report.

Inox Wind Energy (NSEI:IWEL)

Overview: Inox Wind Energy Limited, along with its subsidiaries, specializes in the manufacturing and selling of wind turbine generators in India, boasting a market capitalization of approximately ₹92.14 billion.

Operations: The primary revenue segment for the company is derived from the manufacturing of wind turbine generators, generating ₹17.46 billion.

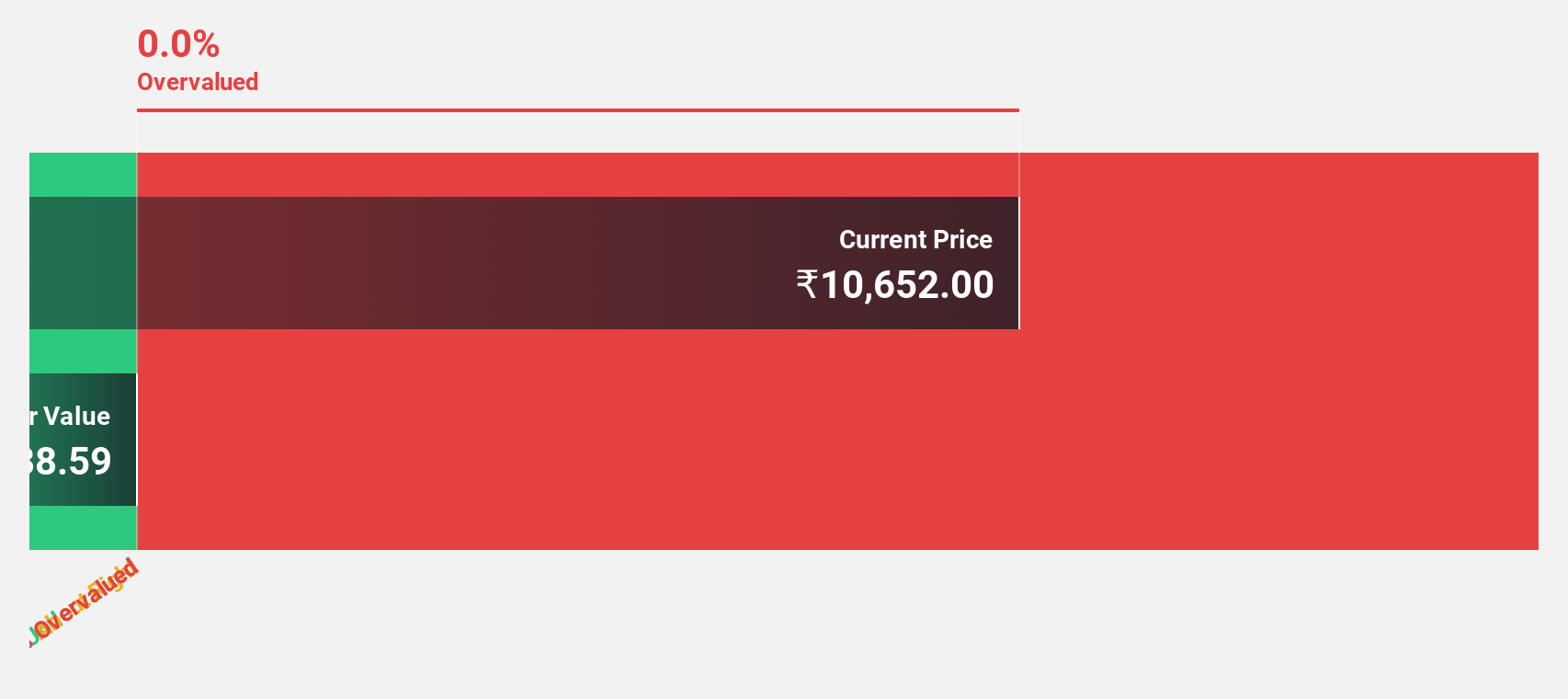

Estimated Discount To Fair Value: 21.5%

Inox Wind Energy, with a current price of ₹7647.6, is positioned below its fair value of ₹9743.79, indicating potential undervaluation based on discounted cash flow analysis. The company's revenue is projected to grow at 43.3% annually, outpacing the Indian market's average. Despite a low forecasted Return on Equity of 13.2%, Inox Wind is expected to shift from losses to profitability within three years, with significant growth in earnings anticipated at 60.73% annually.

- The growth report we've compiled suggests that Inox Wind Energy's future prospects could be on the up.

- Dive into the specifics of Inox Wind Energy here with our thorough financial health report.

Texmaco Rail & Engineering (NSEI:TEXRAIL)

Overview: Texmaco Rail & Engineering Limited is an engineering and infrastructure company operating both in India and internationally, with a market capitalization of approximately ₹113.97 billion.

Operations: The company generates revenue from three primary segments: the Freight Car Division (₹27.50 billion), Infra - Electrical (₹2.26 billion), and Infra - Rail & Green Energy (₹5.27 billion).

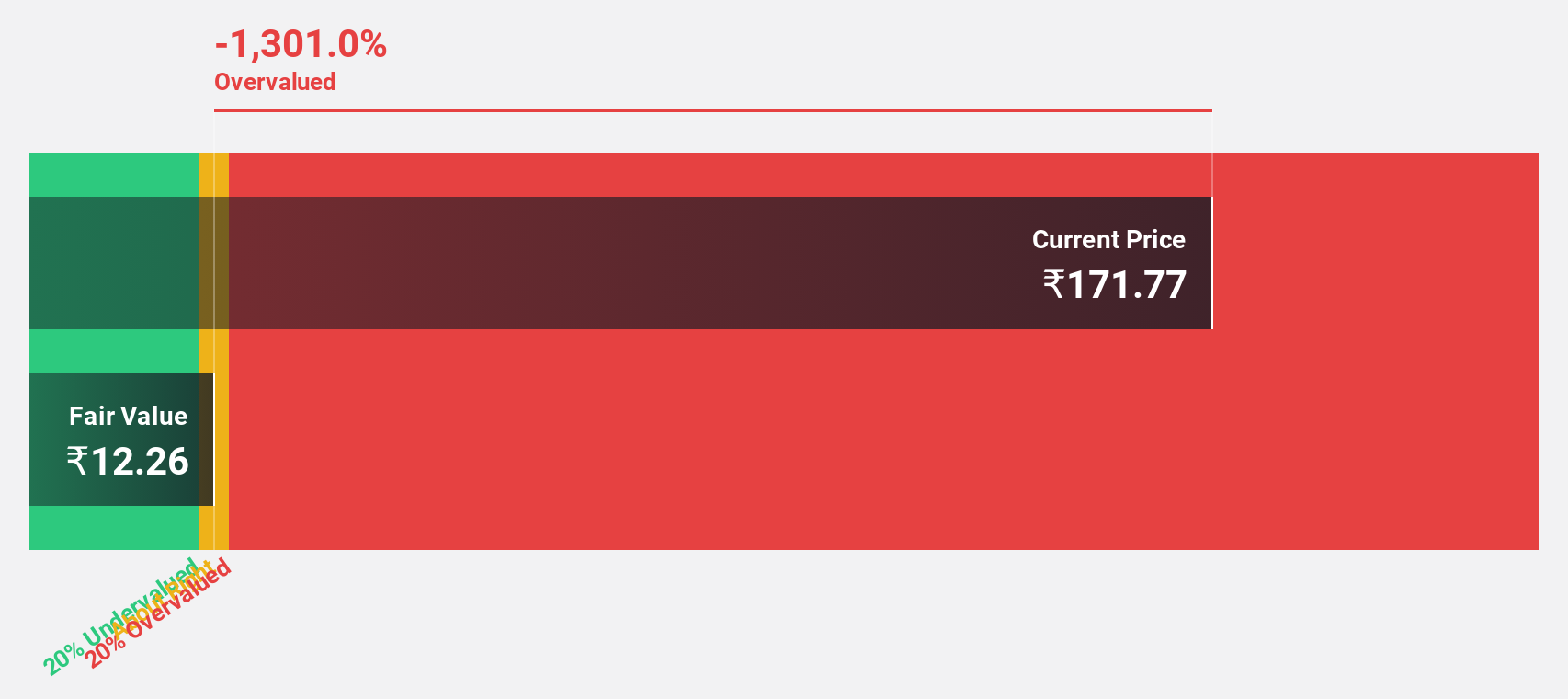

Estimated Discount To Fair Value: 14.1%

Texmaco Rail & Engineering, priced at ₹285.31, trades below its calculated fair value of ₹332.3, suggesting undervaluation based on discounted cash flow. Despite a recent dividend increase to INR 0.50 per share and robust earnings growth of 335% last year, the company's forecasted revenue growth at 14.2% annually is modest compared to its peers. Expected earnings are set to rise by 28.9% annually, outperforming the broader Indian market's average but with a low projected Return on Equity of 9.4%.

- The analysis detailed in our Texmaco Rail & Engineering growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Texmaco Rail & Engineering.

Make It Happen

- Get an in-depth perspective on all 19 Undervalued Indian Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IWEL

Inox Wind Energy

Engages in the manufacture and sale of wind turbine generators (WTGs) in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives