- India

- /

- Oil and Gas

- /

- NSEI:IOC

3 High Yield Dividend Stocks In India Offering Up To 8.2%

Reviewed by Simply Wall St

The Indian market has shown robust growth, with a 2.3% increase over the last week and a significant 45% rise over the past year, alongside an optimistic forecast of 16% annual earnings growth. In this thriving environment, high-yield dividend stocks can be particularly appealing for investors looking for both stability and income.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 4.02% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 3.74% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.10% | ★★★★★☆ |

| Castrol India (BSE:500870) | 3.70% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.21% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.61% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.26% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.70% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.57% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.32% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Castrol India (BSE:500870)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castrol India Limited specializes in manufacturing and marketing automotive and industrial lubricants both domestically and internationally, with a market capitalization of approximately ₹200.64 billion.

Operations: Castrol India Limited generates its revenue primarily from the lubricants segment, which amounted to ₹51.06 billion.

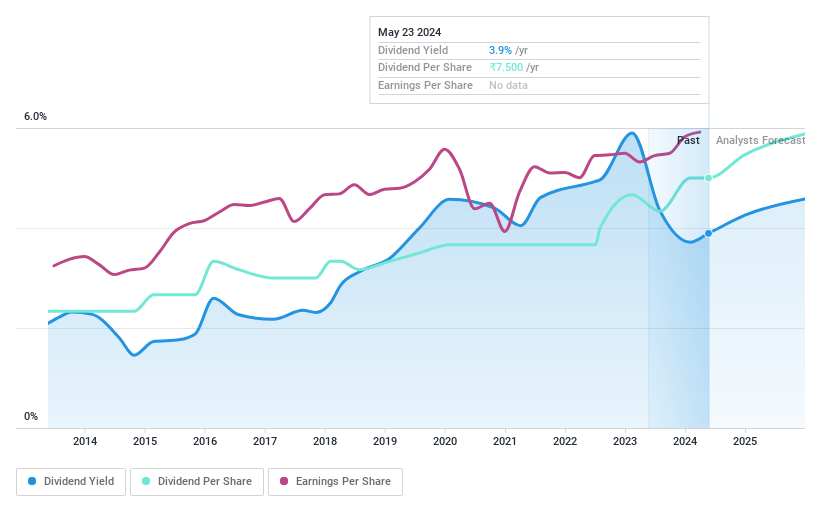

Dividend Yield: 3.7%

Castrol India's dividend yield of 3.7% ranks in the top 25% of Indian dividend payers, demonstrating a strong appeal for those seeking steady income streams. Despite this attractive yield, the sustainability of these payments is questionable as they are not well covered by cash flows, with a high cash payout ratio of 97.9%. However, dividends have shown reliability and growth over the past decade. Recently, leadership changes were announced with Mr. Sandeep Sangwan stepping down as Managing Director by October 2024.

- Click here to discover the nuances of Castrol India with our detailed analytical dividend report.

- The analysis detailed in our Castrol India valuation report hints at an deflated share price compared to its estimated value.

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited operates primarily in refining, pipeline transportation, and marketing of petroleum products across India, with a market capitalization of approximately ₹2.34 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily through its petrochemicals and petroleum products segments, with earnings of ₹2.62 billion and ₹83.35 billion respectively.

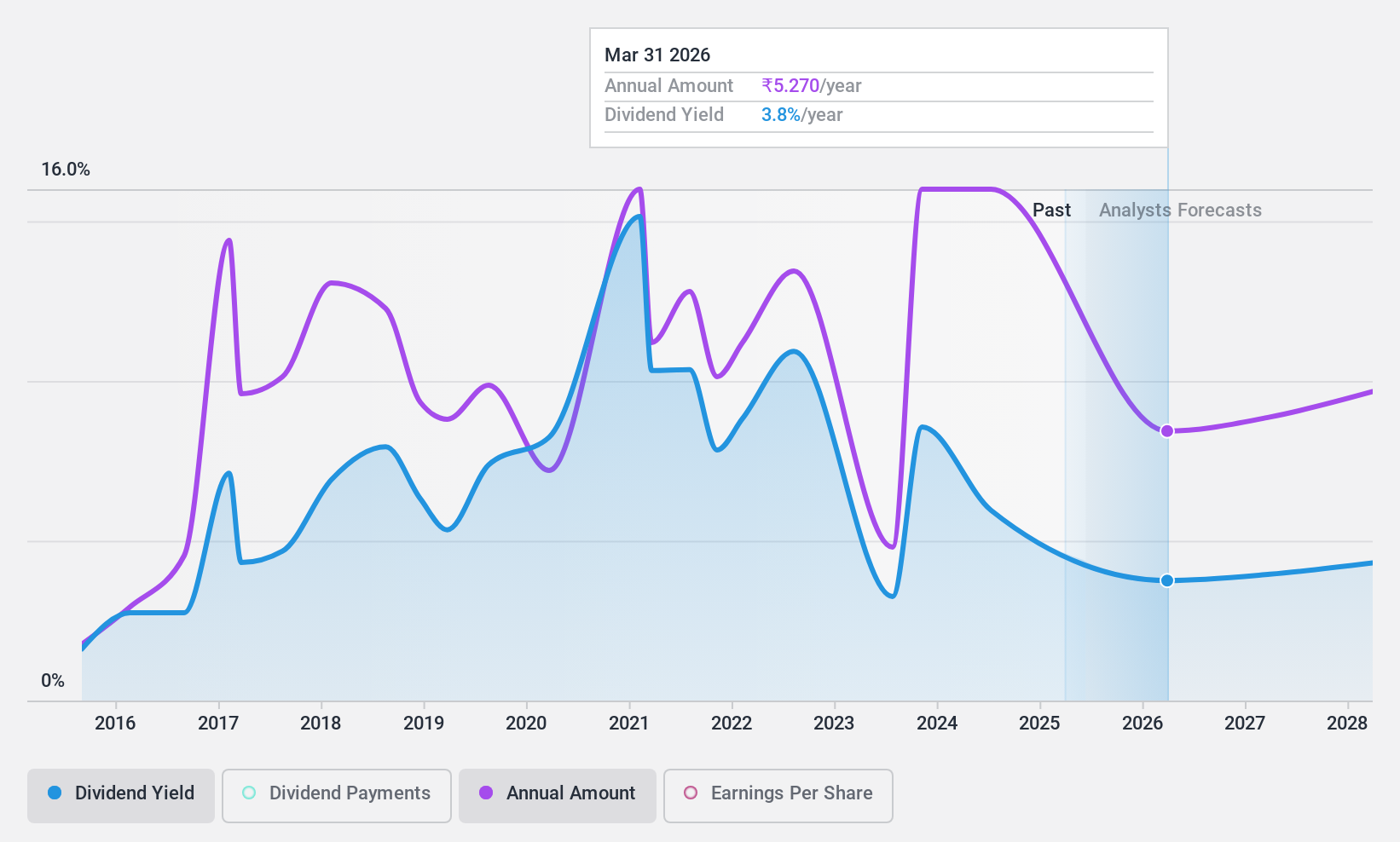

Dividend Yield: 8.3%

Indian Oil Corporation Limited (IOCL) recently settled a legal dispute amicably, agreeing to pay INR 23.67 crore, which will be recorded as income in Q1 FY2025. Additionally, IOCL is expanding into the electric vehicle sector through a joint venture for battery swapping with Sun Mobility and has committed USD 78.31 million to its subsidiary for related investments. Despite these strategic moves, IOCL's dividend history over the past decade has been inconsistent and unreliable with a high debt level posing further risks. However, the dividends are currently supported by earnings and cash flows with payout ratios of 39.6% and 56.8% respectively, suggesting some level of sustainability in its dividend payments amidst financial commitments.

- Unlock comprehensive insights into our analysis of Indian Oil stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Indian Oil is priced lower than what may be justified by its financials.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹34.86 billion.

Operations: Swaraj Engines Limited generates revenue primarily from the sale of diesel engines, components, and spare parts, totaling ₹14.19 billion.

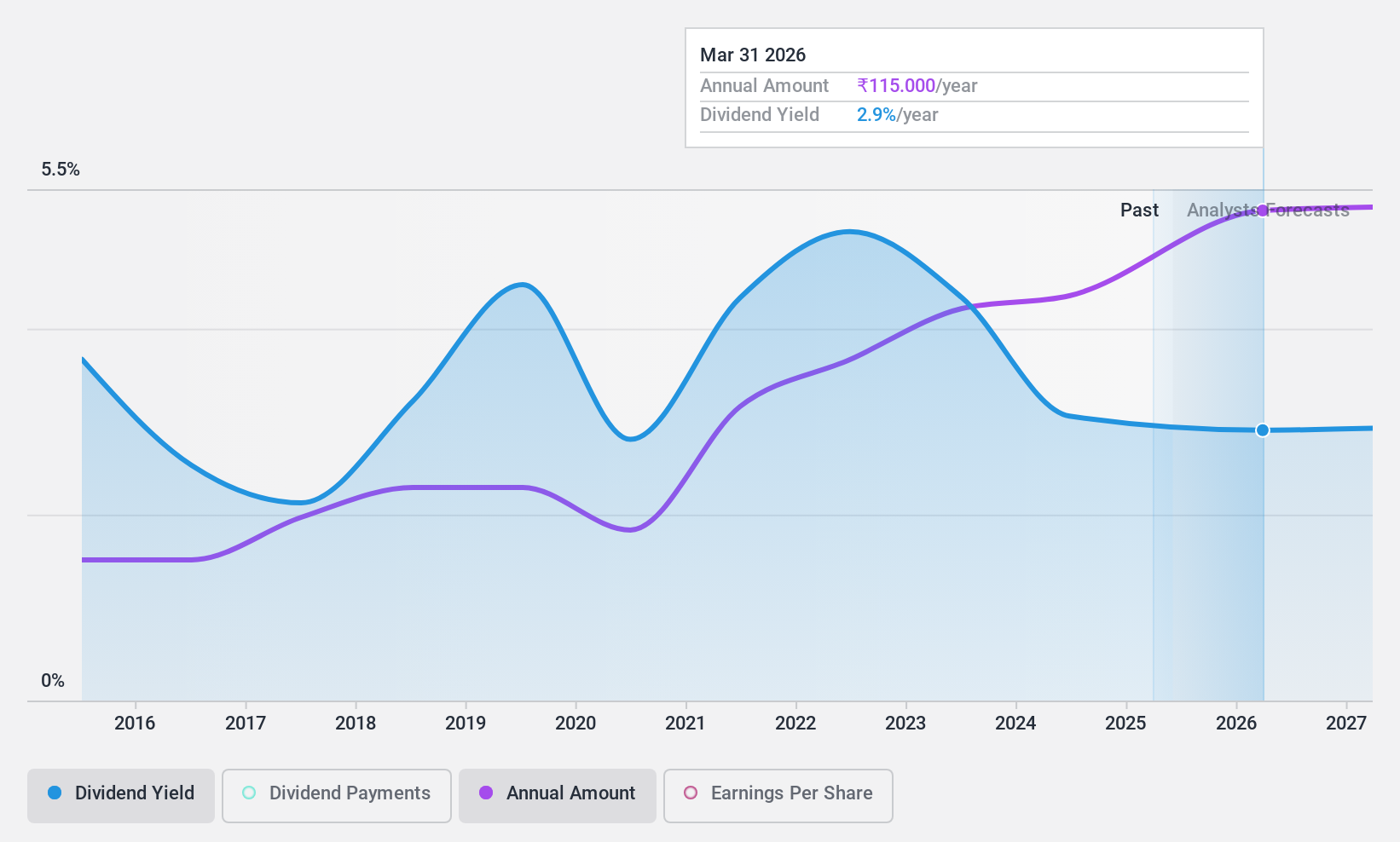

Dividend Yield: 3.3%

Swaraj Engines Limited, despite a dividend yield of 3.31% among the top 25% in India, faces challenges with its dividend sustainability due to a high cash payout ratio of 122%. While dividends have increased over the past decade, payments have been volatile and not well-covered by earnings or cash flows. Recent financials show modest year-over-year growth in net income and earnings per share. The company also announced a significant dividend increase recently, recommending INR 95 per share for FY2024.

- Take a closer look at Swaraj Engines' potential here in our dividend report.

- Upon reviewing our latest valuation report, Swaraj Engines' share price might be too pessimistic.

Next Steps

- Reveal the 19 hidden gems among our Top Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IOC

Indian Oil

Indian Oil Corporation Limited, together with its subsidiaries, refines, pipeline transports, and markets petroleum products in India and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives