- India

- /

- Construction

- /

- NSEI:TECHNOE

Analysts Are More Bearish On Techno Electric & Engineering Company Limited (NSE:TECHNOE) Than They Used To Be

The analysts covering Techno Electric & Engineering Company Limited (NSE:TECHNOE) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business.

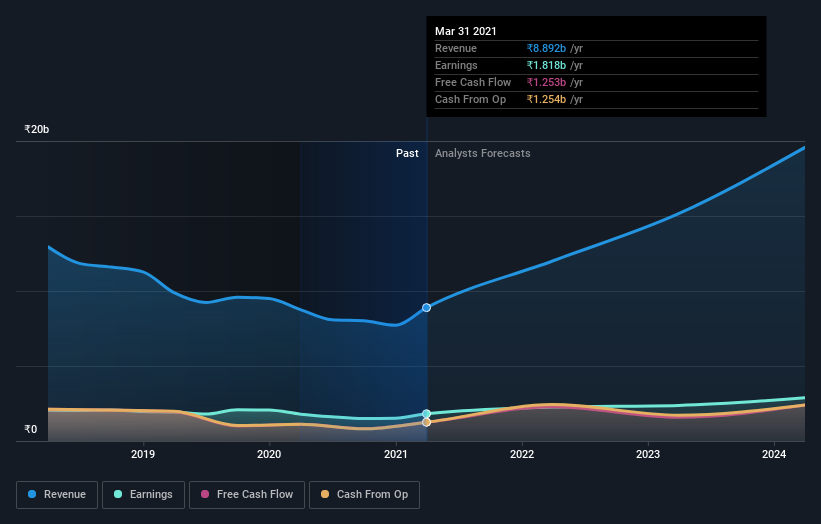

After the downgrade, the five analysts covering Techno Electric & Engineering are now predicting revenues of ₹12b in 2022. If met, this would reflect a sizeable 35% improvement in sales compared to the last 12 months. Per-share earnings are expected to swell 13% to ₹18.65. Previously, the analysts had been modelling revenues of ₹14b and earnings per share (EPS) of ₹21.06 in 2022. Indeed, we can see that the analysts are a lot more bearish about Techno Electric & Engineering's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for Techno Electric & Engineering

What's most unexpected is that the consensus price target rose 13% to ₹370, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Techno Electric & Engineering, with the most bullish analyst valuing it at ₹407 and the most bearish at ₹314 per share. This is a very narrow spread of estimates, implying either that Techno Electric & Engineering is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that Techno Electric & Engineering is forecast to grow faster in the future than it has in the past, with revenues expected to display 35% annualised growth until the end of 2022. If achieved, this would be a much better result than the 7.4% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 12% per year. So it looks like Techno Electric & Engineering is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. The rising price target is a puzzle, but still - with a serious cut to this year's outlook, we wouldn't be surprised if investors were a bit wary of Techno Electric & Engineering.

Unfortunately, by using these new estimates as a starting point, we've run a discounted cash flow calculation (DCF) on Techno Electric & Engineering that suggests the company could be somewhat overvalued. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Techno Electric & Engineering, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Techno Electric & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TECHNOE

Techno Electric & Engineering

Provides engineering, procurement, and construction (EPC) services to the power generation, transmission, and distribution sectors in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives