- India

- /

- Trade Distributors

- /

- NSEI:RAJMET

With EPS Growth And More, Rajnandini Metal (NSE:RAJMET) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Rajnandini Metal (NSE:RAJMET). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Rajnandini Metal with the means to add long-term value to shareholders.

View our latest analysis for Rajnandini Metal

How Fast Is Rajnandini Metal Growing Its Earnings Per Share?

Over the last three years, Rajnandini Metal has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Rajnandini Metal's EPS shot up from ₹0.49 to ₹0.66; a result that's bound to keep shareholders happy. That's a commendable gain of 35%.

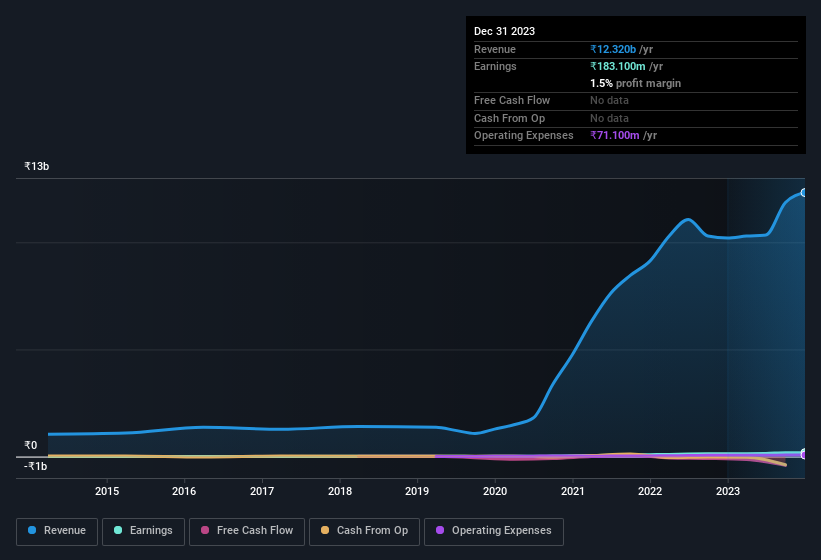

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Rajnandini Metal remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 21% to ₹12b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Rajnandini Metal is no giant, with a market capitalisation of ₹2.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Rajnandini Metal Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Rajnandini Metal will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 52% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have ₹1.5b invested in the business, at the current share price. That's nothing to sneeze at!

Is Rajnandini Metal Worth Keeping An Eye On?

You can't deny that Rajnandini Metal has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Rajnandini Metal's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. What about risks? Every company has them, and we've spotted 5 warning signs for Rajnandini Metal (of which 2 make us uncomfortable!) you should know about.

Although Rajnandini Metal certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Rajnandini Metal, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAJMET

Rajnandini Metal

Engages in the manufacturing and trading of copper continuous casting rods and wires in India and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives