Shareholders May Be More Conservative With Somany Ceramics Limited's (NSE:SOMANYCERA) CEO Compensation For Now

Performance at Somany Ceramics Limited (NSE:SOMANYCERA) has been reasonably good and CEO Shreekant Somany has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 23 September 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Somany Ceramics

How Does Total Compensation For Shreekant Somany Compare With Other Companies In The Industry?

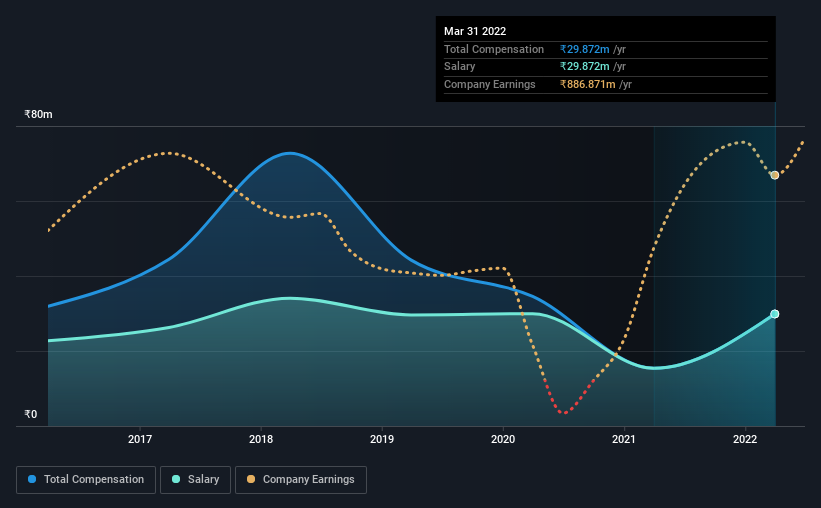

At the time of writing, our data shows that Somany Ceramics Limited has a market capitalization of ₹26b, and reported total annual CEO compensation of ₹30m for the year to March 2022. We note that's an increase of 94% above last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹30m.

For comparison, other companies in the same industry with market capitalizations ranging between ₹16b and ₹64b had a median total CEO compensation of ₹22m. Accordingly, our analysis reveals that Somany Ceramics Limited pays Shreekant Somany north of the industry median. Moreover, Shreekant Somany also holds ₹148m worth of Somany Ceramics stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹30m | ₹15m | 100% |

| Other | - | - | - |

| Total Compensation | ₹30m | ₹15m | 100% |

On an industry level, around 90% of total compensation represents salary and 10% is other remuneration. On a company level, Somany Ceramics prefers to reward its CEO through a salary, opting not to pay Shreekant Somany through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Somany Ceramics Limited's Growth Numbers

Somany Ceramics Limited has seen its earnings per share (EPS) increase by 32% a year over the past three years. Its revenue is up 28% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Somany Ceramics Limited Been A Good Investment?

We think that the total shareholder return of 208%, over three years, would leave most Somany Ceramics Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Somany Ceramics pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Somany Ceramics that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOMANYCERA

Somany Ceramics

Engages in the manufacture and sale of ceramic tiles and related products in India.

Excellent balance sheet with reasonable growth potential and pays a dividend.