- India

- /

- Construction

- /

- NSEI:SADBHAV

Sadbhav Engineering Limited's (NSE:SADBHAV) Prospects Need A Boost To Lift Shares

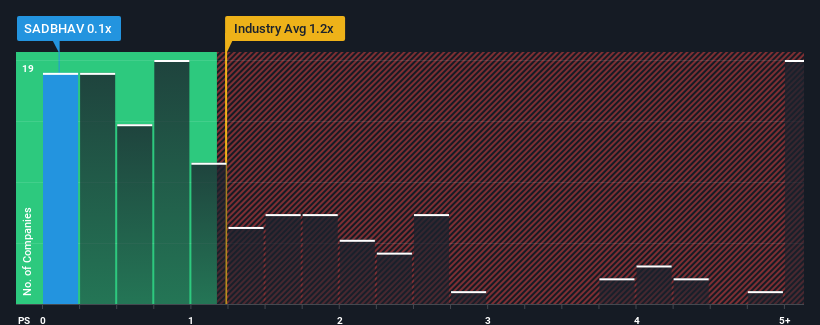

When you see that almost half of the companies in the Construction industry in India have price-to-sales ratios (or "P/S") above 1.2x, Sadbhav Engineering Limited (NSE:SADBHAV) looks to be giving off some buy signals with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sadbhav Engineering

What Does Sadbhav Engineering's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Sadbhav Engineering's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Sadbhav Engineering's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Sadbhav Engineering would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 50% during the coming year according to the lone analyst following the company. Meanwhile, the broader industry is forecast to expand by 10%, which paints a poor picture.

With this in consideration, we find it intriguing that Sadbhav Engineering's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Sadbhav Engineering's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Sadbhav Engineering maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Sadbhav Engineering (1 is significant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SADBHAV

Sadbhav Engineering

Engages in engineering, construction, and infrastructure development projects business in India.

Good value low.

Similar Companies

Market Insights

Community Narratives