- India

- /

- Construction

- /

- NSEI:RPPINFRA

Market Might Still Lack Some Conviction On R.P.P. Infra Projects Limited (NSE:RPPINFRA) Even After 26% Share Price Boost

R.P.P. Infra Projects Limited (NSE:RPPINFRA) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 170% in the last year.

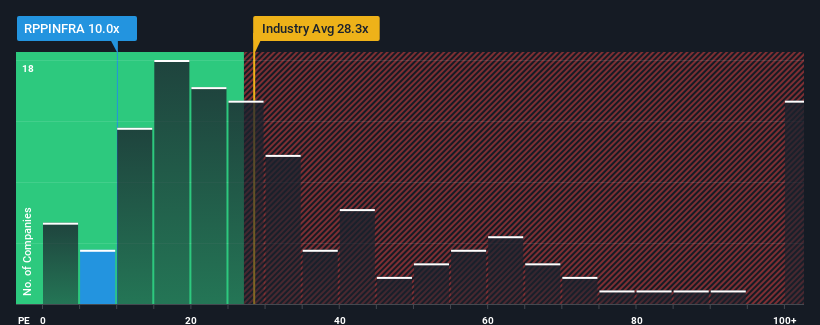

In spite of the firm bounce in price, R.P.P. Infra Projects may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10x, since almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 64x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for R.P.P. Infra Projects as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for R.P.P. Infra Projects

How Is R.P.P. Infra Projects' Growth Trending?

R.P.P. Infra Projects' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 69% gain to the company's bottom line. Pleasingly, EPS has also lifted 173% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that R.P.P. Infra Projects is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Even after such a strong price move, R.P.P. Infra Projects' P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that R.P.P. Infra Projects currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for R.P.P. Infra Projects you should know about.

If these risks are making you reconsider your opinion on R.P.P. Infra Projects, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RPPINFRA

R.P.P. Infra Projects

Engages in the construction and infrastructure development activities in India, Sri Lanka, and Mauritius.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives