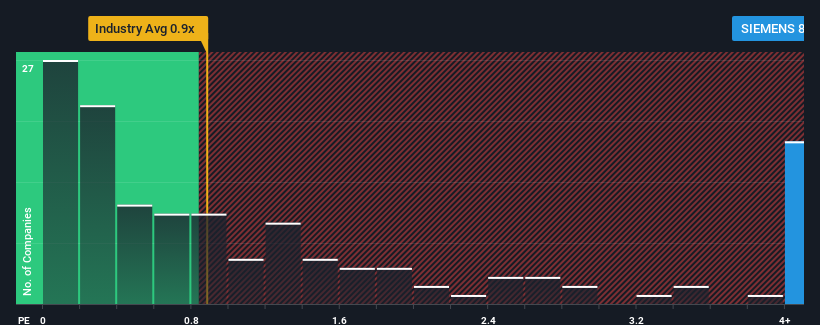

When close to half the companies in the Industrials industry in India have price-to-sales ratios (or "P/S") below 1.9x, you may consider Siemens Limited (NSE:SIEMENS) as a stock to avoid entirely with its 8.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Siemens

How Siemens Has Been Performing

Siemens certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Siemens will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Siemens' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 97% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.0%, which is noticeably less attractive.

In light of this, it's understandable that Siemens' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Siemens' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Siemens' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Siemens with six simple checks.

If these risks are making you reconsider your opinion on Siemens, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Siemens, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SIEMENS

Siemens

Manufactures and sells electric motors, generators, transformers, electricity distribution and control apparatus, general purpose machinery, other electrical equipment, electronic components, and optical products in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.