- India

- /

- Construction

- /

- NSEI:SALASAR

Salasar Techno Engineering's (NSE:SALASAR) Solid Earnings May Rest On Weak Foundations

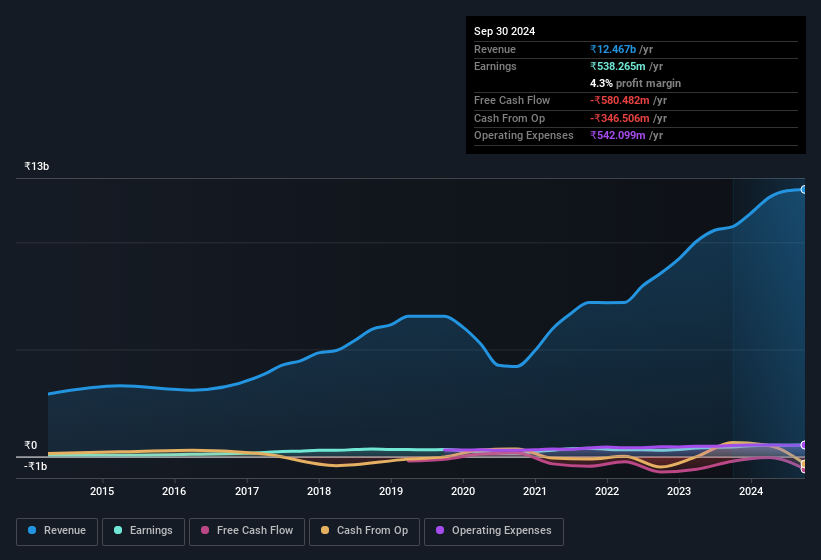

The stock price didn't jump after Salasar Techno Engineering Limited (NSE:SALASAR) posted decent earnings last week. We think that investors might be worried about some concerning underlying factors.

View our latest analysis for Salasar Techno Engineering

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Salasar Techno Engineering issued 9.4% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Salasar Techno Engineering's EPS by clicking here.

How Is Dilution Impacting Salasar Techno Engineering's Earnings Per Share (EPS)?

Salasar Techno Engineering has improved its profit over the last three years, with an annualized gain of 40% in that time. In comparison, earnings per share only gained 20% over the same period. And at a glance the 21% gain in profit over the last year impresses. On the other hand, earnings per share are only up 18% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Salasar Techno Engineering shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Salasar Techno Engineering.

Our Take On Salasar Techno Engineering's Profit Performance

Each Salasar Techno Engineering share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Salasar Techno Engineering's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 20% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Salasar Techno Engineering, you'd also look into what risks it is currently facing. To help with this, we've discovered 3 warning signs (1 is significant!) that you ought to be aware of before buying any shares in Salasar Techno Engineering.

Today we've zoomed in on a single data point to better understand the nature of Salasar Techno Engineering's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SALASAR

Salasar Techno Engineering

Engages in the manufacture and sale of galvanized and non-galvanized steel structures in India and internationally.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives