- India

- /

- Interactive Media and Services

- /

- NSEI:NAUKRI

Top Growth Companies With High Insider Ownership On Indian Exchanges October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 2.6% drop, yet over the longer term, it has impressively risen by 42% in the past year with earnings forecasted to grow by 17% annually. In this context of robust growth potential, companies with high insider ownership often attract attention as they can indicate strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.6% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.2% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 22.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Here we highlight a subset of our preferred stocks from the screener.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company offering services in recruitment, matrimony, real estate, and education both in India and internationally, with a market cap of ₹1.05 trillion.

Operations: The company's revenue segments include Recruitment Solutions generating ₹19.05 billion and 99acres for Real Estate contributing ₹3.67 billion.

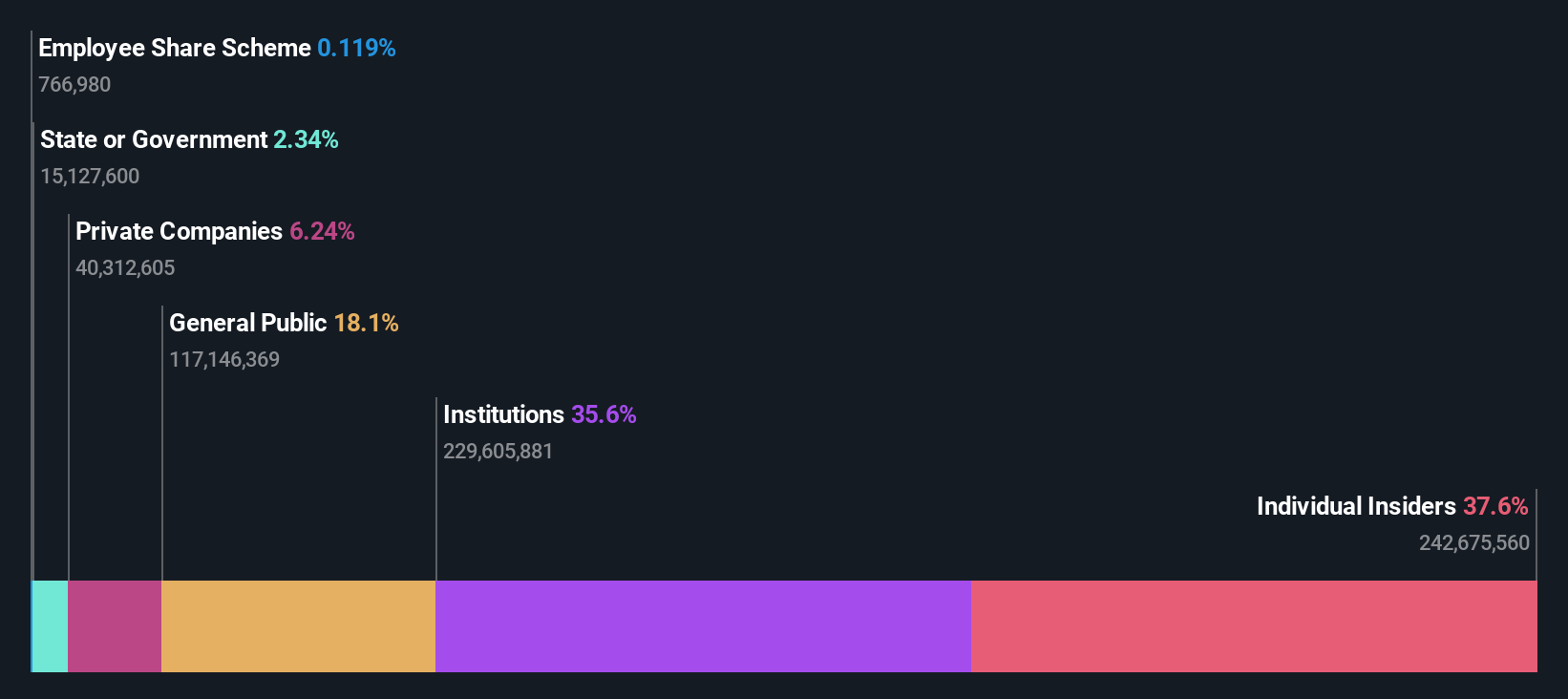

Insider Ownership: 37.7%

Info Edge (India) shows strong growth potential with forecasted earnings growth of 23.6% annually, outpacing the Indian market. Despite becoming profitable this year, insider activity reveals substantial selling in the last three months. Recent developments include a INR 4.2 Crore investment in Nexstem India and strategic executive appointments to bolster revenue and public policy initiatives. However, regulatory challenges persist with a GST-related tax demand under appeal, highlighting operational risks amidst its expansion strategy.

- Navigate through the intricacies of Info Edge (India) with our comprehensive analyst estimates report here.

- The analysis detailed in our Info Edge (India) valuation report hints at an inflated share price compared to its estimated value.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited operates in India, offering payment, commerce and cloud, and financial services to consumers and merchants, with a market cap of ₹4.63 billion.

Operations: The company generates revenue primarily from data processing, amounting to ₹91.38 billion.

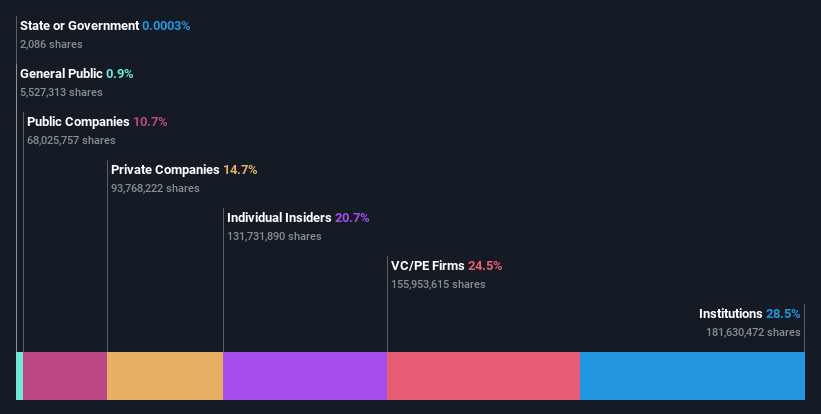

Insider Ownership: 20.7%

One97 Communications, known for its Paytm brand, is forecast to achieve profitability within three years, with revenue growth outpacing the Indian market at 12.1% annually. Recent strategic moves include selling its entertainment ticketing business to Zomato for ₹20.48 billion, strengthening its focus on core services and balance sheet. However, the company faces challenges such as a volatile share price and recent penalties for stamp duty non-payment, impacting financial performance but not operations.

- Click here to discover the nuances of One97 Communications with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, One97 Communications' share price might be too optimistic.

Tega Industries (NSEI:TEGA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tega Industries Limited designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries with a market cap of ₹129.23 billion.

Operations: The company's revenue is derived from two main segments: Equipments, contributing ₹1.98 billion, and Consumables, generating ₹13.71 billion.

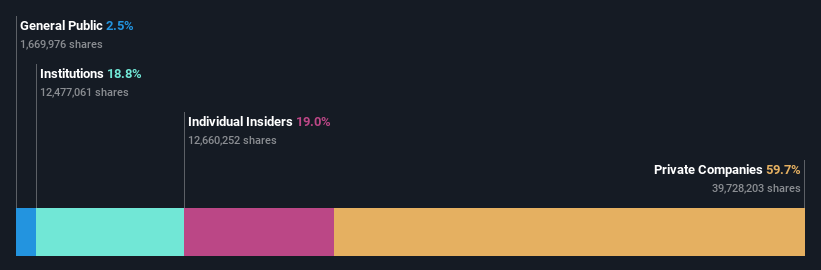

Insider Ownership: 19%

Tega Industries demonstrates strong growth potential with earnings projected to grow significantly at 24.7% annually, outpacing the Indian market's average. The company's revenue is also expected to increase by 17% per year, surpassing market growth rates. Recent financials show robust performance with first-quarter net income rising from ₹213.91 million to ₹367.44 million year-on-year. Despite no significant insider trading activity recently, substantial insider ownership aligns interests with shareholders and supports long-term value creation strategies.

- Unlock comprehensive insights into our analysis of Tega Industries stock in this growth report.

- Our valuation report here indicates Tega Industries may be overvalued.

Taking Advantage

- Reveal the 92 hidden gems among our Fast Growing Indian Companies With High Insider Ownership screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NAUKRI

Info Edge (India)

Operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives