- India

- /

- Electrical

- /

- NSEI:SPECTRUM

We Ran A Stock Scan For Earnings Growth And Spectrum Electrical Industries (NSE:SPECTRUM) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Spectrum Electrical Industries (NSE:SPECTRUM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Spectrum Electrical Industries with the means to add long-term value to shareholders.

Check out our latest analysis for Spectrum Electrical Industries

How Fast Is Spectrum Electrical Industries Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Spectrum Electrical Industries' EPS shot up from ₹3.91 to ₹5.06; a result that's bound to keep shareholders happy. That's a impressive gain of 29%.

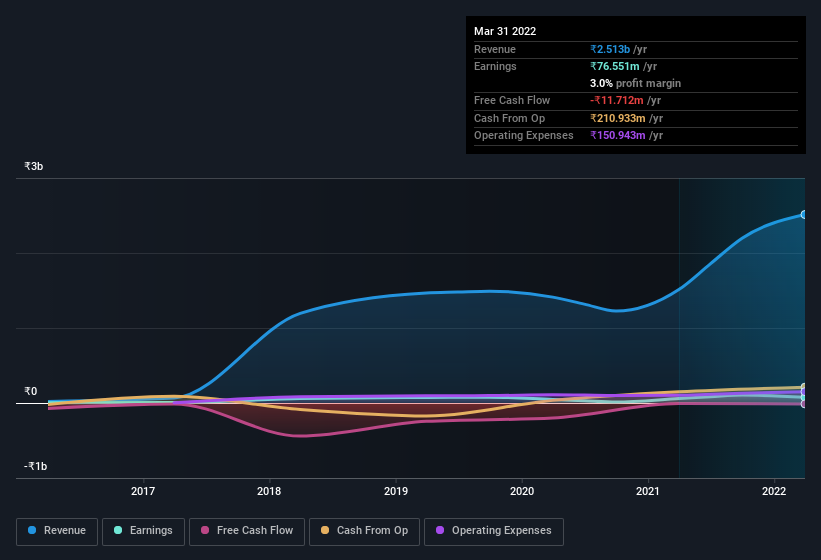

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Spectrum Electrical Industries achieved similar EBIT margins to last year, revenue grew by a solid 66% to ₹2.5b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Spectrum Electrical Industries isn't a huge company, given its market capitalisation of ₹999m. That makes it extra important to check on its balance sheet strength.

Are Spectrum Electrical Industries Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Spectrum Electrical Industries shareholders can gain quiet confidence from the fact that insiders shelled out ₹24m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was MD & Director Deepak Chaudhari who made the biggest single purchase, worth ₹10.0m, paying ₹53.10 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Spectrum Electrical Industries will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 65% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Although, with Spectrum Electrical Industries being valued at ₹999m, this is a small company we're talking about. That means insiders only have ₹646m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Spectrum Electrical Industries Worth Keeping An Eye On?

You can't deny that Spectrum Electrical Industries has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 4 warning signs for Spectrum Electrical Industries (2 are potentially serious!) that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, Spectrum Electrical Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SPECTRUM

Spectrum Electrical Industries

Designs, manufactures, and sells electrical, automobile, and irrigation components in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.