- India

- /

- Construction

- /

- NSEI:SEMAC

Even though Semac Consultants (NSE:SEMAC) has lost ₹3.7b market cap in last 7 days, shareholders are still up 505% over 5 years

It certainly was a quite a shock to see the Semac Consultants Limited (NSE:SEMAC) share price fall -32% in the last week. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 503% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. Only time will tell if there is still too much optimism currently reflected in the share price. Anyone who held for that rewarding ride would probably be keen to talk about it.

In light of the stock dropping 32% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Semac Consultants

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Semac Consultants' earnings per share are down 3.1% per year, despite strong share price performance over five years.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.2% dividend yield is unlikely to be propping up the share price. On the other hand, Semac Consultants' revenue is growing nicely, at a compound rate of 12% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

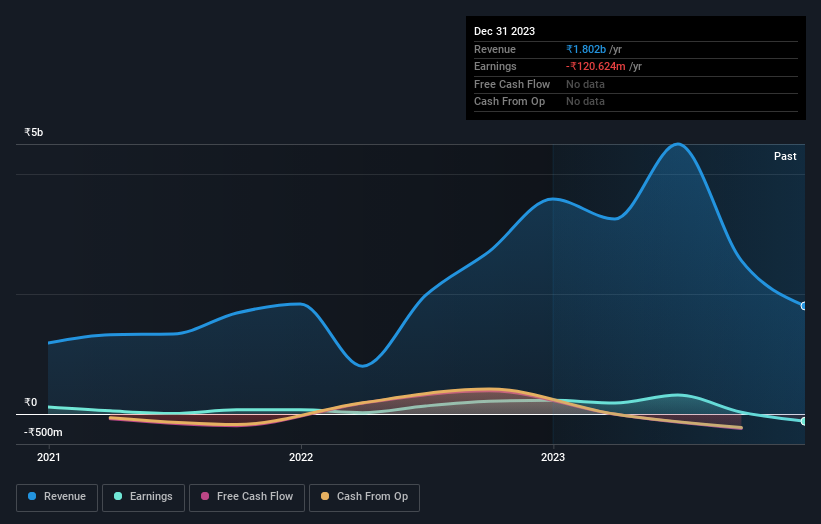

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Semac Consultants' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Semac Consultants shareholders have received a total shareholder return of 63% over one year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 43% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Semac Consultants better, we need to consider many other factors. Even so, be aware that Semac Consultants is showing 4 warning signs in our investment analysis , and 2 of those are significant...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SEMAC

Semac Construction

Provides integrated design, engineering, procurement, construction, and consultancy services for commercial and industrial projects in India.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives