- India

- /

- Trade Distributors

- /

- NSEI:REFEX

Investors Still Aren't Entirely Convinced By Refex Industries Limited's (NSE:REFEX) Earnings Despite 38% Price Jump

The Refex Industries Limited (NSE:REFEX) share price has done very well over the last month, posting an excellent gain of 38%. The last 30 days bring the annual gain to a very sharp 72%.

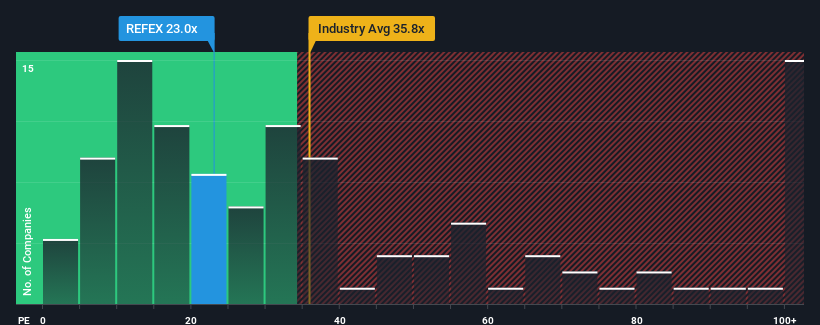

In spite of the firm bounce in price, Refex Industries may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 23x, since almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 65x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Refex Industries' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Refex Industries

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Refex Industries would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 87% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the market is similarly expected to grow by 25% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Refex Industries is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Refex Industries' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Refex Industries currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

It is also worth noting that we have found 3 warning signs for Refex Industries (1 is a bit concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:REFEX

Proven track record with adequate balance sheet.

Market Insights

Community Narratives