- India

- /

- Construction

- /

- NSEI:RVNL

There's Reason For Concern Over Rail Vikas Nigam Limited's (NSE:RVNL) Massive 63% Price Jump

Rail Vikas Nigam Limited (NSE:RVNL) shares have continued their recent momentum with a 63% gain in the last month alone. This latest share price bounce rounds out a remarkable 405% gain over the last twelve months.

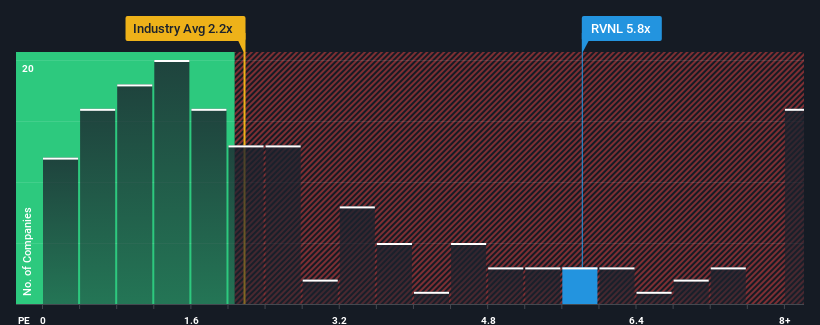

Following the firm bounce in price, given around half the companies in India's Construction industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Rail Vikas Nigam as a stock to avoid entirely with its 5.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Rail Vikas Nigam

How Has Rail Vikas Nigam Performed Recently?

Recent times haven't been great for Rail Vikas Nigam as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Rail Vikas Nigam's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Rail Vikas Nigam?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Rail Vikas Nigam's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.9% gain to the company's revenues. The latest three year period has also seen an excellent 42% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.0% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is noticeably more attractive.

In light of this, it's alarming that Rail Vikas Nigam's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Rail Vikas Nigam's P/S Mean For Investors?

Rail Vikas Nigam's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Rail Vikas Nigam currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Rail Vikas Nigam (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Rail Vikas Nigam, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RVNL

Rail Vikas Nigam

Engages in rail infrastructure works in India and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives