- India

- /

- Construction

- /

- NSEI:SADBHAV

Sadbhav Engineering Limited's (NSE:SADBHAV) Price Is Right But Growth Is Lacking After Shares Rocket 30%

Sadbhav Engineering Limited (NSE:SADBHAV) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 252% in the last year.

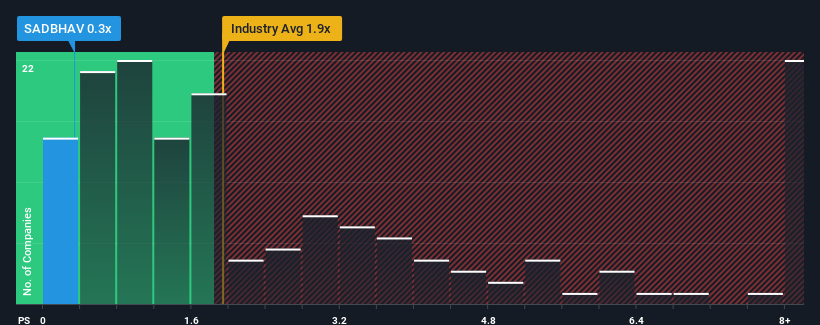

Although its price has surged higher, Sadbhav Engineering may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Construction industry in India have P/S ratios greater than 1.9x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sadbhav Engineering

How Sadbhav Engineering Has Been Performing

Sadbhav Engineering hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sadbhav Engineering.Is There Any Revenue Growth Forecasted For Sadbhav Engineering?

Sadbhav Engineering's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.6%. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 39% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 12% growth, that's a disappointing outcome.

In light of this, it's understandable that Sadbhav Engineering's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Sadbhav Engineering's P/S?

Despite Sadbhav Engineering's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Sadbhav Engineering maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Sadbhav Engineering's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sadbhav Engineering (at least 2 which shouldn't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of Sadbhav Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Sadbhav Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SADBHAV

Sadbhav Engineering

Engages in engineering, construction, and infrastructure development projects business in India.

Good value low.

Similar Companies

Market Insights

Community Narratives